People Get Ready! For The Federal Reserve to actually withdraw its massive stimulus.

I generally discuss that negative impact of rising mortgage rates on the housing market, but today I am focusing on the decline in agency mortgage-backed security prices due to rising mortgage rates.

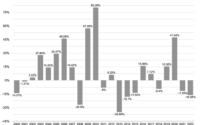

Here is the uniform MBS price for a 3.5% coupon security. It is falling like a rock with anticipated Fed monetary tightening.

And duration risk is going to the moon! (That is, accelerating rapidly).

FNCL 3.5 coupon MBS has a WAC of 4.206 and a WAM (or WARM) of 359. Not to mention a factor 0.997.

At least energy prices are cooling thanks to China grinding to a halt with the latest Covid epidemic.

I wish The Fed would back off its allegedly ambitious tightening and soothe me.

But hold on, Powell and The Fed are coming with their sword of destruction.