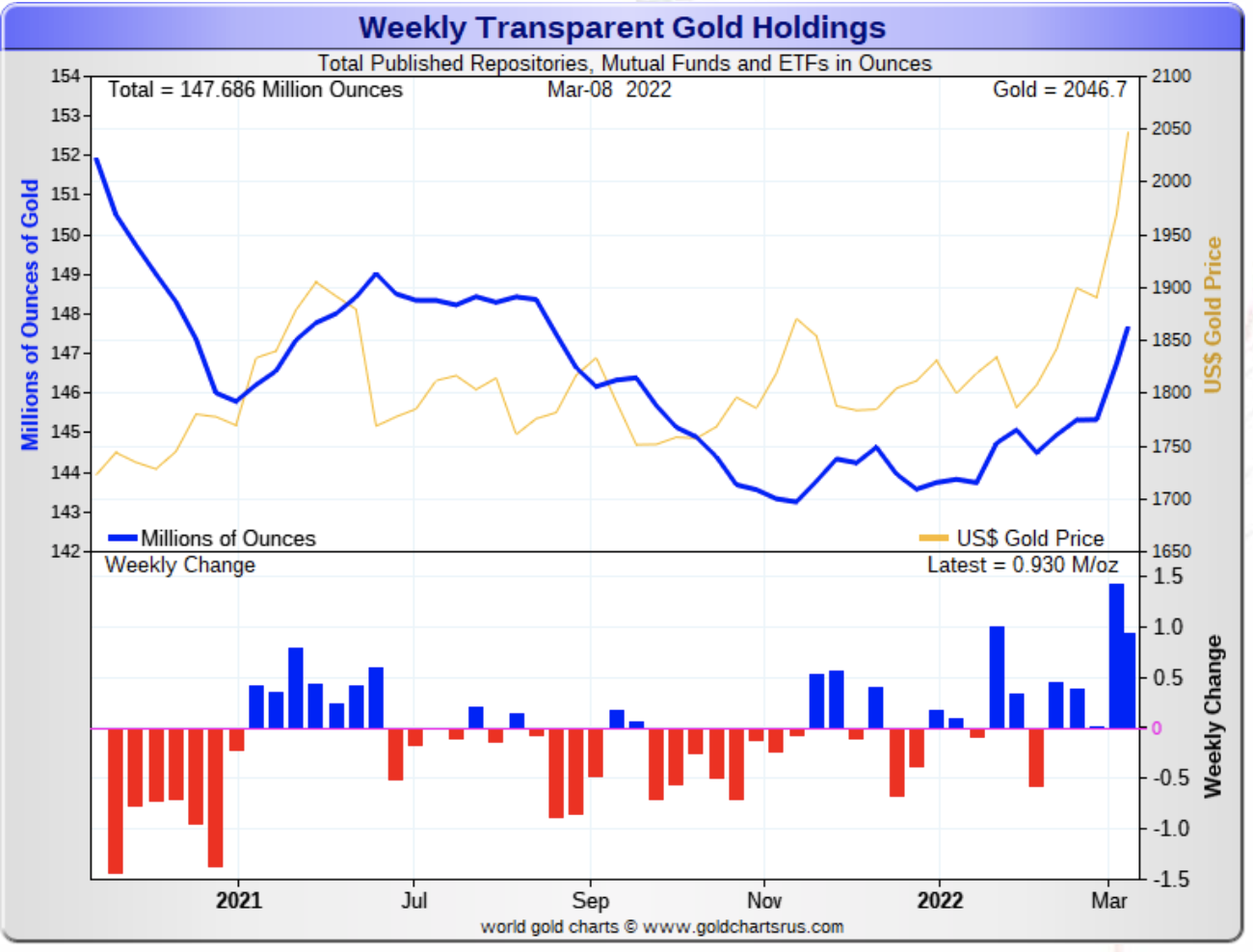

World Gold Council/Staff/3-7-2022

“Global gold ETFs drew net inflows of 35.3t (US$2.1bn, 1.0% of AUM) in February. Positive flows were almost evenly split between North American and European funds, continuing the year-to-date growth in Western markets and considerably outweighing outflows from Asia. Global net inflows were driven by stubbornly high inflation and a surge in geopolitical risk on the back of the Russian invasion of Ukraine, which pushed the gold price to an intra-month high of US$1,936/oz.”

USAGOLD note: It is fairly well established that gold ETF stockpile levels are a driver to gold prices, and, at the moment, they are on the rise. Just a couple of days after WGC posted this report, the price went over $2000 and true to form ETF stockpile additions surged in concert with the increase.

Chart courtesy of GoldChartsRUs.com