Final Q4 GDP Estimate Below Expectations On Weak Consumption As All Attention Turns To Looming Recession

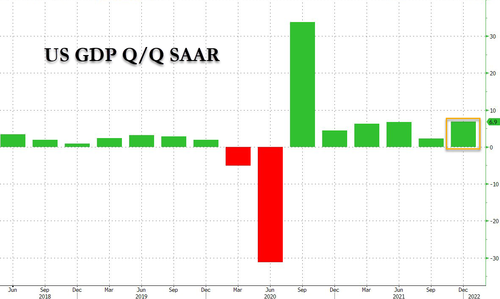

While it’s ancient history now, and attention is turning not so much to economic growth in the current quarter but rather what will happen in the near future now that the yield curve has inverted and a recession is imminent, moments ago the BEA reported its third and final estimate of Q4 GDP which came at 6.9%, just a fraction below the 2nd estimate and the consensus forecast of 7.0%.

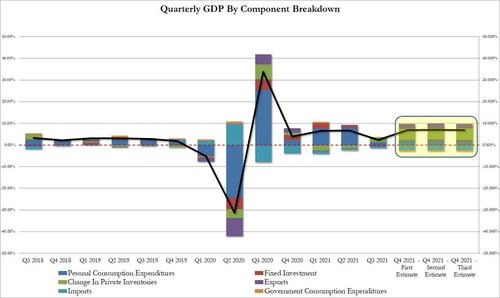

According to the BEA, the update primarily reflects downward revisions to consumer spending and exports that were partly offset by an upward revision to inventory investment. Imports, a subtraction in the calculation of GDP, were revised up.

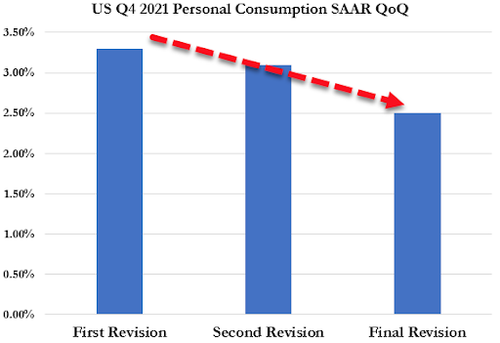

Indeed, looking at the all important Personal Consumption, it tumbled sharply from 3.1% annualized in the 2nd estimate to just 2.5% in the third and final, contributing just 1.76% of the bottom line 6.90% number (which dropped from 6.99%).

Offsetting the slide in consumption was a big jump in the change in private inventories which rose from 4.90% to 5.32% of the final GDP print (and contributed 77% of the bottom line number).

Elsewhere, fixed investment was revised from 0.48% to 0.50% of the bottom line GDP print

Net exports (exports less imports) was revised slightly lower from -0.07% to -0.22% and government consumption was virtually flat at -0.46%.

And while it’s ancient history now, with recent numbers showing that personal savings is well below pre-covid levels currently, the BEA reported that real disposable personal income (DPI) decreased 5.6 percent in the fourth quarter after decreasing 4.1 percent in the third quarter. Meanwhile, current-dollar DPI increased 0.4 percent in the fourth quarter, primarily reflecting an increase in compensation of employees, after increasing 1.0 percent in the third quarter. Personal saving as a percentage of DPI was 7.7 percent in the fourth quarter, compared with 9.5 percent in the third quarter.

Elsewhere, profits increased 0.7 percent at a quarterly rate in the fourth quarter after increasing 3.4 percent in the third quarter.

- Profits of domestic nonfinancial corporations increased 0.3 percent after increasing 1.7 percent.

- Profits of domestic financial corporations decreased 0.2 percent after increasing 2.6 percent.

- Profits from the rest of the world increased 3.3 percent after increasing 11.1 percent.

- Corporate profits increased 21.0 percent in the fourth quarter from one year ago.

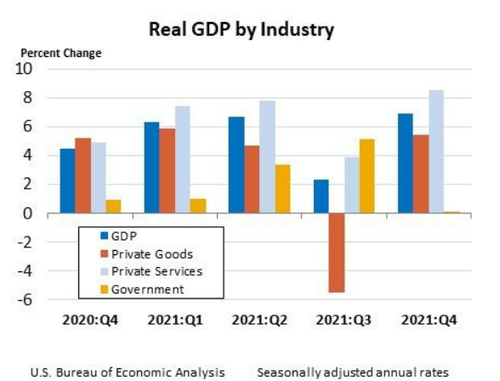

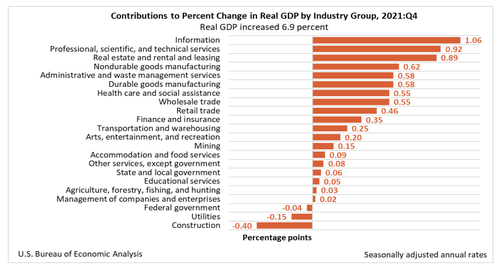

Today’s release also included estimates of GDP by industry. Private goods-producing industries increased 5.4 percent, private services-producing industries increased 8.5 percent, and government increased 0.1 percent.

Overall, 19 of 22 industry groups contributed to the fourth-quarter increase in real GDP.

The increase in private goods-producing industries was primarily reflected by increases in nondurable goods (led by chemical products as well as food and beverage and tobacco products) and durable goods (led by motor vehicles, bodies and trailers, and parts) that were partly offset by a decrease in construction.

The increase in private services-producing industries primarily reflected increases in information; professional, scientific, and technical services; real estate and rental and leasing (led by real estate); administrative and waste management services; health care and social assistance (led by ambulatory health care services); and wholesale trade. Partly offsetting these increases was a decrease in utilities.

The increase in government reflected an increase in state and local government that was partly offset by a decrease in federal government.

Finally, and the reason all of this is irrelevant, is because Q1 GDP is currently on the verge of contraction, and considering where the 2s10s is, we are confident that a recession is now just a matter of time.

It’s cool: there is a productivity golden age coming in Q2, and stuff pic.twitter.com/mVio4aSqtk

— zerohedge (@zerohedge) March 29, 2022

[ad_2]

Source link