Currency Angst Signals Worse To Come For Investors

By Garfield Reynolds, Bloomberg Markets Live Commentator and reporter

Foreign-exchange traders are getting more nervous than at any time since the pandemic meltdown, underscoring concerns that the worst is yet to come for risk assets this year.

Developed-market currency volatility just surged past highs generated by the war in Ukraine and the Federal Reserve’s initial interest-rate hike for the cycle, while the Treasuries fear gauge has approached last month’s peak.

Anxiety in foreign-exchange markets has been led by the spike in yen implied volatility, as Japan’s currency suffers collateral damagefrom the yawning policy divergence between Federal Reserve Chair Jerome Powell and Bank of Japan Governor Haruhiko Kuroda.

Powell and Kuroda are offering radically different signals, but the zeitgeist seeping through from bond and currency markets is that recessions may be coming for numerous economies, just as the antidote of central bank stimulus that investors have come to rely on is off the menu.

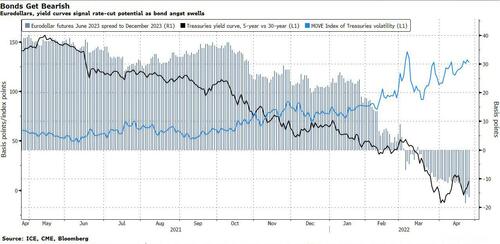

Powell’s strident calls for rapid rate hikes reflect the extreme concern that the inflation genie is out of the bottle and has to be shoved back in at almost any cost. The Fed is striving to reassure investors that it can do that without damaging the economy too severely. Fixed-income markets, from eurodollars to Treasuries, beg to differ.

Kuroda meanwhile is sticking with extreme easing because the BOJ remains convinced that inflation is not about to become sustainably higher in Japan, despite a cratering currency and soaring prices for commodities the nation has to import.

The policy divergence is even starker when it comes to China, which has seen the yuan drop at a frantic pace and volatility surge as the PBOC tries to turn the economy around.

The concern for investors should be that currencies and bonds imply that inflation will prove far more resilient than GDP growth. Concerns are growing that the devastation delivered to the economies of Russia and Ukraine, and the further damage looming for China as omicron spurs lockdowns, will result in further supply shocks to drive commodity-fueled inflation higher still.

That underscores the likelihood that Treasuries curves will go on flattening along with eurodollar futures as recession risks intensify

The dollar is set to keep strengthening in good times and bad, as will the cost of options used to hedge against the sudden reversals that continue to hit Treasuries, currencies and commodities.

The one shoe that had failed to drop was stocks, though Tuesday’s turmoil signals it may now be doing so. Equity volatility is threatening to bust out of what had been relatively tight ranges — gauges of implied vol for U.S. and Japanese indexes jumped to more than 1.5 points above their 50-day moving averages for the first time in more than a month.

Currencies and bonds look set to remain on edge, and if equities start to feel the same sort of sustained fear, then 2022 can get a lot worse for most investors.

[ad_2]

Source link