Overheating job market has raised the risk of recession meaningfully, warns Goldman Sachs

Goldman Sachs isn’t yet ready to join the chorus of its peers in calling a U.S. recession, but it sure appears to be inching closer to that frenzied camp.

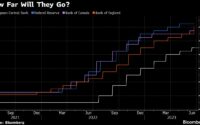

“We do put some weight on the historical patterns [of the labor market] and believe that the overheating of the labor market has raised the risk of recession meaningfully. The yield curve seems to discount a recession probability in 2023 of about one in three, roughly double the unconditional average, and we would broadly concur with this assessment,” warned Goldman Sachs Chief economist Jan Hatzius in a new client note on Tuesday.

Without question, talk of a looming recession has intensified on Wall Street amid hot reads on inflation, an inversion of the yield curve and elevated energy costs for households.

This week has already brought another worrying signal on inflation.

Expectations about inflation over the next 12 months for U.S. consumers hit a record 6.6% in March, according to new data from the Federal Reserve Bank of New York. In February, those expectations stood at a still bloated 6%.

Tuesday’s closely watched Consumer Price Index (CPI) is expected to hit more than 8% on the headline, underscoring the findings in the New York Fed survey.

Keep in mind, the latest jobs report for March only showed average hourly earnings rising 5.6% over the past 12 months. In other words, consumer purchasing power is being eroded at the same time interest rates are heading higher.

That’s not exactly a great combination.

Big investors are beginning to take notice of these recession calls and trends, even if they are still staying mostly bullish on stocks.

Global growth optimism has sunk to an all-time low among fund managers, per a new survey from Bank of America today. The percentage of investors expecting economic conditions to weaken hit its highest ever level seen in the survey. Stagflation expectations approached levels not seen since summer 2008.

“I would say that it’s probably closer to a coin toss that the economy will be moving into recession by the end of the year,” said Dreyfus and Mellon Chief economist and macro strategist Vince Reinhart on Yahoo Finance Live.

Brian Sozzi is an editor-at-large and anchor at Yahoo Finance. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit

[ad_2]

Source link