Stagflation Threat Soars As Manufacturing Surveys Show Soaring Costs, Weaker Jobs

With US Macro Surprise data in freefall throughout May, expectations were for Manufacturing sentiment surveys to slide (ISM extending its weakness and PMI confirming its flash dip).

-

S&P Global US Manufacturing missed, falling from 59.2 in April to 57.5 in preliminary May to 57.0 final for May – the lowest since January 2022

-

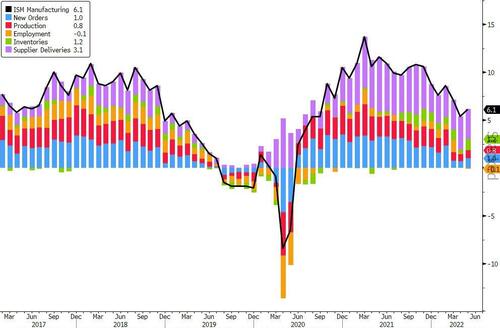

US ISM Manufacturing beat, bouncing from 55.4 in April to 56.1 in May, better than the expected drop to 54.5.

Source: Bloomberg

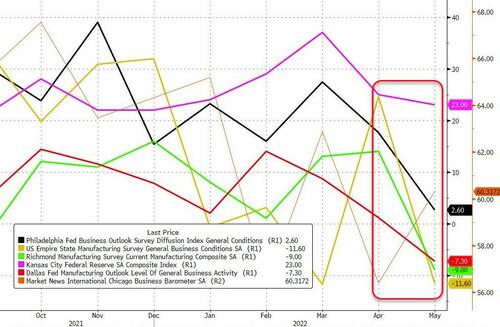

Bear in mind that the ISM results stand in contrast to several regional Federal Reserve bank surveys that showed a clear pullback in factory activity.

Gauges of manufacturing in New York state and Texas, along with the Richmond and Philadelphia Fed regions, all declined in May from the prior month.

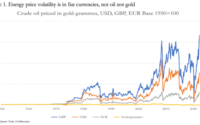

Under the hood of the PMI report, things were even worse with the smell of stagflation in the air as cost inflation soaring at its fastest since Nov 2021’s all-time high and production and new orders slowing. Additionally, backlogs dropped to their lowest since Feb 2021.

Inventory additions appeared to provide support for ISM’s surprise gains… and while the PMI report showed new orders slowing, ISM reports new orders rising…

But, the ISM report added to the pain with prices remaining at near extreme highs (and printing hotter than expected), while ISM Employment tumbled to 49.4 (in contraction for the first time since Nov 2020)…

Source: Bloomberg

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

“A solid expansion of manufacturing output in May should help drive an increase in GDP during the second quarter, with production growth running well above the average seen over the past decade. However, the rate of growth has slowed as producers report ongoing issues with supply chain delays and labor shortages, as well as slower demand growth.

“A cooling in new orders growth was in part linked to customers pushing back on high prices, though also reflected shortages and growing concern about the outlook.

“Input cost pressures meanwhile intensified further during the month. Although delivery delays were the least widespread for 16 months, pricing power remained firmly in the hands of the supplier, with rising energy, wage and transportation costs adding to firms’ cost burdens. The result was the steepest rise in costs since November, feeding through to yet another near-record factory gate price increase and serving as a reminder that inflationary pressures remain worryingly elevated.”

These reports are not what The Fed wanted to see – yes, it appears the economy is slowing (perhaps on Fed hikes and jawboning), but slower growth is NOT leading to slower price acceleration.

[ad_2]

Source link