World Gold Council/Staff/4-28-2022

“ETF inflows came flooding back in Q1 on safe-haven demand and inflation concerns; bar and coin investment, although healthy, failed to match lofty year-earlier levels. Investment demand for gold in Q1 returned to levels that were last seen during the early months of the pandemic in 2020, fuelled by similar drivers: namely, safe haven flows and high/rising gold prices. Heightened geopolitical risk, caused by the invasion of Ukraine, encouraged investment flows, which fed through to a sharp rise in the gold price. Inflation concerns – already supportive for gold investment – were accelerated by the conflict, with data prints showing prices across the globe rising at a multi-decade, if not record, pace. Rising interest rates were, however, a continued headwind and this likely tempered investment inflows to an extent.”

USAGOLD note: Overall investment demand was up 203% over the first quarter of 2021. Gold coins and bullion demand was down 20% from last year’s robust pace.

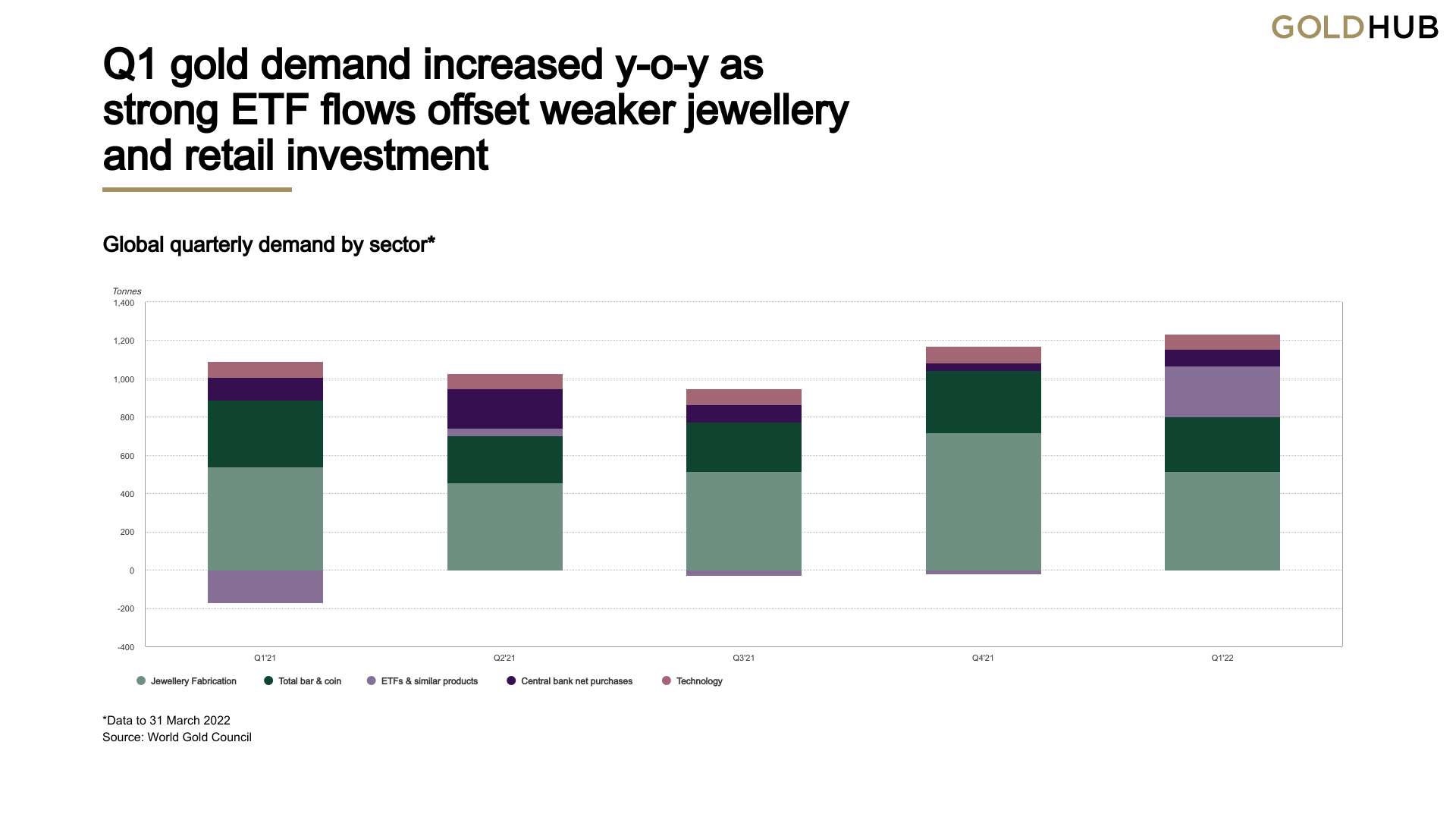

Chart courtesy of the World Gold Council • • • Click to enlarge