Bloomberg/John Authers/5-2-2022

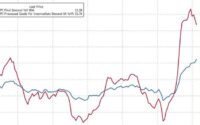

“In important ways, the Fed’s tightening campaign is already well underway; markets are priced for a sharp rise in interest rates, and this has already tightened financial conditions. How much will it matter that the Fed’s balance sheet will start to shrink, and what effect will it have on inflation? What has until now been an abstruse technical debate is about to get very tangible.”

USAGOLD note: He quotes Bear Traps Report’s Larry McDonald, who is not convinced the Fed can proceed with quantitative tightening, saying, “Who are they kidding? It´s the worst start to a year for stocks in decades, consumer savings is down to the bone, GDP prints negative, and the Fed is going to kick-off a record tightening cycle? It´s all a show. With conviction – we see a near-term top in the U.S. dollar and another leg up for hard assets, value vs. growth and emerging markets.” We referenced this same Authers column in Tuesday’s Daily Market Report and repost the link here for those who may have missed it. Highly recommended.