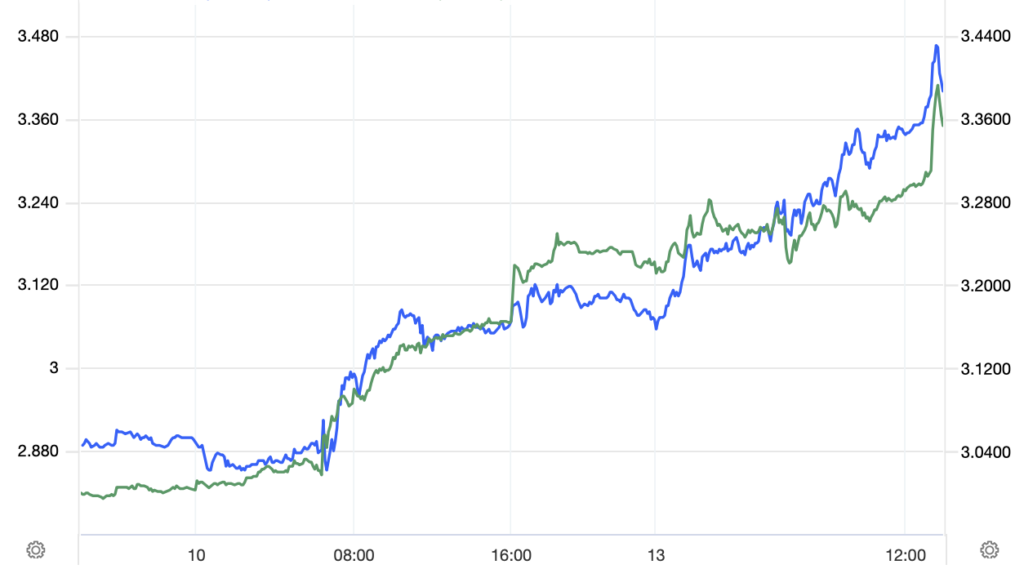

(USAGOLD – 6/13/2022) – If you’ve dropped by to get a read on what happened to gold today, we provide a two-chart explanation. Please note in the first chart the converging yields on the US Treasury two-year note and the ten-year bond. Note also the lines crossing earlier this morning – an inversion, though temporary, that sent a chill through financial markets, including gold and silver. Such inversions have signaled recessions in the past. Coincident with that, note in the second chart the US dollar index’s unusually sharp gains over the past five trading sessions. As many of you already know, there is presently a heavily traded strong inverse correlation between gold and the US dollar index. The unusually strong move in the index induced an unusually strong move in the gold market.

Both trends have a common denominator – the Fed’s determination to push rates higher even with a recession looming on the horizon. Bloomberg posted a report earlier that Wall Street had begun to entertain the notion of a 1% rate increase at this week’s meeting as a way for the Fed to show it means business on inflation. The claim added fuel to the fire in all the markets. JP Morgan’s Kolanovic is going the other way saying the Fed will surprise on the dovish side. Wednesday tells the tale………..

Gold was down $52 on the day at $1822. Silver was down 81¢ at $21.16.

There are a couple of additional possibilities ……

– One, the sharp declines reflect thin summer markets.

– Two, traders might be selling gold positions to cover margin calls generated by the sharp declines in the crypto, stock, and bond markets.

Converging yields

(Two-year US Treasury note, Ten-year Treasury bond, one day)

US Dollar Index

(Five days)

Charts courtesy of TradingEconomics.com