In Times Like This, There Is No Alternative to Gold

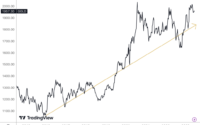

Geopolitical uncertainty abounds as the Russian invasion of Ukraine hits the one-week mark. Gold prices are holding above $1,900 an ounce and are poised to surge further.

“Besides looking for a store of value in times of heightened market stress, we believe many investors see the coming rate hiking cycle as extremely risky given the abnormal macroeconomic backdrop,” said James Luke, fund manager at Schroders. “Apart from being highly indebted, developed economies have become reliant on massive monetary and fiscal stimulus. The potential for negative feedback loops (a reaction that causes a decrease in function in response to a stimulus) into the real economy and financial markets as stimulus is removed and interest rates rise, is elevated,” Luke added.

Luke believes that there is a risk that tightening monetary policies could create stagflation. When stagflation hit in the ’70s, gold and gold miners were lone islands of relief amid a dismal economic ocean. Given the high geopolitical risk and persistent inflation, investors may want to look into funds such as the Sprott Physical Gold Trust (PHYS), the Sprott Gold Miners ETF (SGDM), and the Sprott Junior Gold Miners ETF (SGDJ).

Luke described gold as potentially being the “TINA” (there is no alternative) safe haven asset in the years to come, saying, “It is difficult to argue that traditional hedging instruments, such as government bonds, are as appealing as they’ve been in the past, not least because economies are highly indebted, yields are still close to historical lows, and inflation could well be structurally higher.”

Mark Bristow, CEO of Barrick Gold, also sees upside in the yellow metal and a potential for markets to collapse as the Russian invasion continues. “We’ve got very hot markets, and we are now going to really stress the global economy out. Everyone’s going to be impacted. If this goes on for much longer…the threat of that is it could collapse the market.”

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

[ad_2]

Source link