Gold vs. Stocks a Growing Nightmare for Fed

Housekeeping: Thank you to all the new subscribers. We hope you see GoldFix’s value.

Subscribe

Authored by GoldFixSubstack

TL;DR

Since the Russian/ Ukraine war started, Gold has enjoyed an inverted correlation to stocks. Gold is a good hedge for equities once again. Also, there is a problem for the Fed. The problem is that when wars usually happen, deflation (even with oil spikes) is a risk. Not this time. Gold rallying as stocks take it on the chin during a supply-chain disaster makes the Fed’s inflation-fighting hard. Therefore, The Fed must try to break Gold’s war-hedge relationship to make it less attractive. And unless there is a marked escalation in Europe, or another big inflation uptick, they will keep trying to do just that. But will they succeed? Sure they can break Gold during QE, but can they break war fears and supply-side inflation? We’re not so sure.

Not a Good Look for the Fed…..

Gold Knocked Down, Not Out By Fed in May So Far

These past 2 weeks they have knocked Gold down while stocks dropped, damaging the hedge correlation for sure. But on Monday something happened. Oil started cranking again no doubt in response to anticipated China reopenings. Gold had started the day down but Silver was curiously up. Gold took these 2 things into account and went positive by $14 by end of day.

Today is more of the same. Stocks, Oil, Gold, and Silver are all up. Nothing crazy but extremely worrisome if you are trying to break the perception that Gold is a hedge for poor stock behavior. Gold is attracting US buyers from inflationary fears even as it attracts overseas buyers from War concerns. Lets look at Gold versus Stocks on a historical basis now for perspective.

Gold Versus Stocks Since 2007

The correlation of gold prices to US large cap equities:

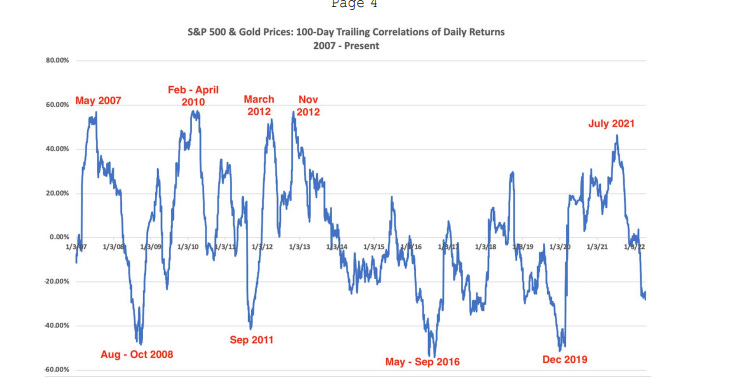

- Historically post the GFC, Gold’s counter relationship with Stocks gets to about negative 40% before regressing to the mean. That mean it’s basically zero on average. (1st graph below)

- But that average of zero varies widely based on types of events

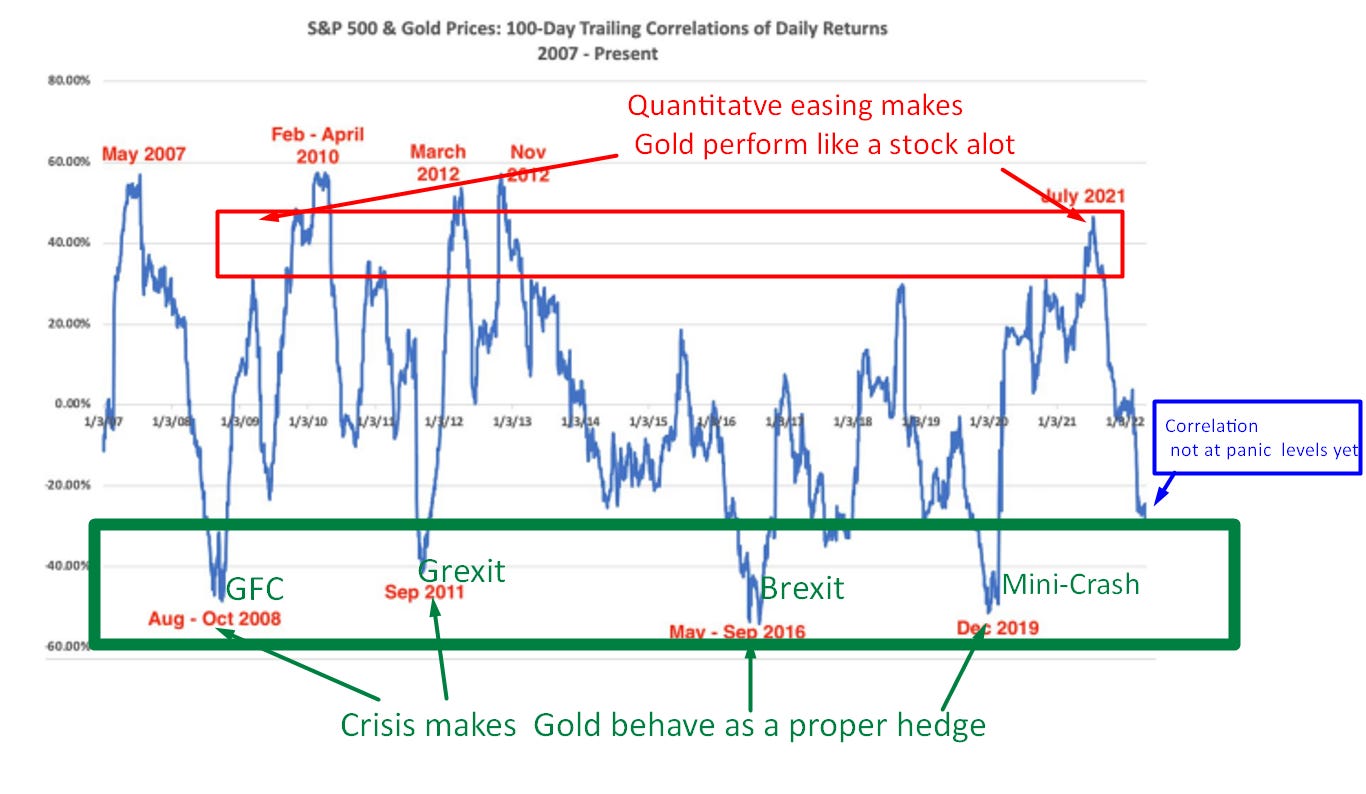

- Not Surprisingly: Financial events like QE increase positive correlation. Real world events like war/brexit/sanctions increase negative correlation. This is not a coincidence. (2nd graph below)

- Since the GFC: Gold has not net-net been a diversifier. It has mostly moved with stocks or randomly. This is in no small part from QE we imagine.

- Gold as a hedge of equities had been destroyed by QE. [EDIT-Lets see how it does in QT- vbl]

- But Gold remains a tremendous hedge for Global crisis protection like Wars and currency fears, and the Fed has not been able to break that as of the End of April

- They stepped up their game in May as we shall see below.

Gold and Stock Correlations….

**Premium continues below this line**

A few data points to set the stage:…

- Since 2007, the correlation between the daily change in the price of gold and the daily return of the S&P 500 has averaged 0.03 over any given 100-day period.

- That is essentially zero, which is what you’d expect to see. However, as the chart below shows, gold-stock price correlations vary considerably across time.

- Gold’s value as a portfolio diversifier changes depending on overall market conditions.

- It tends to perform that function best going into a rough patch for stocks (2008, 2011, 2016, and even 2019)

Coming out of a crisis, asset price correlations trend towards 1.0 and gold is no exception. We’ve noted these extremes in the chart above. As of End of April the gold – S&P 500 correlation over the prior 100 days stood at negative 0.27, just outside one standard deviation (0.26 points) from the mean.

Gold Still Hedges War

Via DataTrek:

We’re not yet at true outlier levels, as shown in blue above, but gold is certainly trading in a manner consistent with prior periods of equity market turmoil.

Takeaway: should equity markets continue to move lower on geopolitical and inflation concerns, the historical data says gold should remain a productive hedge. There is still room for gold to be even less correlated to stocks over the next 100 days than the last 100 days.- April 27th

We wish that were true, sadly it is not the past 2 weeks. But the grass roots flows say: the longer this goes on, the more entrenched the buy-gold-to-hedge inflation-by-boomers will become

Gold’s Inverted Correlation is Making the Fed Look Bad

The Fed does not want this inverted correlation. Witness last week as an example. Stocks and Gold sold off hard. Why? Increased inverted correlation is a bad look for Fed inflation fighting. And we do know they fight inflation in more ways than one.

Why has Gold’s negative correlation persisted over the previous 100 days then? The Fed still has no cure for geo-political unrest like wars and currency crises. Therefore the War is hurting their desired optics of Gold sucking at hedging inflation. The Russian war is concurrent with the inflationary problems they are fighting. It looks very bad, and if it continues, Gold will attract more and more buying. So, they must break it.

Inverted correlation with stocks will hurt their inflation fighting plans 2 ways. First, it will call attention once again to Gold as a safe haven from stock volatility. This will dampen bond buying. Second, it will simply start to do better than stocks. Buyers originally for safe-haven use will begin to see gold not just as a parking spot, but as a source of profit. The Fed cannot let that stand.

The takeaway from combining the data with experience, therefore is this: despite the excellent data above telling you to buy gold and sell stocks in a bear market, the Fed will do everything in its power to break any re-emerging narrative of Gold as a hedge for stock risk.

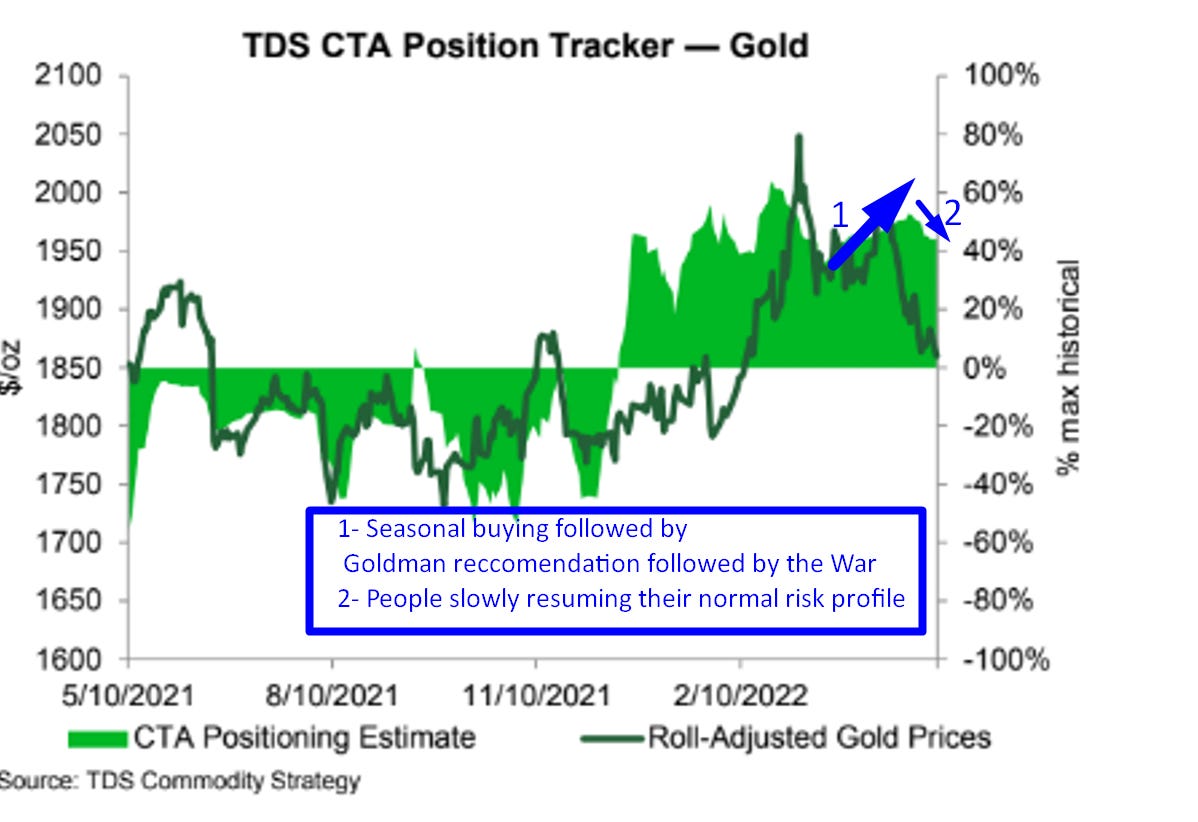

Why They Must Try to Break Gold

This in the past has not been hard to do given the brain dead momentum chasing of hedge funds and CTA retail flows. It will get harder for them to do this in the future as Gold reasserts itself on a global stage and Post Basel 3 implementation. But never underestimate a cornered, wounded animal. And the Fed is that right now.

Assume things can stay as they were in the past for now (Gold kept in its place) with Gold given a bigger leash on which to stretch away from that past; but not enough to break that leash yet. The Fed needs to be completely distracted by some other bigger problem first. Of this we are supremely confident.

Remember, keeping gold down hurts Russia’s Ruble now. Therefore Oil finally getting slammed will hurt Gold based on algorithmic action seen lately. Thus, they will use all their powers to keep the 2 assets down. So far they have failed with oil. But you can blame the politicians for that idiocy.

Finally, longs continue to sell their gold as they weigh the combined effects of Fed rate hikes and the end of the world not coming from the war. Sorry, this is a stupid reason to sell gold, but it exists and has been facilitated by decades of Fed “discouragement”. But the longer the war goes on, the sticker the Gold rallies will be, especially if stocks are dropping

Excerpted Section from WEEKLY PREMIUM REPORT

Free Posts To Your Mailbox

Contributor posts published on Zero Hedge do not necessarily represent the views and opinions of Zero Hedge, and are not selected, edited or screened by Zero Hedge editors.

[ad_2]

Source link