Pensions’ Bad Year Poised to Get Worse

State and local government retirement funds started the year with their worst quarterly returns since the beginning of the pandemic. Things have only gone downhill since.

Losses across both stock and bond markets delivered a double blow to the funds that manage more than $4.5 trillion in retirement savings for America’s teachers, firefighters and other public workers. These retirement plans returned a median minus 4.01% in the first quarter, according to data from the Wilshire Trust Universe Comparison Service expected to be released Tuesday. Recent losses have further eroded their holdings.

“It’s a tough period,” said Jay Bowen, manager of the Tampa Firefighters and Police Officers Pension Fund. “Nobody is immune.”

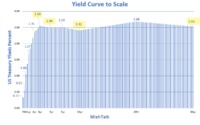

The simultaneous declines in stocks and bonds are inflicting pain on household and institutional investors alike in 2022. The S&P 500 has returned minus 13.5% year to date through Friday, while the Bloomberg U.S. Aggregate bond index—largely U.S. Treasurys, highly rated corporate bonds and mortgage-backed securities—returned minus 10.5%.

Pension funds maintain huge portfolios of stocks, bonds and other assets, wielding significant power on Wall Street, where their purchases and sales can shift prices and investment managers vie for their business. Their losses can raise costs for governments and workers, squeeze municipal budgets and drive up taxes.

At the Tampa fund, one of the nation’s best performing, Mr. Bowen is sitting tight waiting for long-term opportunities, such as investment-grade bonds with coupons of at least 6% or promising stocks whose prices have fallen enough to make them a bargain.

“The companies that have been unfairly punished, that have the strong balance sheets, that have free [after-expenses] cash flow, that have dividends,” he said. “Particularly in this environment, we like finding companies that not only have a strong record of raising their dividends but that have relatively attractive dividends.”

Pension plans’ lackluster performance puts the retirement funds’ median return for the nine months ended March 31 at 0.82%, said Robert J. Waid, managing director at Wilshire. That likely means higher retirement costs for many state and local government employers and employees who must help make up the difference when these funds, which predominantly have a June 30 fiscal year-end date, don’t meet their returns targets of around 7%.

The North Carolina Retirement Systems, among the nation’s better-funded retirement plans, with an investment-return target of 6.5%, has returned an estimated minus 5.5% through May 6 in its fiscal year, which runs from July 1 to June 30.

“We have a lot of counties and cities that are struggling right now with inflationary costs, and every time the plan doesn’t perform, they have to put in more money,” said North Carolina Treasurer Dale Folwell. “At the local level, they have nowhere to go but property taxes.”

Quarterly public pension returns last dipped into negative territory in the beginning of 2020, when they endured their worst quarter on record, returning a median minus 13.2% after the onset of the Covid-19 pandemic sent markets into turmoil. But a federal stimulus effort soon helped propel retirement funds to seven straight quarters of gains, including their best quarter on record. Now some fund managers worry this downturn could be more sustained.

Central bank efforts to rein in inflation have dragged down returns on stocks and bonds over 2022. Many funds scrambled to react to Russia’s invasion of Ukraine in February, either marking down assets or selling them at a loss in response to public pressure. Oil and gas stocks, along with commodities, provided one bright spot.

Stocks drive returns at public pension funds. They have just over half of their assets in domestic stocks, according to Wilshire, and another nearly 7% in international equities. Retirement funds with assets of more than $1 billion have 38% of assets in domestic stocks and nearly 10% in international ones.

Pension plans’ lackluster performance likely means higher retirement costs for many state and local government employers and employees.

Photo:

Jeff Chiu/Associated Press

“You’ve got higher inflation, you’ve got the war in Ukraine, the supply chain,” Mr. Waid said. “The market’s really nervous about what shoe is going to fall next.”

Pension plans with assets greater than $1 billion returned a median minus 3.1% in the first quarter. Those plans tend to field bigger staffs and attract more sophisticated investment professionals.

But additional losses may be in store for those retirement funds. Larger funds allocate more money to alternative investments, such as private equity, which typically report returns one or more months behind.

“It’s difficult to tell whether that [slightly better median return] was due to the lag in performance,” Mr. Waid said. “Did they actually generate alpha?”

Write to Heather Gillers at [email protected]

Copyright ©2022 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

[ad_2]

Source link