Is Housing a Bubble That’s About to Crash?

We are all prone to believing the recent past is a reliable guide to the future. But in times of

dynamic reversals, the past is an anchor thwarting our progress, not a forecast.

Are we heading into another real estate bubble / crash?

Those who say “no” see the housing shortage as real, while those who say “yes” see the demand as a reflection

of the Federal Reserve’s artificial goosing of the housing market via its unprecedented purchases of mortgage-backed

securities and “easy money” financial conditions.

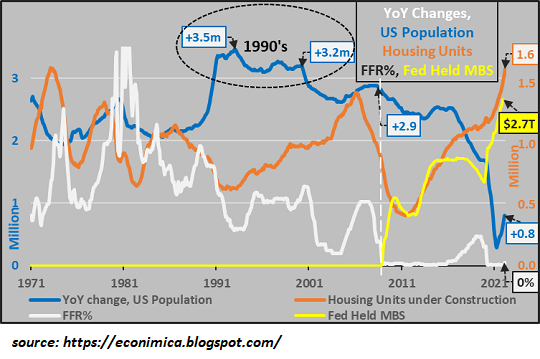

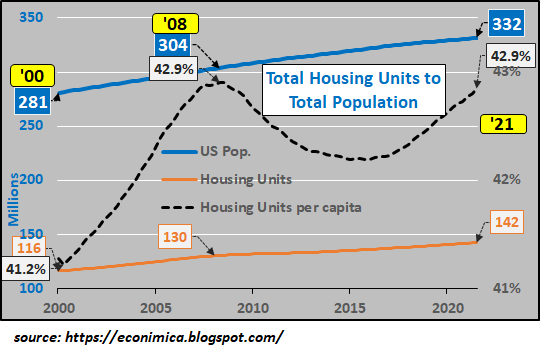

My colleague CH at econimica.blogspot.com

recently posted charts calling this assumption into question. The first chart (below) shows the U.S. population

growth rate plummeting as housing starts soar, and the second chart shows housing unit per capita, which has just

reached the same extreme as the 2008 housing bubble.

Demographics and housing do not reflect a housing shortage nationally, though there could be scarcities

locally, of course, and other factors such as thousands of units being held off the market as short-term rentals

or investments by overseas buyers who have no interest in renting their investment dwellings.

On a per capita basis, housing has reached previous bubble levels. That suggests housing shortages are artificial

or local, not structural.

Next, let’s consider how the current housing bubble differs from previous bubbles in the late 1970s and 2000s.

In my view, the previous bubbles were driven by demographics, inflation and monetary policy: in the late 70s,

the 65 million-strong Baby Boom generation began buying their first homes, pushing demand higher while inflation

soared, making real-world assets such as housing more desirable.

Once the Federal Reserve pushed interest rates to 18%, mortgage rates rose in lockstep and housing crashed as few

could afford sky-high housing prices at sky-high mortgage rates.

The housing bubble of 2007-08 was largely driven by declines in mortgage rates (as the Fed pursued an “easy money”

policy to escape the negative effects of the Dot-Com stock market bubble crash) and a loosening of credit/mortgage

standards. These fueled a bubble that morphed into a speculative free-for-all of no-down payment and

no-document loans.

This decline in the cost of borrowing money (mortgage rates) enabled a sharp rise in the price of housing, a

speculative boom that was greatly accelerated by “innovations” in the mortgage market such as zero down payments

loans, interest-only loans, home equity loans, and no-document “liar loans”–mortgages underwritten without the

usual documentation of income and net worth.

These forces generated a speculative frenzy of house-flipping, leveraging the equity in the family home to buy two

or three homes under construction and selling them before they were even completed for fat profits, and so on.

Needless to say, the pool of potential buyers expanded tremendously when people earning $25,000 a year could buy

$500,000 houses on speculation.

Once the bubble popped, the pool of buyers shrank along with the home equity.

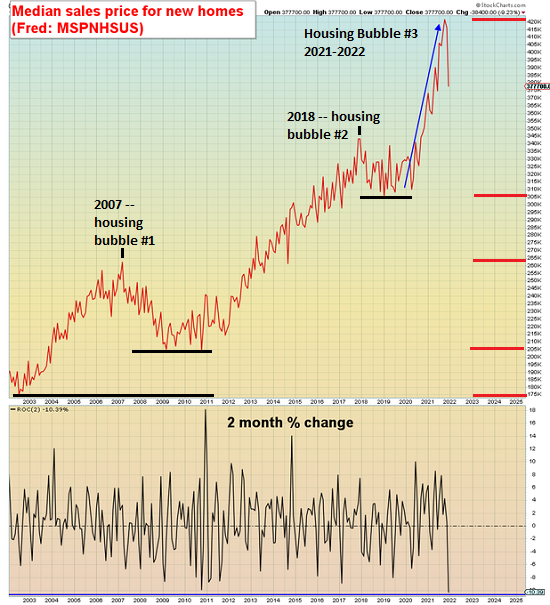

If we study this chart below of new home prices (courtesy of Mac10), we can see that the 21st century’s Bubble #2 rose

as the Federal Reserve pushed mortgage rates far below historic norms. Once rates reached a bottom, the 7-year

inflation of home prices (from 2011 to 2018) began rolling over.

This deflation of home prices was reversed by the pandemic recession, as the Fed’s vast expansion of credit and

mortgage-buying, which pushed mortgage rates to new lows. Trillions of dollars in new credit and cash stimulus

ignited a speculative frenzy in stocks, bonds and real estate, a frenzy which drove bubble #3 to extraordinary heights.

All this unprecedented fiscal and monetary stimulus also ignited inflation, and so rates are rising in response.

Bubble #3 is already deflating, at least by the measure of new home prices.

But the current bubble has a number of dynamics that weren’t big factors in previous bubbles.

One is the rise of remote work. Many people have been working remotely since the late 1990s enabled Internet-based

work, but the pandemic greatly increased the pool of employers willing to accept remote work as a permanent feature

of employment.

This trend has been well documented, but the consequences are still unfolding: remote workers are no longer trapped

in unaffordable, congested cities and suburbs.

Several other trends have attracted much less attention, but I see them as equally consequential.

1. Housing in many urban zones are out of reach of all but the top 10% without extraordinary sacrifice, and now that

employment isn’t necessarily tied to urban zones, the bottom 90% of young people without family wealth or high

incomes are coming to realize the benefits of urban living are not worth the extreme sacrifices needed to buy

an overvalued house.

A middle-class life–home ownership, financial security, leisure and surplus income to invest in one’s family and

well-being–is no longer affordable for the majority of young Americans.

Few are willing to concede this because it reveals the neofeudal nature of American life. Those who bought homes

in coastal urban zones 20+ years ago are wealthy due to soaring housing valuations while young people can’t even

afford the rent, much less buying a house.

If you’re not making $250,000 or more a year as a couple, the only hope for a middle-class life that includes

leisure and some surplus income to invest is top move to some place with much lower housing and other costs.

That place is rural America.

2. The benefits of urban living are deteriorating while the sacrifices and downsides are increasing. Urban living

is fun if you’re wealthy, not so fun if you don’t have plenty of surplus income to spend.

Urban problems such as homelessness, traffic congestion and crime are endemic and unresolvable, though few are

willing to state the obvious. Americans are expected to be optimistic and to count on some new whiz-bang technology

to solve all problems.

Unfortunately, problems generated by dysfunctional, overly complex institutions, corruption and unaffordable costs

can’t be solved by some new technology, and so the decay of cities will only gather momentum.

The hope that billions of federal stimulus funding would solve these problems is about to encounter reality as the

funds dry up and all the problems remain or have actually expanded despite massive “investments” in solutions.

Few analysts have looked at the finances of high-cost cities. The decline in bricks-and-mortar retail, rising crime,

soaring junk fees, rents and property taxes have all made urban small business insanely costly and therefore risky.

Small businesses are the core sources of employment and taxes. As high costs, crime, etc. choke small businesses,

employment and tax revenues drop and commercial real estate sits empty, generating decay and defaults.

Once office and retail space is no longer affordable or necessary, commercial real estate crashes in value as owners

who bought at the top default and go bankrupt.

People need shelter but they don’t need office space or to start a bricks-and-mortar retail business.

As urban finances unravel, cities won’t have the funding to run their bloated, inefficient, overly complex and

unaccountable bureaucracies.

3. In geopolitics, we speak of the core and the periphery. Empires have a core (Rome and central Italy in the

Roman Empire) and a periphery (Britain, North Africa, Egypt, the Levant).

As finances and trade decay and costs soar, the periphery is surrendered to maintain the core.

In urban zones, the same dynamic will become increasingly visible: the peripheral neighborhoods will be underfunded

to continue protecting the wealthy enclaves.

Crime will skyrocket in the periphery even as residents of the wealthy enclaves see little decay in their neighborhoods.

This asymmetry–already extreme–will drive social unrest and disorder. This is a self-reinforcing feedback: as

the periphery neighborhoods deteriorate, the remaining businesses flee and the smart money sells and moves away.

Tax revenues plummet and city services decay even further, persuading hangers-on to move before it gets even worse.

Cities compensate for the lower revenues by increasing taxes on the remaining residents and cutting services.

Each turn of the screw triggers more closures and selling and fewer tax revenues.

4. Dependency chains will become increasingly consequential:

the greater a city’s dependency on essentials trucked/shipped from hundreds or thousands of of kilometers/miles

away, the more prone that city will be to disruptions of essentials: food, energy, materials and infrastructure.

Though few are willing to dwell on such vulnerabilities, most cities are totally dependent on diesel fueled

fleets of trucks, rail and jet fuel for luxuries flown in from afar for virtually all goods. Cities produce

very little in the way of essentials such as food and energy.

The past reliability of long supply chains has instilled a confidence that these supply chains stretching thousands

of kilometers and miles are unbreakable and forever. They aren’t, and the initial disruptions will be a great

shock to Americans who believe full gas tanks and fully stocked store shelves are their birthright.

5. As I’ve explained in my new book

Global Crisis, National Renewal,

the era of cheap, reliable abundance has drawn to a

close and now we are entering an era of scarcity in essentials.

Another reality few discuss is the relative stability of global weather over the past 40 years. As weather

becomes less reliable, so too do crop yields and food supplies.

Globalization has poured capital into expanding acreage under cultivation to the point that the planet’s forests

are being decimated to grow more soy to feed animals to be slaughtered for human consumption.

On the margins, land that was once productive has been lost to desertification. Fresh water aquifers have been

drained and glaciers feeding rivers are melting away. Soil fertility has declined even as fertilizer use has expanded.

The low-hanging fruit of GMO seeds, fertilizers, insecticides, herbicides and Green Revolution hybrids have all

been plucked. The gains have been reaped but now the downsides of these dependencies are becoming increasingly

consequential: fertilizer costs are rising fast, insects and diseases are evading chemicals and vaccines, and

the vulnerabilities of mono-crop, industrialized agriculture and animal husbandry threaten to cascade into

crop failures, soaring prices and shortages.

6. This will have two consequences: rural incomes which have been falling for decades due to globalization

(i.e. bringing in cheap food from places with no environmental standards, cheap labor and few taxes / social

costs) will start rising sharply, fueling a reversal in the long decline of rural communities based on

agricultural income.

The soaring costs of essentials will reduce the disposable income of the bottom 90%, reducing the money they’ll

have to spend on eating out, retail shopping, etc.–all the surplus spending that drives cities’ economies and

tax revenues.

Few (if any) commentators forecast a cyclical reversal of the demographic trend of people moving from rural

locales to cities. I think this trend has already reversed and will gather momentum as cities become increasingly

unlivable, disposable incomes decline as scarcities push prices higher and people flee for lower cost, more

secure environs.

7. As I often note, following what the super-wealthy are doing is a pretty sound investment strategy because

the super-wealthy spend freely to buy the best advice and are highly motivated to protect their wealth.

People who live in well-known, highly desirable rural towns (Telluride, Jackson Hole, Lake Tahoe, etc.) are

describing a feeding frenzy of wealthy urbanites buying multi-million dollar homes. Small cities such as

Bozeman, MT and Ashville, NC are experiencing a flood of new residents that is straining infrastructure and

pushing housing prices out of reach for local residents with average wages.

8. Rural towns in the U.S., Italy, Japan and even Switzerland are trying to attract new residents with offers

of free land, subsidized rent, low cost homes, etc. This shows that the trends are global and not limited

to any one nation.

Would you take free land in rural America?

The decay of urban life isn’t yet consequential enough to push people into making a major move, but once someone has

been robbed, repeatedly found human feces on their doorstep

or experienced scarcities that trigger the madness of crowds, the decision to leave becomes much, much easier.

Some cities will manage the decline of employment and tax revenues more gracefully than others. Most will suffer

from the dynamic I’ve often described on the blog: the Ratchet Effect. Costs move effortlessly higher as tax

revenues have increased in one speculative bubble after another, but once revenues drop, cities have no mechanisms

or political constituency to manage a sharp, long-term decline in revenues.

They then become prone to the other dynamic I’ve described, the Rising Wedge Breakdown (see chart below):

as agencies and institutions

become sclerotic, unaccountable and self-serving, even a relatively modest cut in revenues triggers institutional

collapse, as the system requires 100% funding to function. A 10% reduction doesn’t cause a 10% decline in service,

it causes an 50% decline in service, on the way to complete dysfunction.

Few believe cities can unravel, but remote work, geographic arbitrage (discussed below), tightening

credit, rising crime, the decline of commercial real estate, end of massive stimulus, scarcities, the madness

of crowds, the decline of civic services and amenities and an insanely high cost of living all have consequences

and second-order effects.

What were beneficial synergies become fatal synergies as dynamics reverse and begin reinforcing each other.

So let’s put all this together.

A. The cycle of declining interest rates and inflation has ended and a cycle of much higher interest and

mortgage rates and inflation is beginning. Higher mortgages rates will depress housing prices as only the

highest income households will be able to afford today’s prices once mortgage rates rise.

B. The decay of urban finances and quality of life will accelerate as stimulus ends, credit dries up and

inflation decimates disposable income.

C. The stress of trying to make enough money to afford the high costs of city/suburban living as the real

estate bubble pops and the benefits of city living decline will burn out increasing numbers of people who

will have no choice but to find more affordable, more secure and more livable places.

D. While the wealthy have already secured second or third homes in the toniest desirable towns, there are

still opportunities for lower cost, more secure residences in rural areas.

E. This migration, even at the margins, will further depress urban housing prices and push prices in desirable

rural locales higher.

F. This migration will have regional, ethnic and cultural variations. For example, some African-Americans leaving

the upper Midwest are finding favor with communities in the South where family, church and cultural ties beckon.

G. Correspondent John F. used the phrase geographic arbitrage which means earning money remotely in high-wage

sectors while living some place that’s low cost and secure.

I wrote about this many years ago in my post about young Japanese maintaining a part-time remote-work gig while

pursuing farming in rural communities:

Degrowth Solutions:

Half-Farmer, Half-X (July 19, 2014).

H. Though monetary / inflationary forces will pop housing prices based solely on low mortgage rates, this

doesn’t mean housing everywhere will decline: as burned out urbanites seek lower cost, more secure and livable

places in rural locales, homes in desirable towns and small cities could rise sharply because they’re starting

from such low levels.

I. If urban areas decay rapidly, housing prices could plummet much faster than most people think

possible.

When cities lose employment, tax revenues and desirability, they can go down fast. Property values can fall in

half and then by 90%.

How is this possible? Supply and demand: if demand falls off a cliff, there won’t be buyers for thousands of

homes that come on the market all at once. This is just like a stock market in which buyers disappear, as no

one wants to buy an asset that’s rapidly losing value.

As I’ve noted many times, prices for assets are set on the margins: the last sale of a house resets the price

for the entire neighborhood.

The stock market is easily manipulated by the big players, who can stop a slide in prices by buying huge chunks

of stocks and call options. There are no equivalent forces which can stop a decline in housing prices.

And since rates will rise regardless of what the Federal Reserve does because global capital is demanding a real

return above inflation, then the hope for lower mortgage rates to support bubble-level housing prices will be in vain.

How low could housing go? As explained above, there will likely be very asymmetric declines and increases in

housing valuations going forward. But on a technical-analysis level, we can anticipate a general decline to

previous lows, first to the 2019 lows and then to the 2011 lows.

Some analysts believe inflation will funnel capital into housing as investors seek assets that will go up with

inflation, but this is a murky forecast: the bottom 90% of American households are already priced out of

coastal housing, so inflation only robs their wages of purchasing power. They don’t have any hope of buying

a house anywhere near current prices.

Corporations are buying thousands of houses for the rental income, but once all the stimulus runs out and the

excesses of speculation reverse, they’ll find few renters can afford their sky-high rents. At that point

corporate buyers become corporate sellers, but they won’t find buyers willing or able to pay their asking

prices, which are based on bubble pricing, not reality.

All these swirling currents will affect housing valuations in different places differently. Some areas could

see 50% declines while others see 50% increases, regardless of mortgage rates or Fed policy.

What will become most desirable is a low cost of living, security and livability, which includes

community, reduced dependency on long supply chains and local production of essentials.

We are all prone to believing the recent past is a reliable guide to the future. But in times of

dynamic reversals, the past is an anchor thwarting our progress, not a forecast.

This essay was first published as a weekly Musings Report sent exclusively to subscribers and

patrons at the $5/month ($54/year) and higher level. Thank you, patrons and subscribers, for

supporting my work and free website.

My new book is now available at a 10% discount this month:

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $8.95, print $20)

If you found value in this content, please join me in seeking solutions by

becoming

a $1/month patron of my work via patreon.com.

Recent Videos/Podcasts:

The Dam Has Cracked (37 minutes, with Gordon Long)

My recent books:

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $25, audiobook)

Read Chapter One for free (PDF).

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic

($5 Kindle, $10 print, (

audiobook):

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake

$1.29 Kindle, $8.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email

remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Gunnar G. ($5/month), for your marvelously generous pledge |

Thank you, Matt M. ($5/month), for your magnificently generous pledge |

[ad_2]

Source link