Mises Institute/Anthony P. Mueller/5-2-2022

“The monetary policy makers tend to promote the prolongation of credit expansion because they fear deflation. By doing this, however, the central banks prevent monetary moderate deflation as it would happen as the natural consequence of rising productivity. This way, an antideflationary monetary policy lays the groundwork for an upsurge of price inflation along with augmenting the risk of an abrupt contraction of the financial markets.”

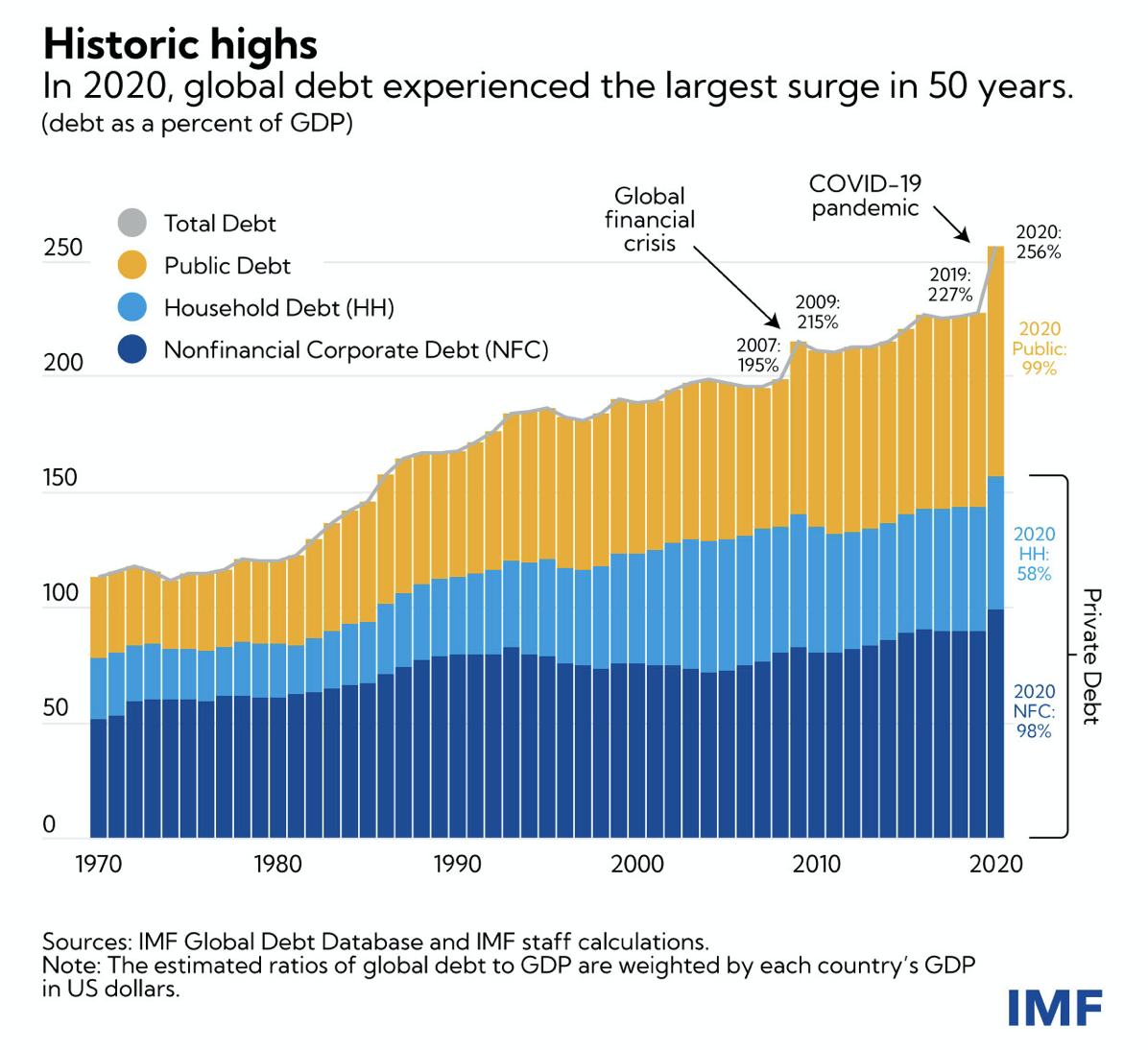

USAGOLD note: Mueller goes on to point out, as shown in the IMF chart below, that global debt is rapidly approaching $300 trillion (that’s not a typo) saying that “With the end of the US dollar’s link to gold in the 1970s, the international monetary system lost its anchor.” He says a “severe financial crisis looms now again on the horizon.” Mueller is a professor of economics at the Federal University UFS in Brazil.