|

| But Where Does The Money Go From There? |

When you start thinking about all the money and jobs we shift into

Mexico each year you would think by now Mexico would be rolling in cash.

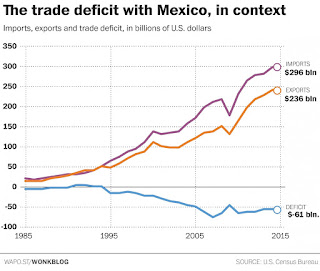

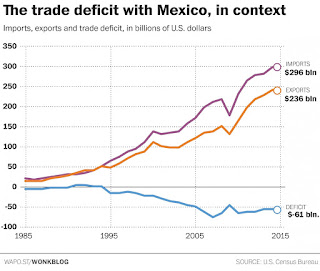

Interesting trade deficit data concerning Mexico reveal a fact most

people miss. A bit of research quickly confirms that the money Mexico

receives by way of trading with America quickly passes through its

lands and flows to Asia. It could be argued that when all is said and done we

are still transferring our wealth to the far east only by the scenic

route.

The true size of our trade deficit with Mexico is difficult to get a handle on, some figures show it as around 102 billion dollars in 2019. What

really stands out is where Mexico sends this trade

income. The following numbers show that when it comes to trade in 2019

exports of goods and services made up about 39% of Mexico’s GDP but

even with a huge trade surplus with the United States, Mexico still ran

an overall trade deficit. This is the reasoning behind substantially strengthening NAFTA

but in a way that gives a great deal more value to the United States.

|

| Once Wealth flows To Asia, It Stays There |

For years the overspending of consumers here in the United States has allowed countries like China, South Korea, and

Japan to sell as far more than we export. We have enriched them through what often seems like rather

lopsided trade arrangements, and during that time we have watched them

grow stronger as we have weakened.

Those preaching the virtues of

globalism and free trade point out that American consumers pay far lower

prices because of this but overlook the fact that in the long run such

an unbalance will not end well.

The bottom-line is the United States not only

directly but even indirectly is shipping wealth off to Asia, this means such trade poses a far bigger issue than what is seen as the imbalance with our NAFTA partners.

This article ties in with several others published on AdvancingTime. One delves into

how China has not been fair in trading with America and how a very

strong strategic dimension exists for NAFTA and a powerful regional

trade bloc to compete in a changing global economy. The second explores the strong business relationship between Japan and China that has grown stronger since Japan imploded decades ago. This tight relationship is apparent each time trouble surfaces in China. It seems, the yen jumps in value as wealth in a stealth move flees China through business back-channels. This should not be misinterpreted as the

yen strengthening, but rather a temporary bump before the wealth moves

on to an even safer place.

It is likely the controversy over just how much trade contributes to America’s

economic growth will be ramped up as growth slows. Trade between

countries is given far too much credit for being a big driver of our

economy. It pales next to factors such as government spending and credit

expansion. The fact is if John needs to buy a wheelbarrow for work it

does not matter where it is built. John needs and will buy a

wheelbarrow. Where trade does fit into this has to do with what country employs workers to make that wheelbarrow and how much it will cost.

While John may save money if the wheelbarrow was produced in a low-wage

country trade has more to do with who benefits from commerce rather than a force driving our economy forward.In many ways, trade should be seen as a way to increase access to a

greater variety of goods at a better price but this only works over a

long period of time if it is balanced. A county that constantly

enjoys a trade surplus at the expense of its trade partners often

reaches a position to exploit the weaker countries and generally does

so.

Throughout history, trade policies have had massive long-term

ramifications on the strength of a nation’s economy. The recent promise by politicians that

increased trade will

create new jobs has turned out to be largely a

myth. Still, we hear the narrative spun by politicians playing the “fear

card” with statements such as “We

can’t let countries like China write the rules of the global economy.”

This implies we will lose the power to control our own fate if we stand

firm and protect what is ours.

The big driver for free trade has always been big companies wanting to

expand their markets and exploit ways to reduce labor costs. This is where it is important to remember it is not all about human labor but technology is playing a greater role in production. If factories filled with mostly robot workers are the future then we

should do all that we can to see that they are located in America. While

they would not necessarily be a massive creator of jobs they would at

least allow us to have control of our own manufacturing and reduce

America’s trade deficit. Fortunately, several events that have taken

place since then have fed into an awareness of the vulnerabilities

created by allowing control of production to flow into foreign hands.

Footnote; For more on this subject see the link below.

http://Nafta And Regional Trade Better than Buying From China.html

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)