Economic downturn spreads as more sectors report falling output and record price rises

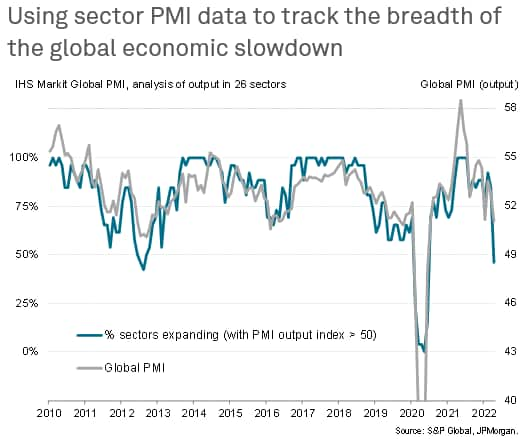

Detail sector PMI data compiled by S&P Global, derived from

information provided by panels of over 30,000 companies in 45

countries, revealed a broadening of the global economic slowdown in

April. With the exception of the downturn seen in early 2020 during

the initial phase of the pandemic, April saw more sectors reporting

falling output than at any time since 2012.

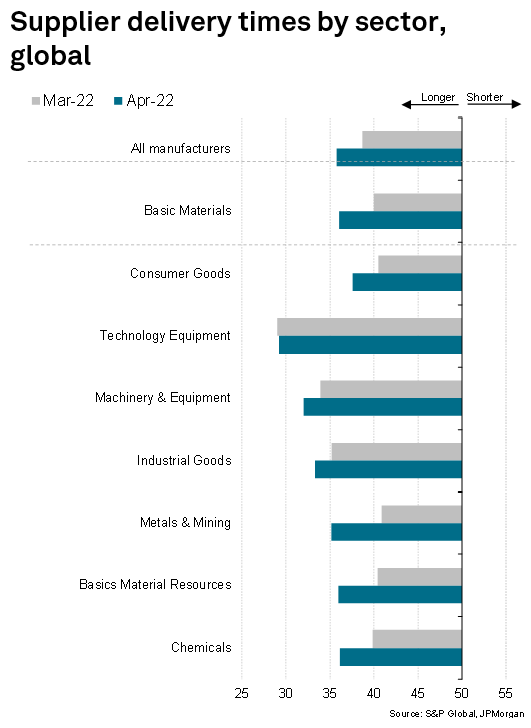

With the Ukraine war ongoing and mainland China locking down

some of its major cities to fight the Omicron variant of COVID-19,

supply chain disruptions have increased, damaging vast swathes of

the global manufacturing economy, while price pressures have

intensified, eroding spending power.

While growth outside of China has shown some encouraging

resilience, losing only marginal momentum in April on average, this

can be linked to resurgent spending on consumer services amid to

loosened COVID-19 restrictions. However, demand for consumer goods

has almost stalled as household spending is diverted to services,

suggesting there is a risk that the global economy is reliant on a

potentially short-lived rebound in consumer service spending to

support sustained growth in the coming months.

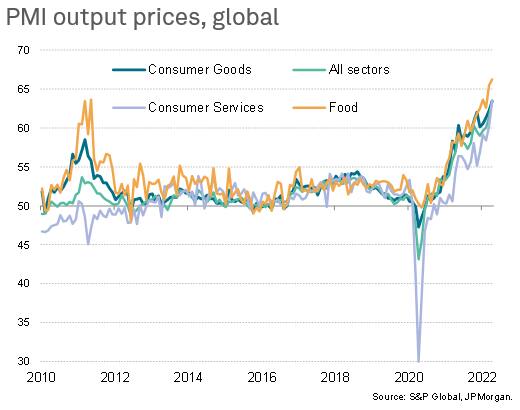

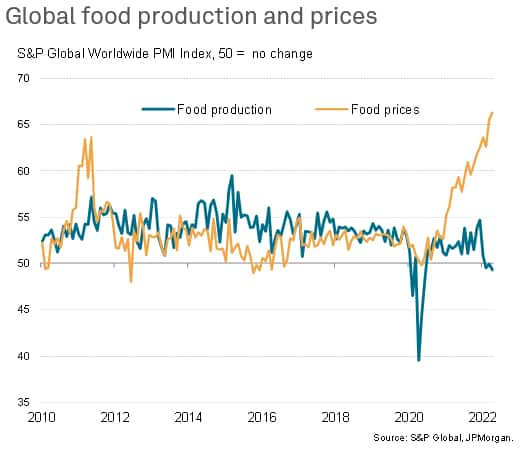

Prices are meanwhile rising for all goods and services, though

of particular concern is a record rise in food prices amid falling

food production, which is likely to add to the global cost of

living crisis.

Output growth reliant on consumer

services

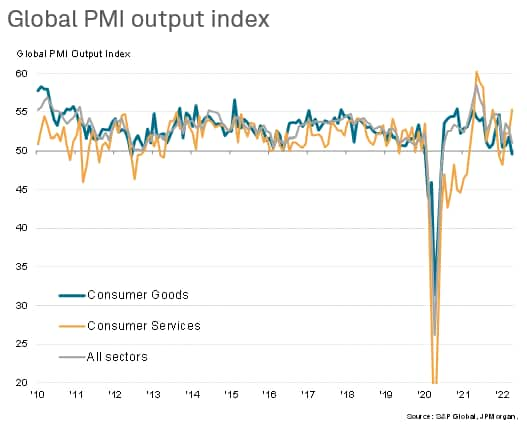

April saw the weakest pace of global economic growth since the

initial pandemic lockdowns in early 2020, according to the JPMorgan

Global Manufacturing Purchasing Managers’ Index™ (PMI™). The PMI,

compiled by S&P Global, fell from 52.7 in March to 51.0 in

April, signalling only a modest expansion of output.

The expansion was largely reliant on a surge in consumer

services activity, in turn attributable to an easing of COVID-19

containment measures on average globally during April. Output of

the consumer services industries rose worldwide at a rate not

exceeded since July of last year, driven by the steepest rise in

demand for nine months. Excluding prior pandemic growth spurts as

economies relaxed COVID-19 restrictions, the latest jump in

consumer services activity was the strongest since data were first

available in 2009.

In contrast, consumer goods manufacturers felt the pinch, as

household spending was diverted to services, reporting only a

modest expansion and the weakest performance since June 2020. New

orders placed for consumer goods likewise came close to stalling,

with companies often also reporting that higher prices were

deterring customers.

Downturn spreads to 14 sectors from just four in

March

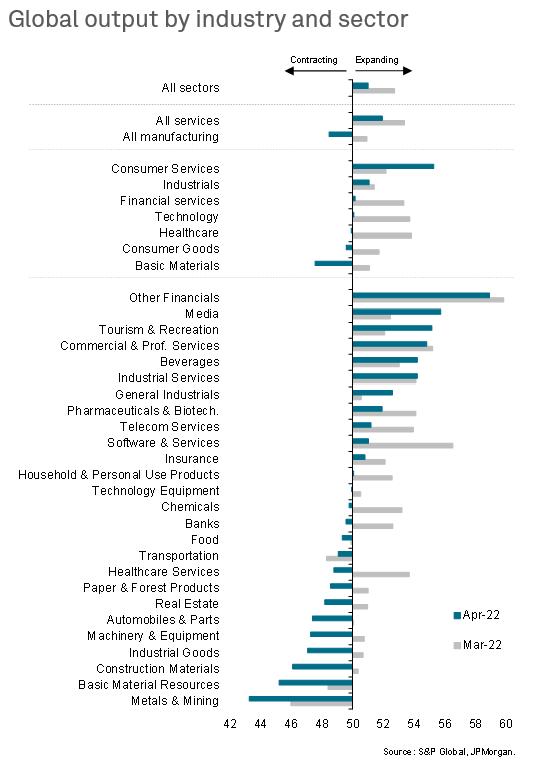

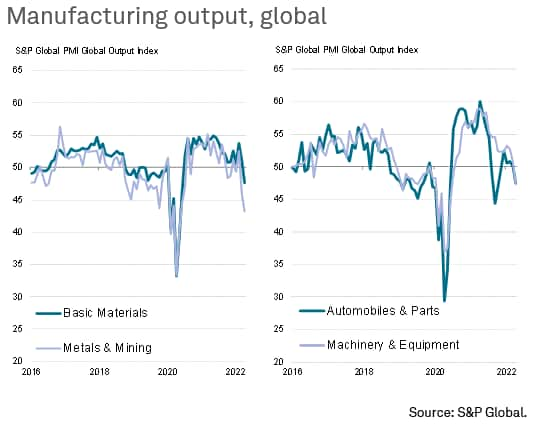

Looking into the PMI data at a more detailed sector level, some

14 of the 26 sectors covered by the PMIs reported falling output in

April, up sharply from just four in March. The steepest declines

were seen in basic material manufacturing sectors, including

sustained downturns in mining & metals and basic materials

resources, as well as renewed downturns for construction materials

and industrial goods, often linked to deteriorating supply

chains.

Worsening supply chain delays meanwhile contributed to renewed

output falls for autos & parts and machinery & equipment

manufacturing.

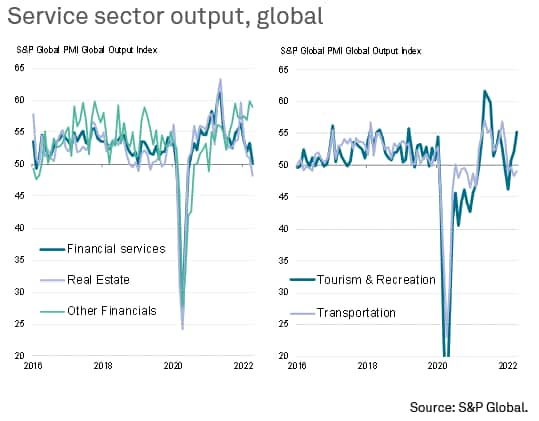

The service sector slowdown was led by the first drop in global

real estate activity since May 2020, though banking services,

transportation and healthcare services all also declined.

Growth rates varied markedly among the 12 sectors reporting

output growth in April, ranging from sustained near-record growth

in ‘other financials’ and reviving expansions for media and tourism

& recreation, to near-stalled output of household products.

Record price rises seen in half of all

sectors

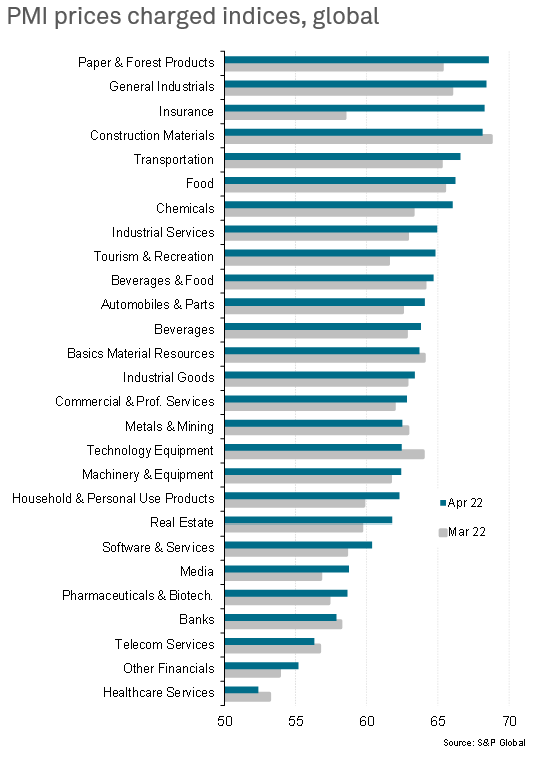

Selling prices meanwhile rose in all 26 sectors during April,

with rates of inflation accelerating in all but six. Around half of

all sectors reported unprecedented rates of increase. In the

service sector, these included transportation, commercial &

professional services, industrial services, insurance, real estate,

‘other’ financials, media and tourism & recreation. In

manufacturing, new record selling price increases were reported for

autos & parts, general industrials and food & drink.

Food prices surge at record pace amid falling

production

The record rise in food prices is a particular concern,

especially given that that the sector has also reported falling

output continually now for three months, with the worsening trend

linked to the Ukraine war. The growing scarcity of food and

associated price rises, combined with persistent elevated energy

prices, threatens to exacerbate the global cost of living crisis,

tending to hit the poorest the hardest.

Outlook

The broadening economic malaise is being triggered by the

lockdowns in China and Ukraine war, both of which are exacerbating

existing pandemic-related supply chain disruptions and price rises.

Whether more sectors fall into decline depends on how long these

two headwinds persist for, but is also a function of how well

spending on consumer services can be sustained amid the

intensifying cost of living crisis and growing concerns about the

economic outlook.

Chris Williamson, Chief Business Economist, S&P

Global Market Intelligence

Tel: +44 207 260 2329

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers’ Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn how to access and receive PMI data

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

[ad_2]

Source link