PensionsAge/Staff/April 2022

“So, if bonds are less likely to be effective diversified going forward, what other assets could pension funds consider in their asset mix? We believe that gold is uniquely placed to play an important diversification role in pension fund portfolios, not just in the current environment but over the long term.”

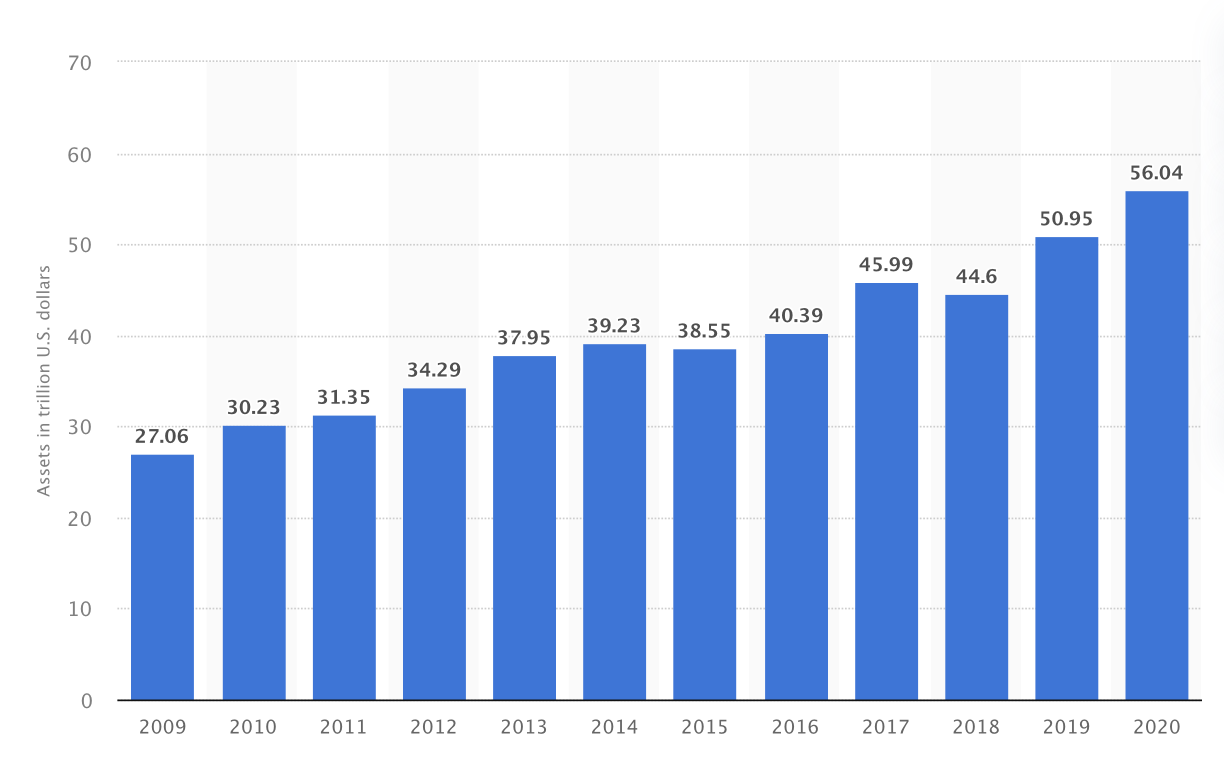

USAGOLD note: According to a survey conducted by Pension Age, 70% of respondents said gold is a proven and effective portfolio diversifier. Worldwide through 2020, global pension fund assets amounted to $56 trillion, according to Statista. If pension funds devoted just 1% of those assets ($560 billion) to physical gold ownership, the impact on supply-demand fundamentals would be significant. By way of perspective, GoldChartsRUs currently values total global gold ETF stockpiles at just under $300 billion.

Total pension fund assets worldwide

(Trillions of U.S. dollars)

Chart courtesy of Statista.com