China Cabinet Vows Monetary Stimulus, Saying Risks Worsening

(Bloomberg) — China signaled it will step up monetary stimulus for the economy, acknowledging that domestic and global risks are now bigger than previously expected.

Most Read from Bloomberg

Officials will use multiple monetary policy tools at an “appropriate time” to support the real economy, according to a readout from a meeting of the State Council chaired by Premier Li Keqiang on Wednesday. The “complexity and uncertainty of domestic and foreign environments have intensified, and some have exceeded expectations,” the meeting said.

The State Council, China’s Cabinet, didn’t mention specific easing steps, like reducing the reserve requirement ratio. It previously gave signals for a RRR cut in July and December days before the People’s Bank of China cut the ratio.

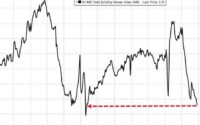

Chinese authorities have made repeated vows to stabilize the economy in recent weeks as Covid restrictions curtail spending and business activity. A gauge of sentiment in the services sector fell in March to the lowest level in about two years, while the country’s financial hub Shanghai is in total lockdown. That’s putting the government’s ambitious growth target of about 5.5% for this year in doubt.

The State Council said that while the economy is still moving in a reasonable range, new downward pressures have intensified, with more frequent virus outbreaks, a slowing global economic recovery and fluctuating commodity prices. The government should promptly introduce measures that are conducive to stabilizing market expectations and bring forward some policies laid out in the government work report, it said.

Top financial leaders pledged last month to ease regulatory crackdowns, support property developers and stimulate the economy through monetary policy. However, few concrete steps have been taken so far.

Although the meeting didn’t explicitly mention cuts to the reserve requirement ratio and policy interest rates, further reductions are likely to be part of the package to support growth, Goldman Sachs Group Inc. economists including Maggie Wei wrote in a note. They predicted a 10 basis-point cut to policy interest rates and a 50 basis-point RRR reduction, without providing a timeframe for the easing.

A reduction in the interest rate on one-year policy loans — the medium-term lending facility — could come as soon as next week, a Bloomberg survey shows.

Small Businesses

The PBOC’s easing stance is in stark contrast with other major central banks such as the Federal Reserve, which is expected to undertake its most aggressive monetary-policy tightening in almost three decades as it fights a commodity-driven inflation spike.

Huatai Securities analysts also argued that it’s still necessary for China to cut interest rates and the RRR, although they said it’s not urgent to reduce the latter and the room for lowering interest rates is getting limited. The mention of multiple monetary tools, however, suggests measures including MLF injections, re-lending programs, loan support for small businesses are also on the table, they said in a report.

Several economists have also said the central bank may soon need to move away from using the RRR as a tool to spur liquidity and growth in the economy as it becomes less effective in addressing structural challenges.

Liquidity in China’s banking system appears to be stable at the moment. The rates on one-year negotiable certificates of deposits, an interbank borrowing instrument, are below the cost of the MLF.

“What’s complicating monetary policy is not expanding money supply but expanding credit,” wrote Yuekai Securities Co. analysts led by Luo Zhiheng in a report after the State Council meeting. The government hopes to introduce policies that will encourage more lending after money supply is expanded, giving the economy a boost.

The State Council said the government will extend the deferral of pension contributions to more industries that are struggling, such as civil aviation and other transportation sectors, after the policy was already applied to restaurants, retail, and tourism.

Lockdowns and other restrictions to curb the spread of Covid-19 show spending is still well below pre-pandemic levels. Tourism revenue over the three-day national holiday that ended Tuesday was only about 39% of the level reached during the same period in 2019, data from the Ministry of Culture and Tourism showed.

The State Council also pledged to improve financial services for new urban dwellers and the demand for affordable housing, part of an effort to boost consumption. It added that proceeds from local government special bonds will be used to replenish capital of medium and small-sized banks to enhance their ability to extend credit.

Separately, the central bank published a draft outline for a stability fund to provide support to troubled financial firms. The fund will be set up with capital from financial institutions and receive liquidity support from the PBOC, according to a draft law published on Wednesday. The size of the fund wasn’t given.

Bloomberg News reported last week the central bank is leading an effort to raise several hundred billion yuan for a new fund to defuse financial risks. China is moving to stem financial risks ranging from hundreds of weak rural banks to dozens of distressed developers saddled with at least $1 trillion of liabilities.

(Adds background about liquidity, RRR, analysts’ comments from paragraph 9.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

[ad_2]

Source link