ECB Extends Backstop for Central Banks as War Jolts Currencies

(Bloomberg) — The European Central Bank will extend a precautionary facility that provides euros to central banks outside the currency bloc until Jan. 15, 2023, signaling it intends to help ease liquidity stresses caused by the war in Ukraine.

Most Read from Bloomberg

The backstop, called EUREP, was created in June 2020 during the early months of the coronavirus pandemic and was supposed to run through the end of this month. It allows a wide range of central banks to receive euros in exchange for some euro-denominated debt securities, complementing other bilateral swap and repo arrangements.

EUREP will continue to complement regular euro liquidity-providing arrangements for non-euro area central banks, the ECB said Thursday. These measures form a “comprehensive set of backstop facilities to address possible euro liquidity needs in the event of market dysfunctions outside the euro area that could adversely affect the smooth transmission of the ECB’s monetary policy.”

Requests for individual euro liquidity lines will be assessed by the Governing Council on a case-by-case basis, it said.

The extension of the facility could particularly help countries in Europe with close trade and financial links to the bloc. Poland’s central bank said Wednesday that it was discussing opening foreign-currency swap lines with international counterparts including the ECB, the Federal Reserve and the Swiss National Bank.

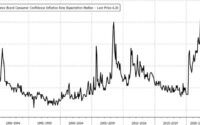

Poland’s zloty has been one of the worst-hit currencies by war in neighboring Ukraine, though it’s recouped some losses in recent days.

The ECB already has standing currency-swap lines with Bulgaria and Croatia, two European Union members that are preparing to adopt the common currency. Those were also scheduled to finish at the end of March.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

[ad_2]

Source link