The First Bank To Forecast A US Recession Now Warns To “Prepare For A Hard Landing”

Two weeks after Deutsche Bank became the first “credible” Wall Street bank to officially make a US recession in late 2023 its base case (here, of course, we exclude such uber bears as BofA’s Michael Hartnett or SocGen’s Albert Edwards, who have pitched recessionary scenarios explicitly different from the banks’ bullish “base cases”), the bank is out with a new, even more bearish view in its latest “House View” note, in which the bank explains that not only is a recession assured but that inflation expectations “will likely move significantly higher, ultimately leading to an even more aggressive tightening and a deeper recession with a larger rise in unemployment” which in turn will mutated into the outcome the Fed has been so desperate to avoid: a hard landing.

Here, courtesy of DB’s David Folkerts-Landau, the bank’s chief economist, is his House View which not only builds upon his bearish economic outlook but leads to a painful conclusion.

The storm clouds over the global economy have darkened dramatically. Russia’s invasion of Ukraine has led to fundamental questions about Europe’s dependence on Russian energy and the continent’s geopolitical stability. It has also significantly pushed up commodity prices, exacerbating above-target inflation, and creating a serious risk that longer-term expectations become unanchored.

This inflation momentum means central banks need to move aggressively to retain their credibility. Our economists expect the Fed funds rate to peak at 3.6% next summer, but my view is that there are significant upside risks in these forecasts. We are in a new environment, dancing to a new tune, and the incremental mean-reversing way of thinking about inflation and rates is likely to be misleading. Inflation is seeping into expectations, and labor markets are historically tight. It is easily imaginable that inflation dynamics that are highly sticky to the downside will prompt the Fed to raise rates into the 4.5-5% range. Likewise, the ECB is expected to raise rates by 250-300bps between this September and December 2023, taking the deposit rate up into the 2-2.5% range.

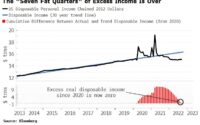

This aggressive tightening has led us to downgrade our growth forecasts, with a US recession in late 2023 as our baseline. The Fed’s record shows that achieving soft landings whilst reining in inflation with rate hikes this large is next to impossible. Furthermore, the recent 2s10s yield curve inversion parallels those that have preceded the last 10 US recessions, on average by around 18 months.

If central banks don’t act soon and more aggressively than forecast, inflation expectations will likely move significantly higher, ultimately leading to an even more aggressive tightening and a deeper recession with a larger rise in unemployment. Whilst the temptation may be to let inflation drift at a higher level, we do not think the Fed will risk losing its hard-won credibility. Prepare for a hard landing ahead.

This is an interesting point, and clashes with what Mohammed El Erian said a few days ago when the former PIMCO strategist predicted that the Fed will have no choice but to raise its infaltion rate from 2% to 3% as it will not be able to hit the lowest inflation target (as a reminder, as recently as 2 years ago, anyone who suggested that inflation would top 2% was laughed out of any polite gathering of clueless macroeconomic hacks and even more clueless economisseds.

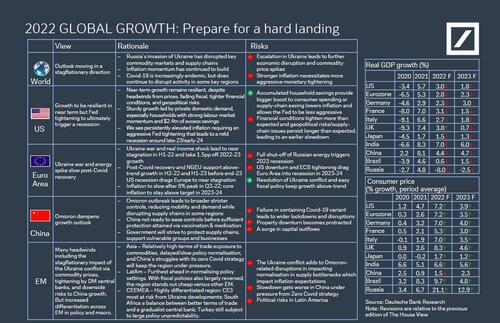

That said, here is DB’s matrix laying out how a hard landing will spread across the globe:

Of course, the cynical bulls will say that this is precisely the best case outcome: a purging crash, which sparks wholesale policymaker panic, and leads to the Fed eventually purchasing not just single name corporate bonds and junk bond ETFs, but also single stocks and ETFs.

The German banks then goes on to recap what it views as the three big risks, including i) Russia’s invasion of Ukraine; ii) Inflation moves well beyond central bank mandate ranges and iii) Covid-19 shock increasingly transitioned from pandemic to more manageable endemic, but risks remain in key regions. Some more observations here:

Key Risk #1: Russia’s invasion of Ukraine

- Russia’s invasion of Ukraine has pushed energy prices significantly higher and disrupted a number of other key commodity markets and supply chains.

- This is another major supply shock to world activity on the heels of the pandemic shock, causing key commodity prices to surge and real income and spending growth to slow.

- The war in Ukraine has reached a stalemate on most fronts since mid-March. Our baseline view is that the war morphs into a frozen military conflict and a fragile ceasefire emerges within the next few months. This would mark the end of the large-scale hot phase of the war but with flare-ups that continue for many months, if not years, likely with declining intensity over time.

- Downside scenarios centre on stronger aggression by Russia driving a major step up of the Western response in terms of sanctions and military support to Ukraine.

Key Risk #2: Inflation moves well beyond central bank mandate ranges

- The momentum of inflation has continued to build at a surprising pace in the US, Europe and elsewhere, necessitating a more aggressive tightening of policy by central banks.

- As a result, we now expect the US economy to be in outright recession by late next year, and the EA in a growth recession in 2024 with unemployment edging up.

- Our baseline view is that these developments will spill over to dampen growth in much of the rest of the world and at the same time help to bring inflation back toward mandated levels, diminishing the risk of greater disruptions further down the road.

- Downside risks could result from further geopolitical or other supply shocks, sending commodity prices higher still. Another risk is that inflation expectations become unanchored, necessitating an even more aggressive response from central banks, resulting in a deeper economic slowdown/recession.

- We do not believe the Fed will tolerate higher inflation. Elevated inflation is politically unpopular, and they won’t want to lose their hard-won credibility.

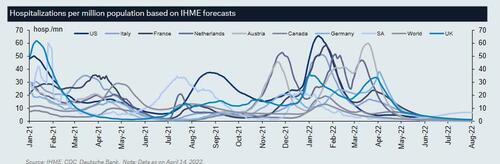

Key Risk #3: Covid-19 shock increasingly transitioned from pandemic to more manageable endemic, but risks remain in key regions

- China is seeing fresh lockdowns and significant disruption to economic activity as it sticks to a Zero Covid approach.

- But other countries are gradually removing restrictions that were first imposed in 2020, moving back toward normal pre-pandemic life.

- For example, the UK scrapped all legal restrictions related to Covid-19, including compulsory masks in public spaces along with self-isolation following a positive test

The bank then goes on to summarize its key macro views, including the US recession in late 2023, its expectations for 50bps of rate hikes in May, June and July, a liftoff by the ECB in September and general tightening everywhere except in China, and its views on the two key themes, inflation and Ukraine:

- Inflation. We assume that central bank action, while tardy, is just in time to keep inflation expectations anchored. This assumes no further major geopolitical or other supply shocks.

- Ukraine. Our baseline is that the war morphs into a frozen military conflict and a fragile ceasefire emerges within the next few months. We assume that natural gas flows from Russia to Western Europe will continue.

Finally, just in case it wasn’t already bearish enough, the bank also lists three key downside risks to its view, which include:

- Higher-than-expected inflation. If expectations become unanchored and inflation does not recede as expected, this would likely necessitate even more aggressive central bank tightening and a deeper economic slowdown/recession.

- Escalation in Ukraine. Stronger aggression by Russia could drive a major step up of the Western response in terms of sanctions and military support to Ukraine.

- New Covid-19 variants. Much of the world is returning to pre-pandemic normality, but a more severe variant could throw this progress off course.

The full note is available to pro subscribers in the usual place.

[ad_2]

Source link