The Carson Report/Joe Carson/2-11-2022

“A student of inflation cycles finds similarities between the 1970s and the current inflation cycle. Supply shocks sparked both cycles. In the 1970s, policymakers’ fear of the negative trade-off between fighting inflation and triggering more unemployment kept policy too easy for too long, extending the inflation cycle and ending with a hard landing.”

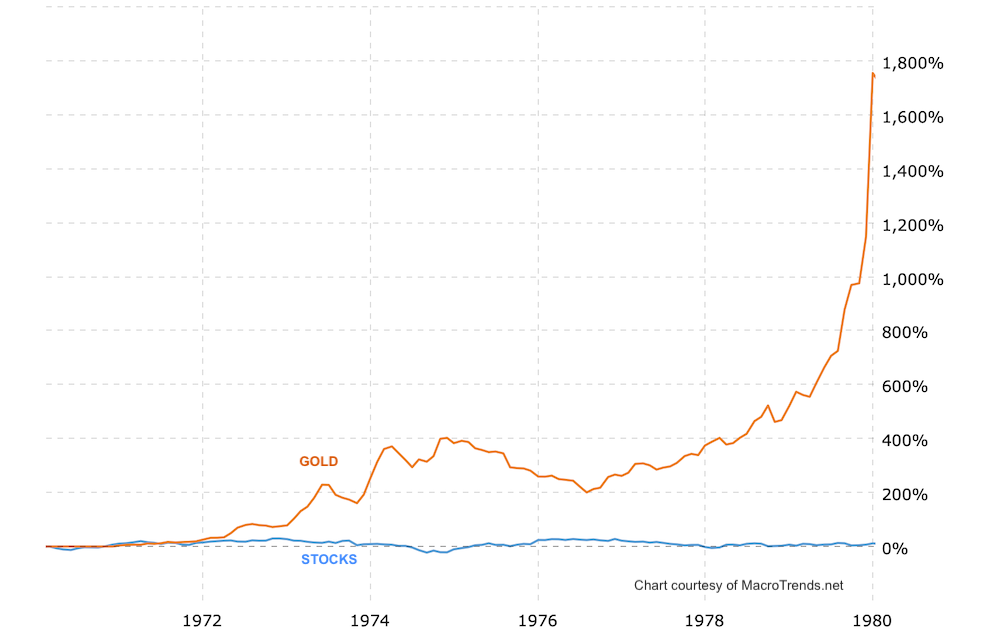

USAGOLD note: A very hard landing, as a matter of fact. In the meanwhile, gold went from $35 in 1970 to $875 in early 1980, while stocks languished. (See chart.) Joe Carson is a highly regarded economics analyst formerly at Alliance Bernstein and other investment banks.

Gold and stocks

(%, 1970s)

Chart courtesy of MacroTrends.net

Chart courtesy of MacroTrends.net