Wall Street Mood Turns Apocalyptic: Majority Sees Bear Market & Stagflation; Optimism Lowest Since Right Before Lehman

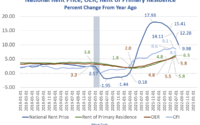

In late 2021 we noted a gaping divergence in one of Wall Street’s most closely watched surveys, the BofA Fund Manager Survey: while the number of respondents seeing a stronger economy had collapsed, the allocation to stocks remained near record high levels, resulting in what we called a “historic divergence”.

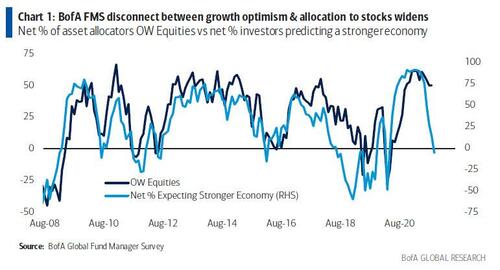

Well, the divergence is no more: after several months of tentative declines, Wall Street sentiment in March has finally hit rock bottom and according to the latest BofA Fund Manager Survey conducted by Chief Investment Strategist Michael Hartnett in which some 341 panelists with $1 trillion in AUM were polled, global growth optimism has crashed to the lowest since July 08, two months before Lehman crashed.

As shown in the chart above, with the collapse in sentiment there finally has come a plunge in the number of stock overweights, or as Hartnett puts it, “the recent disconnect between global growth and equity allocation is now being corrected by a significant decline in equity allocation.” And with that the inexplicable divergence we mused about for much H2 2021 is gone.

That said, another divergence appears: if we go back to July 2008 – just before the biggest financial crisis in generations – the Fed was about to cut rates and launch the first ever QE in order to flood the system with liquidity, but this time, even as investors investors are bracing for a recession with abysmal economic growth and profit expectations, they still expect the Fed to hike rates because inflation expectations are not recessionary; instead they are stagflationary.

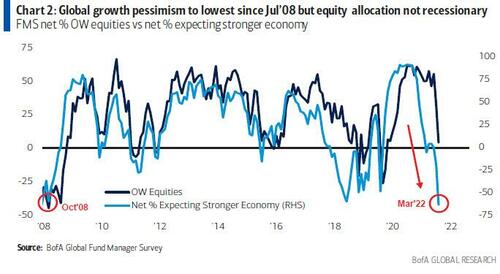

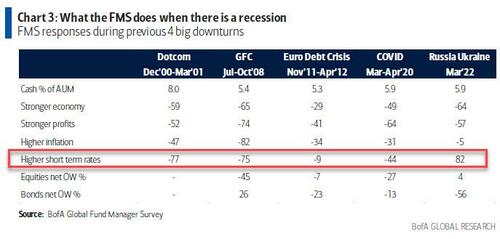

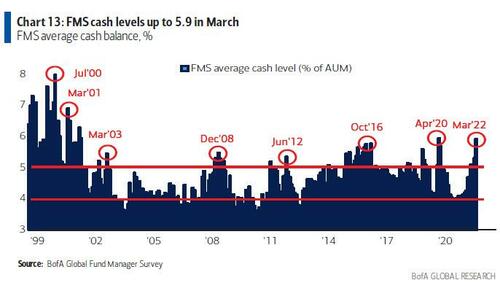

… and even though FMS equity allocations are down, they are still not at capitulation levels, because as shown in the table above, the net overweight equities is still positive: “Investors remain overweight stocks, not underweight; equity allocations are not at “recessionary” close-your-eyes-and-buy levels.” This suggests there is more downside until we finally see a full-blown revulsion to owning stocks, something which can also be seen in the BofA Bull & Bear Indicator at 2.8 from 2.9 as FMS cash rises modestly to 5.9% from 5.3%, i.e. they are still not yet “extremely” bearish.

What are the other notable findings from the latest FMS survey?

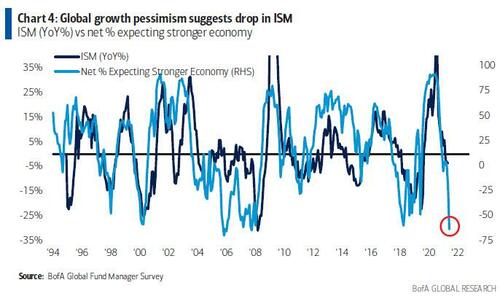

First, looking at macro, growth expectations are at 14-year lows, suggesting a collapse in ISMs in the next few months (according to BofA, “FMS consistent with the ISM index dropping sharply to below 50 in Q2’2022“) as the US economy slides into recession…

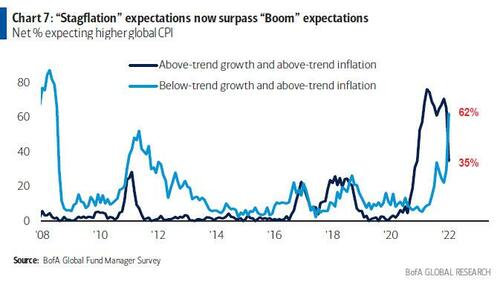

… yet at the same time, CPI expectations are rising (which is bizarre for a garden-variety recession, when deflation rules)….

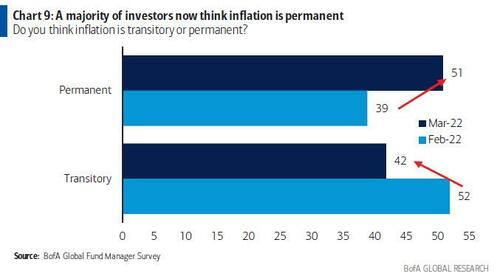

… and a majority now expect inflation to be “permanent”…

… which is also why profit expectations have collapsed to the lowest level since Covid.

It is therefore no surprise that 62% of respondents (up from 30% last month ) now forecast stagflation, while the delusion that the US is heading for a Boom is shared by just 35% (down from 65% a month ago).

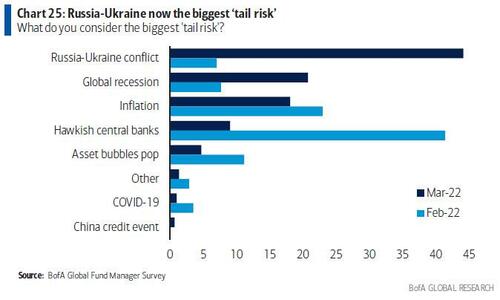

Second, looking at risk, there is a new #1 tail risk on Wall Street which understandably is now Russia/Ukraine (44%), with global recession #2 (21%), inflation #3 (18%)

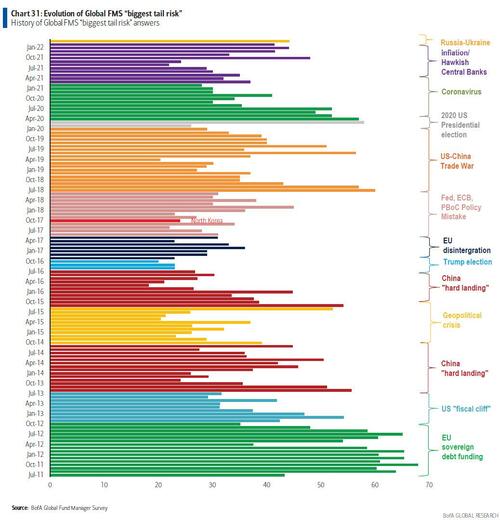

And a longer-term perspective:

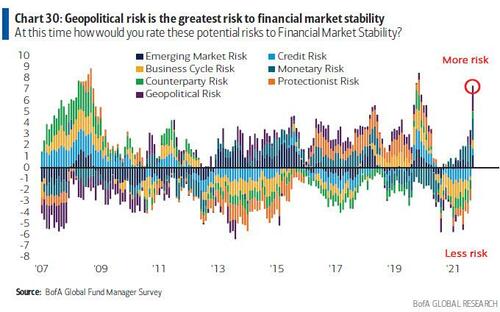

It’s not just Russia/Ukraine though: as the next chart shows, geopolitical risk is the greatest risk to financial market stability at 95% followed by monetary risk at 81%, followed by business cycle risk at 61%.

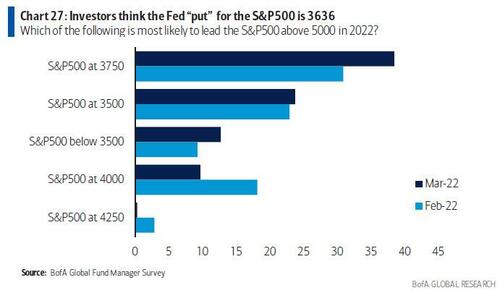

Moving on, FMS respondents say the Fed “put” is now at 3636 for S&P500 (down from 3698)…

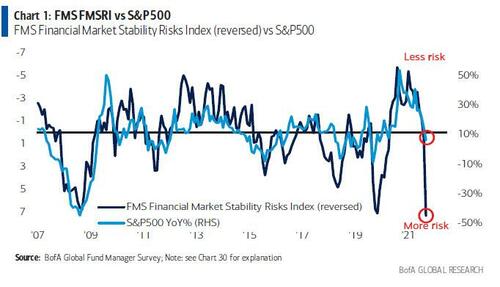

… with investors’ perception of “stability risks” consistent with a >10% YoY drop in SPX toward 3600.

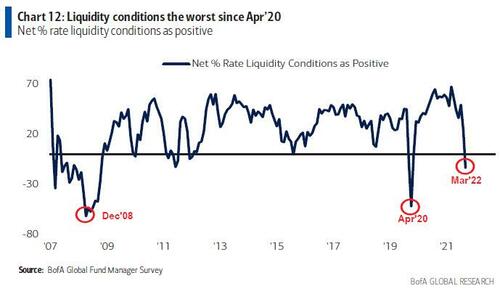

And, as we have been warning for the past month, Wall Street “liquidity conditions” worst since Apr’20 (which sparked Fed QE/emergency liquidity).

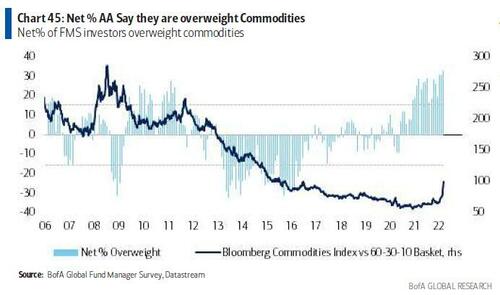

Third, looking at asset allocation, long gone are the days of tech darlings dominating portfolios, as the allocation to commodities is now at record high 33%…

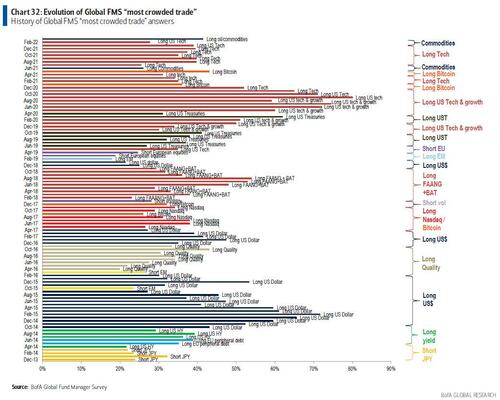

… which is why Wall Street also now thinks that the #1 crowded trade = long oil/commodities (it may have been, but as noted yesterday, every hedge funds has their finger on the sell button, and is also why oil has plunged more than 30% in one week)

And while the allocation to global equities slumps to lowest since May’20….

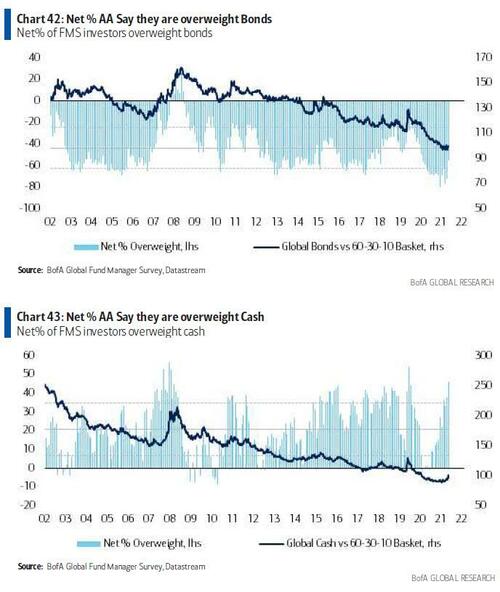

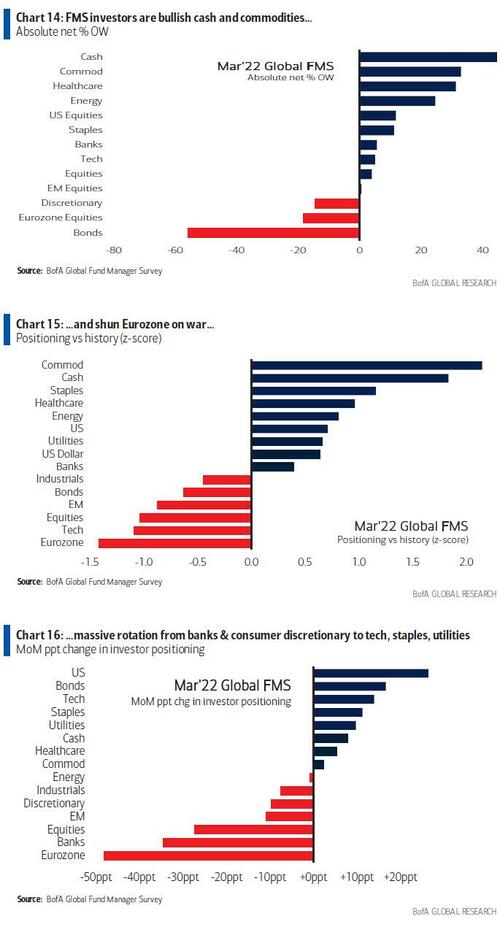

… but investors very underweight bonds (-56%) not stocks (+4%), while very overweight cash.

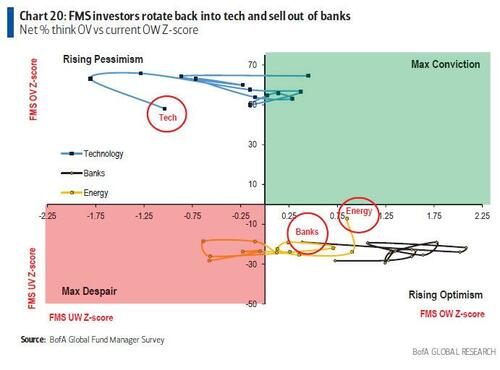

Fourth, looking at sectors & style positioning, a major March 22 rotation is from banks & consumer to tech, staples & utilities…

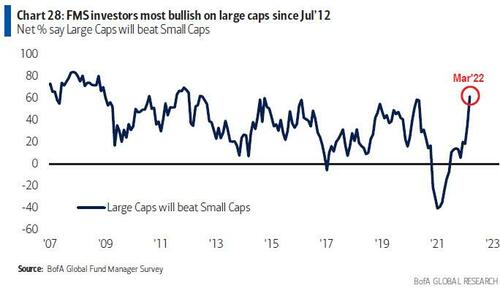

… and from small to large cap (10-year high)…

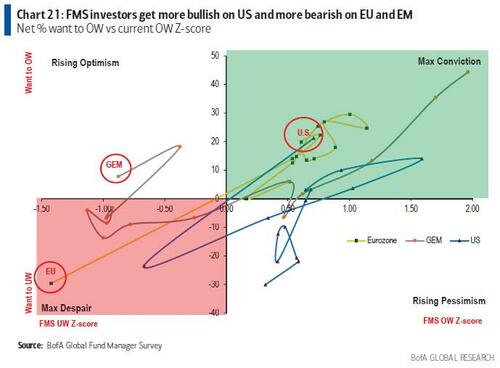

… while getting bullish on US on war (i.e. investors are currently still underweight EM equities on a historical basis but want to increase their exposure as well in the next 12 months). EU equities reversed this month to now an UW at 18% vs a 30% OW last month.

As a result, and in keeping with Hartnett’s overarching pessimism, the strategist writes that “Positioning + Policy = too early for contrarian buy call = we remain tactically & cyclically bearish” and notes that the March FMS “pain trades”: long Europe-short commodities, long cyclicals-short resources; long positions in US dollar & stocks most vulnerable to prolonged war, in contrast long positions in defensives (staples & utilities) vulnerable to peace.

Much more in the full presentation available to pro subscribers.

[ad_2]

Source link