BloombergOpinion/Steven Kelly/4-12-2022

“Justified as they are, the sanctions imposed on Russia – one of the world’s largest exporters of metals and hydrocarbons — are wreaking havoc on already-strained commodities markets, with potentially dire consequences for the global economy. To avoid unnecessary damage, officials should be prepared to meet this extraordinary challenge with a no less extraordinary response: Emergency support from the U.S. Federal Reserve.”

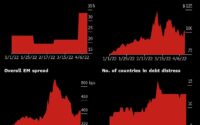

USAGOLD note: The trouble with black swans is that the fact they are….well, black swans. No one where the next one will originate. Apparently, some are worried about the commodities market since the nickel debacle on the London Metals Exchange. Now, we hear rumblings of similar problems in the zinc market (Reuters). But do we really want to go down the bailout road again? Create even more moral hazard than we already have?