FOMC Minutes Signal Bigger, Faster-Than-Expected QT, Multiple 50bps Hikes

Tl; dr…

Fed Minutes more hawkish than expected on rate-hikes and QT:

-

As much as $95 billion in asset runoff per month ($60-90 bn exp)

-

Many Fed officials say half-point hikes may be warranted

-

Fed sees need to get to neutral posture ‘expeditiously’

-

Fed fears public loss of confidence in is resolve over inflation

Ian Lyngen at BMO had a great take after the minutes:

“If the Fed is going to bring rates swiftly to (and through) neutral, we’re apprehensive that this cycle’s terminal will persist for a truly extended period before the realities of the recovery will require lower policy rates; fine tuning or otherwise.”

In other words – if The Fed follows through on this, recession will swiftly follow (along with market chaos), which will likely force The Fed to fold long before achieving its goal (and escalating its anxieties over losing the public’s confidence).

The only question is how negative rates will be in 2024/25.

* * *

Since March 16th’s FOMC Statement, and The Fed’s rate-hike, US equities have soared (giving some back in the last couple of days) and bonds have been battered…

Source: Bloomberg

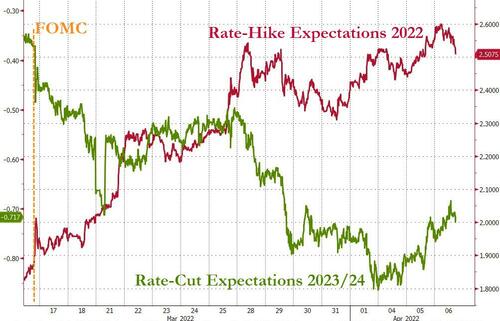

And thanks to the extreme level of hawkish jawboning, the market’s expectations for rate-hikes in 2022 have soared from 6 more to 9 more (with 82% odds of a 50bps hike in May)… and at the same time, rate-cut expectations for 2023/24 have soared from just over 1 cut to more than 3…

Source: Bloomberg

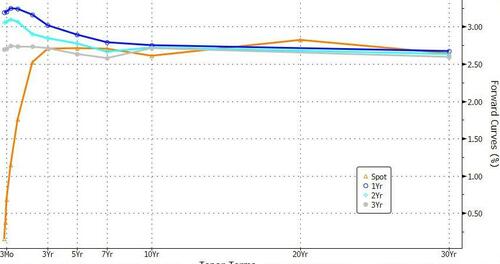

And the yield curve has collapsed (with 2s10s swinging into inversion and back out – the latter the real signal for an imminent recession)…

Source: Bloomberg

The big thing everyone is watching for in today’s Minutes is just how aggressive the balance-sheet reduction is going to be after Brainard’s comments suggested far faster-and-furiouser a contraction than anyone hoped for (an active ‘sell-down’ vs passive ‘run off’) because Powell specifically said at his Q&A that he is “sure there’ll be a more detailed discussion of our [B/S reduction] in the minutes.”

The Minutes were more hawkish than expected ($60-90 billion per month expected):

“Participants generally agreed that monthly caps of about $60 billion for Treasury securities and about $35 billion for agency MBS would likely be appropriate. Participants also generally agreed that the caps could be phased in over a period of three months or modestly longer if market conditions warrant.

Participants reaffirmed that the Federal Reserve’s securities holdings should be reduced over time in a predictable manner primarily by adjusting the amounts reinvested of principal payments received from securities held in the SOMA. Principal payments received from securities held in the SOMA would be reinvested to the extent they exceeded monthly caps.

Several participants remarked that they would be comfortable with relatively high monthly caps or no caps.”

Here’s what QT will look like…

As expected, FOMC says runoff focus should be on coupons, not Bills:

“Participants discussed the approach toward implementing caps for Treasury securities and the role that the Federal Reserve’s holdings of Treasury bills might play in the Committee’s plan to reduce the size of the balance sheet. Most participants judged that it would be appropriate to redeem coupon securities up to the cap amount each month and to redeem Treasury bills in months when Treasury coupon principal payments were below the cap.”

FOMC also considered selling agency MBS after rolloff is well underway:

“Participants generally agreed that after balance sheet runoff was well under way, it will be appropriate to consider sales of agency MBS to enable suitable progress toward a longer-run SOMA portfolio composed primarily of Treasury securities.”

On preference for 50bps rate hike:

“Many participants noted that—with inflation well above the Committee’s objective, inflationary risks to the upside, and the federal funds rate well below participants’ estimates of its longer-run level—they would have preferred a 50 basis point increase in the target range for the federal funds rate at this meeting“

BUT 25 won for now because:

“A number of these participants indicated, however, that, in light of greater near-term uncertainty associated with Russia’s invasion of Ukraine, they judged that a 25 basis point increase would be appropriate at this meeting. Many participants noted that one or more 50 basis point increases in the target range could be appropriate at future meetings, particularly if inflation pressures remained elevated or intensified.”

FOMC getting nervous about broken, illiquid markets:

“Liquidity conditions became strained in some financial markets during the intermeeting period. Market depth deteriorated in U.S. Treasury, U.S. equity, and crude oil markets.”

“Trading volumes generally remained within normal ranges in most markets and increased above normal levels in Treasury markets later in the period. Bid–ask spreads did not increase notably in most markets. However, investors reported that strained liquidity at times amplified the volatility of price moves and may have contributed to the particularly large swings in Treasury yields and equity prices late in the intermeeting period.”

FOMC on Ukraine war:

“The Russian invasion of Ukraine, however, constituted another negative shock to the global economy by pushing up commodity prices further, hurting global risk sentiment, and exacerbating supply bottlenecks”

FOMC on foreign inflation:

“Inflation abroad continued to rise, driven by recovering global demand, rising retail energy and food prices, and ongoing strains on global supply chains; the effects of the Russian invasion contributed to some of these inflationary pressures.”

Did The Fed also announce its willingness to fold like deck-chair (learned lessons from 2017-2019’s chaotic flip-flop):

“Participants agreed that lessons learned from the previous balance sheet reduction episode should inform the Committee’s current approach to reaching ample reserve levels and that close monitoring of money market conditions and indicators of near-ample reserves should help inform adjustments to the pace of runoff.”

Finally, The Fed fears inflation and is willing to aggressively fight it…

“A few participants judged that, at the current juncture, a significant risk facing the Committee was that elevated inflation and inflation expectations could become entrenched if the public began to question the Committee’s resolve to adjust the stance of policy.”

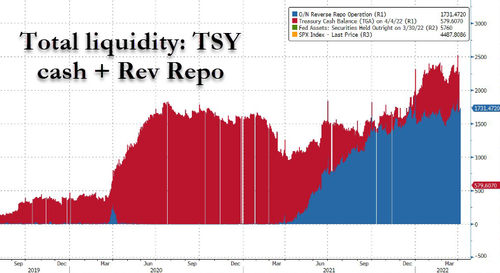

And so, as The Fed readies to initiate QT, total systemic liquidity now is $2.5TN ( $1.73TN in rev repo and $580BN in Treasury cash)…

* * *

Read the full Minutes below:

[ad_2]

Source link