Bloomberg/Alice Gledhill/4-25-2022

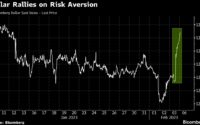

‘The inflation scare that’s dominated much of the investment backdrop this year keeps finding new ways to send shockwaves through markets. On Monday, investors awoke to the idea of China locking down Beijing — a city of more than 20 million people — adding to worries about supply stresses that are keeping the heat on prices.”

USAGOLD note: Bloomberg raises the prospect of the markets getting blindsided by the new wave of Covid lockdowns in China – a supply-side factor not in the market picture ten days ago. Then of course, there’s the other side of the equation: Markets will be taking into account the reduced demand for commodities in China (like oil), which translates to a disinflationary influence. Nothing is easy these days.