As Bitcoin surged from March 2020 through 2021, the market was convinced that Bitcoin was the “new” digital Gold, the new store of value asset. As Bitcoin surged to new highs at each passing day, this became a self-fulfilling prophecy. Gold was seen as the step child, given no attention whatsoever as traders chased the greed and FOMO 100%+ returns in crypto assets. Year to date, Gold is now up 6% vs. Bitcoin down 25%. Has the narrative changed?

People often mistake between correlation and causation. As the direction reinforces the initial thesis, the case for it grows even more. The fundamental case for Bitcoin has been its halving cycle that takes place every four years. As supply shrinks and demand rises, prices naturally have to go higher. In addition to that, cryptocurrencies, specifically Bitcoin, was seen as the new digital currency that would in theory take over the dollar once Fiat system fails completely due to endless money printing by its central bank every time there is an economic hiccup.

True as this narrative may be, a big part of the Bitcoin rally had been on back of that same endless money printing that exacerbated its underlying direction. The Fed’s balance sheet had expanded by over $4 trillion during the Covid crisis, which made its way into all risky assets. Bitcoin was also one of them. It is difficult to separate the fundamental flow from the bigger picture macro flow, but macro does play a part as top down rotation provides tailwinds. As much as it was hailed to be a truly diversified asset, if one were to plot the chart of Bitcoin vs. that of the central bank balance sheet or Nasdaq for that matter, the correlation is uncanny!

But in this particular case, given the Fed’s excess liquidity, it also led to causation because now that the market is considering the end of the Fed QE, Technology stocks and Bitcoin have fallen over the past few months despite their “fundamental valuation”. In that context, one can argue that Bitcoin really is nothing other than a pure risk “on” and “off” asset.

Given its 50%-100% moves, it is far from being a store of value. If it truly was one, then during this period of geopolitical uncertainty and/or recession fears, Bitcoin would be rallying like Gold has all of this year. But instead it has fallen just like one of the Cathy Woods (ARKK) names. Gold is finally outperforming the way one would imagine. It is not always about the absolute performance as it is about the relative performance. Gold may just be up 6% but it has severely outperformed most equities and broader indexes by 25%-80%. Sometimes capital preservation is as important as making returns, and that is exactly what Gold has achieved this year, preserved one’s profits and capital if they had monetized their gains into Gold.

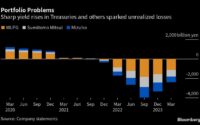

Given the central banks MMT experiment, most asset classes have lost their fundamental relevance as excess liquidity has distorted their real prices. The Fed is now facing an economy with 7.5% y/y inflation and a bloated balance sheet of $9 trillion. What the Fed should do is raise interest rates but with such a huge pile of debt, they are worried about rocking the boat. The market is testing the Fed’s resolve and is doing the job for them by signaling about nine rate hikes for this year alone. We know the Fed will not come anywhere close to that many rate hikes before they need to U-turn and ease policy once again.

Most are conditioned to buying the market as they believe that the Powell “put” is truly alive. There is little the Fed can do here other than hope or wish that inflation comes in fast. It is a shame that the Fed has not even managed to raise interest rates by 25 bps, and the market is already talking about being bailed out! One wonders what “tools” they will have to support the markets the next time we get a repeat of the repo crisis of 2019, or dare I say it, an outright economic recession.