FOMC Minutes Show Fed To Rush Rate-Hikes, Leaves QT Details Up In The Air

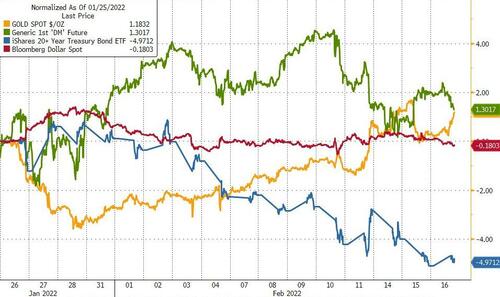

Since the Jan 26th FOMC meeting, bonds have been a bloodbath while stocks and gold are higher and the dollar flat…

Source: Bloomberg

We have also seen a dramatic rise in rate-hike odds in the period since the last FOMC meeting (helped in some part by Jim Bullard’s uber hawkish perspective), with a 60% chance of a 50bps hike in March priced-in…

Source: Bloomberg

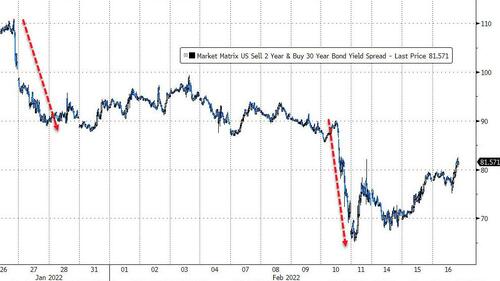

And as the liftoff and trajectory of rate-hikes soared, the yield curve has collapsed signaling growing market fears that The Fed is on a path to a policy error…

Source: Bloomberg

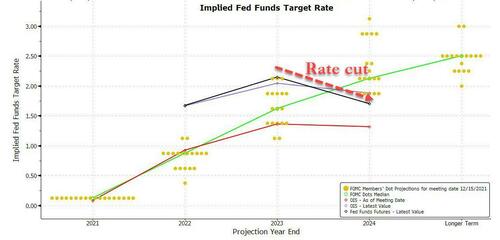

Perhaps most notable is the fact the forward curve has moved rapidly to price in rate-cuts starting in 2023…

Source: Bloomberg

Which is now very obviously pricing in a more hawkish Fed in the short-term and then a dovish collapse…

Source: Bloomberg

With all that said, today’s release of the Fed Minutes are somewhat moot, given all the post-FOMC FedSpeak, but all eyes will be on any signaling around the 50bps hike, the timing of QT, and any comments on the terminal rate (the peak rate of the hiking cycle) anyone on The Fed expects.

Here’s what they want us to see (even though this was before the big jobs print and 2 huge inflation prints):

On The End of Fed Balance Sheet expansion:

“In light of elevated inflation pressures and the strong labor market, participants continued to judge that the Committee’s net asset purchases should be concluded soon.“

“Most participants preferred to continue to reduce the Committee’s net asset purchases according to the schedule announced in December, bringing them to an end in early March“

“A couple of participants stated that they favored ending QE sooner to send an even stronger signal that the Committee was committed to bringing down inflation.”

On QT:

“While no decisions regarding specific details for reducing the size of the balance sheet were made at this meeting, participants agreed to continue their discussions at upcoming meetings.”

“While participants agreed that details on the timing and pace of balance sheet runoff would be determined at upcoming meetings, participants generally noted that current economic and financial conditions would likely warrant a faster pace of balance sheet runoff than during the period of balance sheet reduction from 2017 to 2019.”

On inflation”

“Participants remarked that recent inflation readings had continued to significantly exceed the Committee’s longer-run goal and elevated inflation was persisting longer than they had anticipated, reflecting supply and demand imbalances related to the pandemic and the reopening of the economy.”

“Some participants commented that elevated inflation had broadened beyond sectors most directly affected by those factors, bolstered in part by strong consumer demand”

“Some participants reported that their business contacts remained concerned about persistently high inflation and that they were adjusting their business practices to cope with higher input costs – for instance, by raising output prices or utilizing contracts that were contingent on their costs.”

“Participants generally expected inflation to moderate over the course of the year as supply and demand imbalances ease and monetary policy accommodation is removed.”

On a side note, we point out that yields at the long-end exploded higher about 5 minutes before The Minutes were released…

Developing…

* * *

Read the full Fed Minutes below:

[ad_2]

Source link