Financial Times/Katie Martin/3-31-2022

“Commodities are the clear outlier. Prices of everything Russia produces — chiefly oil, gas, metals and wheat — have ripped higher, which is understandable and an important source of global inflationary pressure. But the process of trading itself is repeatedly falling over. This is the bit that could cause accidents.”

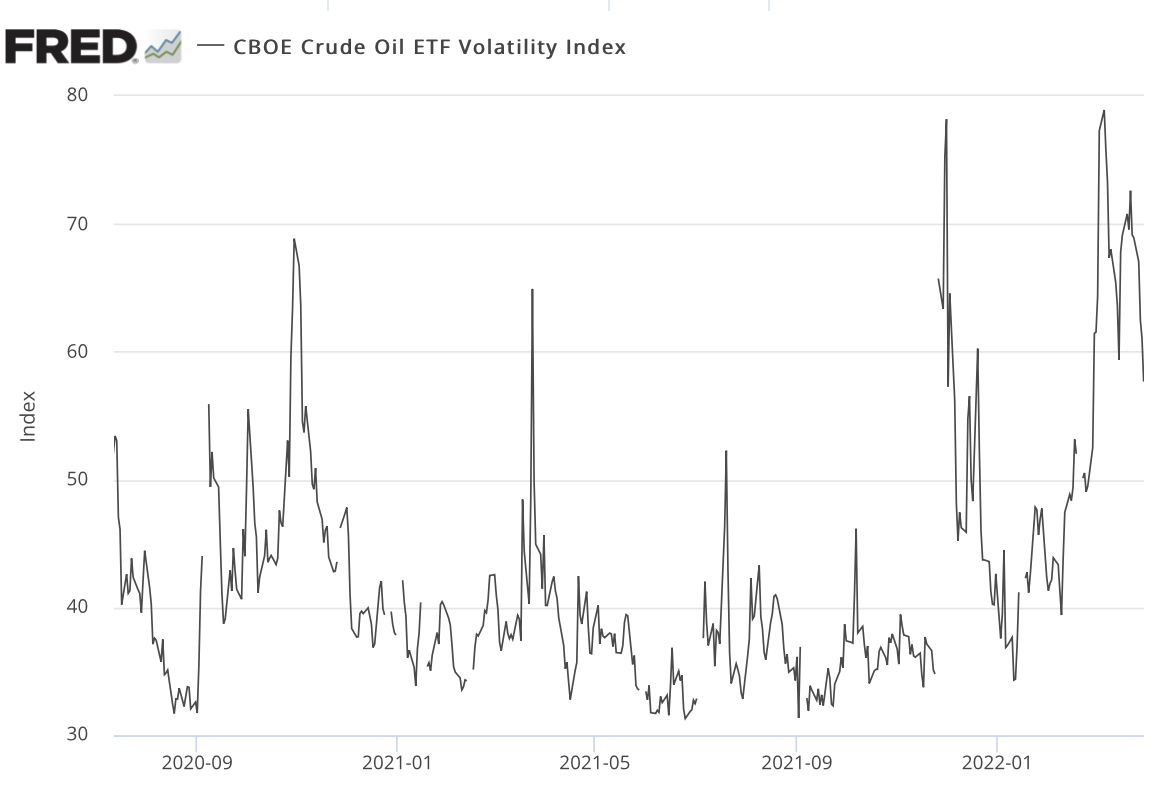

USAGOLD note: Martin says that stock markets are “buoyant” – an outcome that has puzzled investors. Other markets, like bonds, though stressed are still functional. Commodities markets though are showing signs of stress with trading houses asking for more margin to pad the volatility, which in turn is stressing their clientele. She concludes that “if anything is going to break” it will be in the commodities market.

Sources: St. Louis Federal Reserve [FRED], Chicago Board Options Exchange