Consumers are down in the dumps — and that stacks up as a positive signal for gold that shines brighter than many of the more often-cited factors for movements by the yellow metal, a top Wall Street technician said Thursday.

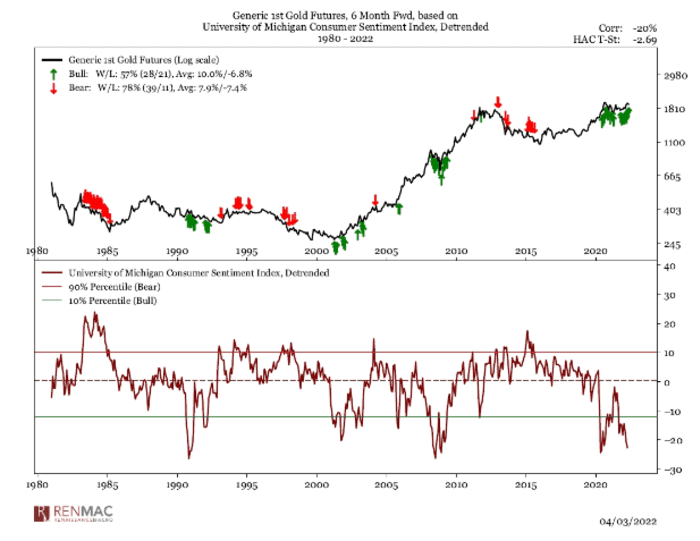

“We don’t find inflation, real‐rates, money supply or any of the theoretical inputs to be of much use for golds forward returns. We do, however, find consumer confidence to be a meaningful input, with high levels of confidence preceding weak forward returns and a dearth of confidence setting up bullish returns,” said Jeff deGraaf, founder of Renaissance Macro Research, in a note.

Renaissance Macro Research

The chart above maps out forward performance for gold futures

GC00,

versus readings for the University of Michigan’s consumer sentiment index going back to 1980.

Gold is up around 6% so far in 2022, more than holding its ground even as Treasury yields have surged and the dollar has rallied. Rising bond yields raise the opportunity cost of holding nonyielding assets like gold, while a firmer dollar is also seen as a headwind for commodities priced in the unit.

Gold has outshined stocks so far this year, with the S&P 500

SPX,

down 6.6% and the Dow Jones Industrial Average

DJIA,

off 5.6%.

The final March reading of the consumer confidence index on March 24 came in at 59.4 — the lowest reading since 2011, with the gloom tied to worries about the cost of living as inflation runs at a nearly 40-year high.

“Consumer confidence is in the bottom decile, own some gold,” deGraaf said.