IMF Says LME Needs Stronger Governance After Nickel Fiasco

(Bloomberg) — The International Monetary Fund said the London Metal Exchange’s governance systems need to be strengthened after a massive short squeeze that left the world’s main nickel market suspended for six days last month and billions of dollars of trades canceled.

Most Read from Bloomberg

The LME has been criticized by investors for its handling of the crisis, when prices surged by 250% in less than two days in a squeeze centered around Chinese nickel and stainless steel producer Tsingshan Holding Group Co. The IMF highlighted the nickel-market chaos as part of wider risks in commodity markets and lessons for policy makers in the wake of recent extreme volatility.

“Governance mechanisms for the LME need to be strengthened to address conflict of interest. Measures must be in place to ensure that the concentration of trading does not adversely impact free and fair markets,” IMF said in its Global Financial Stability Report on Tuesday.

The LME said at the time that it took action after the nickel price spike posed a systemic risk to its market. However, the decision to cancel several hours of trades at the highest prices also served as a bailout of Tsingshan and its banks to the tune of several billion dollars.

This month, the U.K.’s Financial Conduct Authority and the Bank of England announced investigations into the governance, market oversight and risk management of the LME and its clearing house. The LME itself will also conduct an independent review of the events.

The LME said it recognizes the impact of the unprecedented events in the nickel market on a wide range of market participants, and that not all of them agreed with its decisions.

“The LME sought to act in the interests of the market as a whole and acknowledges the concerns expressed by some market participants,” a spokeswoman said by email. “The LME is committed to ensuring that the actions of all participants (including the LME itself) are fully reviewed, and appropriate actions taken to both restore confidence and support the long-term health and efficiency of the market.”

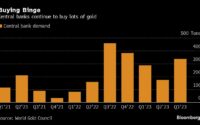

More widely, central banks and other regulators are starting to pay increasing attention to the threat that commodities-market volatility and liquidity concerns could spill over into other financial markets.

Read: Dallas Fed Says Commodity Margin Calls Pose Macroeconomic Risk

In its report, the IMF said the turmoil at the LME raises the risk that exchange-traded contracts migrate to the more opaque over-the-counter market. In nickel, a substantial portion of Tsingshan’s large short position was held off the exchange in bilateral deals with banks such as JPMorgan Chase & Co., Bloomberg has reported.

“Supervisors and regulators should consider enhancing transparency, in both exchange-traded and over-the-counter markets, to preempt the buildup of concentrated positions and thereby limit financial stability implications,” the IMF said.

It also echoed comments by the U.K.’s market regulator in noting that exchanges should ensure the resilience of their operational systems — the restart of the nickel market in mid-March was marked by a series of stop-start glitches.

Read: FCA Warns Exchanges on ‘Operational Resilience’ After LME Shock

“Exchanges and central counterparty clearing houses should also ensure the robustness and resilience of their information technology systems to withstand current trading conditions,” the IMF said.

(Updates with comment from the LME from sixth paragraph.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

[ad_2]

Source link