Initial Jobless Claims Surge To 4 Month High, Philly Fed Plunges

It appears the ‘strongest labor market ever’ is showing signs of stress as the number of Americans seeking first time jobless benefits surged to 218k last week – its highest since mid-January…

Source: Bloomberg

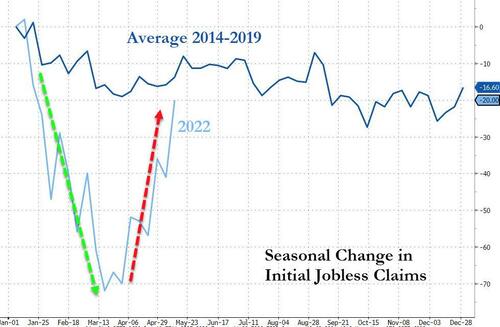

This is the biggest 8-week rise in jobless claims since the growth scare in Dec 2020/Jan 2021… and no this is not seasonal…

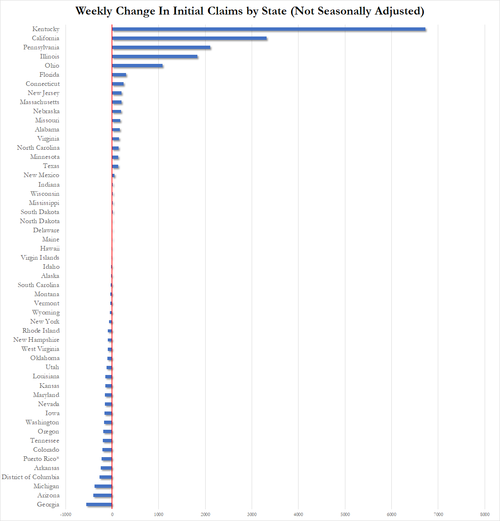

Kentucky, California, and Pennsylvania dominated the rise in jobless claims…

This labor market pain echoes weakness seen in recent survey data – such as ISM Manufacturing and Empire Fed and this morning we saw Philly Fed’s Business Outlook survey plunge from 17.6 to 2.6 (massively missing expectations of 15.0).

That is the weakest since June 2020… with Employment and the outlook sliding…

-

May prices paid fell to 78.9 vs 84.6

-

New orders rose to 22.1 vs 17.8

-

Employment fell to 25.5 vs 41.4

-

Shipments rose to 35.3 vs 19.1

-

Delivery time fell to 17.5 vs 17.9

-

Inventories fell to 3.2 vs 11.9

-

Prices received fell to 51.7 vs 55.0

-

Unfilled orders rose to 17.9 vs 5.7

-

Average workweek fell to 16.1 vs 20.8

-

Six-month outlook fell to 2.5 vs 8.2

-

Six-month outlook for capex fell to 9.6 vs 19.9

So sentiment is slumping, financial conditions are tightening (at their tightest since Dec 2018’s flip-flop), and now the jobs market is floundering.

And The Fed has 10 more rate-hikes to go this year?!

[ad_2]

Source link