International Man/Shan Nagasundaram/5-2-2022

“The US Fed will probably start the QT(2) process in May which will lead to a near breakdown of the financial system within a few weeks/months. QT1 in 2018 lasted for nearly a year, but the leverage and the imbalances within the system are far greater today than it was in 2018. QT2 will then be replaced with QE(to infinity) in short-order ‘to save the economy’. Quite unlike the 2008 to 2018 period during which despite the QE series CPI numbers remained benign, the effect this time around will probably be the opposite – courtesy, Cantillon effects. The to-be-announced QE (the Fed may not call it QE this time around though. The end result however will be a massive expansion in the balance sheet) is going to send even the manipulated CPI numbers well north of 10%.”

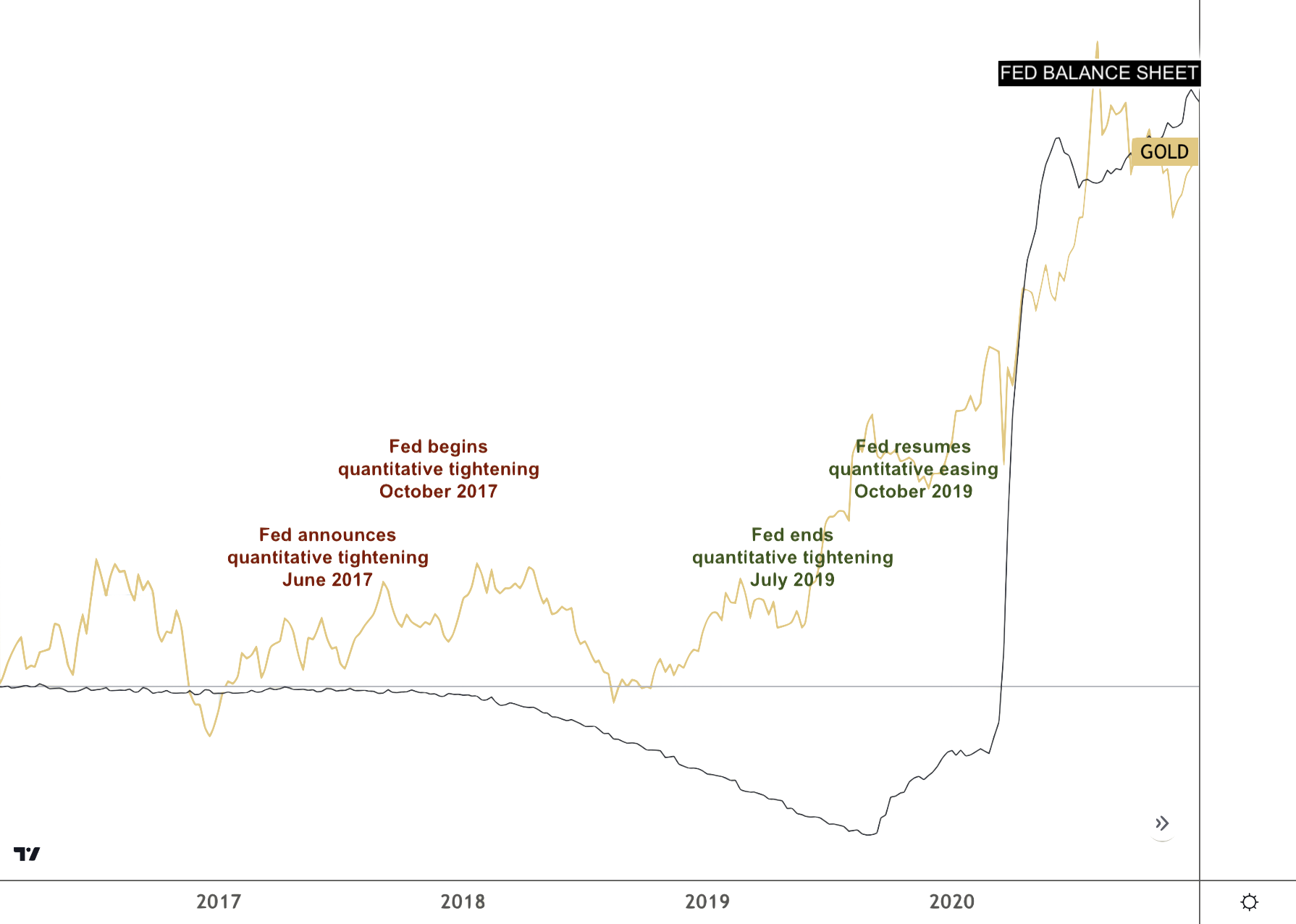

USAGOLD note: We may be in double digits on inflation long before the Fed gets around to quantitative tightening. The chart below shows what happened to gold during the last QE-QT-QE cycle. The author expects the Fed to lag remain behind the inflation curve for at least two to three years and ultimately ending in either an inflationary depression or a deflationary bust.

QE/QT/QE cycle 2016-2022

Chart courtesy of Trading View.com/Annotations by USAGOLD