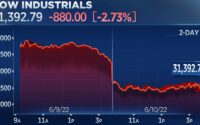

Blain’s Morning Porridge/Bill Blain/5-6-2022

“Crashes are momentum moments. They become a chain reaction: As the shift occurs players worry less about chasing the market higher and start to question why its falling. As they lack information, they wonder what others might now, their core beliefs are shaken, concerns are magnified, sentiment is rocked, fear triggers selling pressure, causing the herd to stampede, and all these behaviour shifts coalesce in a cascading ripple of panic that roils and rolls round the market. Bing, bosh, bank… criticality is reached.”

USAGOLD note: Blain explains the different types of market crashes and concludes that his readership would be best served by reading (or rereading) John Kenneth Galbraith’s The Great Crash of 1929 , a small portion of which we post below:

“There would also be, we may be certain, the traditional reassuring words from Washington. Always when markets are in trouble, the phrases are the same: ‘The economic situation is fundamentally sound’ or simply ‘The fundamentals are good.’ All who hear these words should know that something is wrong.” ― The Great Crash of 1929

“The worst continued to worsen. What looked one day like the end proved on the next day to have been only the beginning. Nothing could have been more ingeniously designed to maximize the suffering, and also to insure that as few people as possible escape the common misfortune. The fortunate speculator who had funds to answer the first margin call presently got another and equally urgent one, and if he met that there would still be another. In the end all the money he had was extracted from him and lost. The man with the smart money, who was safely out of the market when the first crash came, naturally went back in to pick up bargains. The bargains then suffered a ruinous fall. Even the man who waited for volume of trading to return to normal and saw Wall Street become as placid as a produce market, and who then bought common stocks would see their value drop to a third or a fourth of the purchase price in the next 24 months. The Coolidge bull market was a remarkable phenomenon. The ruthlessness of its liquidation was, in its own way, equally remarkable.”

― The Great Crash of 1929