US Existing Home Sales Slump Near 2-Year Lows As Mortgage Rates Soar

After crashing in March, existing home sales were expected to keep slumping in April as mortgage rates have done nothing but accelerate and mortgage applications collapse. Analysts were right as existing home sales fell to 5.77mm SAAR (as expected), sliding 2.7% MoM, slightly better than expected (but only because of a downwardly revised 8.6% MoM drop in March). Existing home sales are now down year-over-year for the eight straight month…

Source: Bloomberg

That is the lowest SAAR since June 2020…

Source: Bloomberg

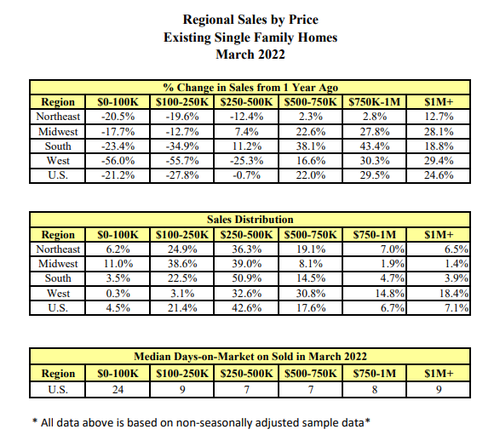

All-cash sales accounted for 28% of transactions in March, up from both the 25% recorded in February and from 23% in March 2021.

“With rising mortgage rates, cash sales made up a larger fraction of transactions, climbing to the highest share since 2014,” Yun said.

Total housing inventory at the end of March totaled 950,000 units, up 11.8% from February and down 9.5% from one year ago (1.05 million). Unsold inventory sits at a 2.0-month supply at the present sales pace, up from 1.7 months in February and down from 2.1 months in March 2021.

“Home prices have consistently moved upward as supply remains tight,” Yun said.

“However, sellers should not expect the easy-profit gains and should look for multiple offers to fade as demand continues to subside.”

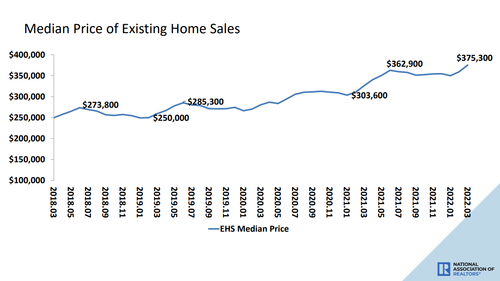

The median existing-home price for all housing types in March was $375,300, up 15.0% from March 2021 ($326,300)…

…as prices rose in each region.

This marks 121 consecutive months of year-over-year increases, the longest-running streak on record.

“The housing market is starting to feel the impact of sharply rising mortgage rates and higher inflation taking a hit on purchasing power,” said Lawrence Yun, NAR’s chief economist.

“Still, homes are selling rapidly, and home price gains remain in the double-digits.”

With mortgage rates expected to rise further, Yun predicts transactions to contract by 10% this year, for home prices to readjust, and for gains to grow around 5%.

Source: Bloomberg

Just how much pain will Powell push before he folds?

[ad_2]

Source link