Markets sink as investors fret that the Fed will start a recession

Can the Federal Reserve slam the brakes on inflation and somehow avoid plunging the world’s biggest economy into a recession? Investors have big doubts.

After an impressive afternoon rally on Wednesday, which saw stocks snap a five-day losing streak, equities are once again in the red on Thursday. Across Asia and Europe, investors are dumping risk assets. And U.S. futures point to a rough open.

At 5 a.m. ET, S&P 500 futures were trading 2.25% lower, more than enough to wipe out yesterday’s gains and plunge the benchmark further into a bear market. The selloff appears widespread with big names such as Apple (down 2.9% premarket) and Tesla (off 3.6%) continuing their slide.

And in another sign of the risk-off mood hanging over markets, crypto is once again in the red—Bitcoin trades around $21,200. Elsewhere, the safe-haven dollar is climbing.

Bumpy landing

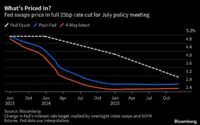

Simply put, investors see pain ahead, more so after yesterday’s historic three-quarters of a percent interest rate hike. To beat back runaway inflation, Fed Chairman Jerome Powell signaled the central bank will not put the bazooka away anytime soon. He sees another large rate hike coming at the July Federal Open Market Committee (FOMC) meeting—in the 50- or even 75-basis-point range. The Fed also sees weaker economic growth, higher unemployment, and a prodigious series of rate hikes well into next year. What they have less clarity on: When will inflation peak, and begin to retreat?

What’s complicating the Fed’s strategy is the kind of inflation hitting Americans’ wallets. It is largely driven by soaring food and fuel prices, and, as Powell admitted on Wednesday, the central bank is largely powerless to do anything about that.

Meanwhile, the worsening economic data is giving the Fed little option but to attack rising prices at all costs. Such a move would essentially kill off the prospect of a soft landing, and could put the crimp on corporate profits and stifle household spending, many on Wall Street now believe.

“The Federal Reserve is going to hike interest rates until policymakers break inflation, but the risk is that they also break the economy,” Ryan Sweet, the senior director at Moody’s Analytics, said after Powell’s press conference yesterday afternoon.

Sweet sees the worst is yet to come as the consequences of the Fed’s moves to raise rates and wrap up its bond-buying program, started earlier this year, begin to hit the economy. Add it all up, and a recession is in the cards.

“The Fed could be faced with a Hobson’s choice: Push the economy into a mild recession, similar to our scenario, to tame inflation, or wait and cause a more significant recession, since a stagflation scenario is possible next year if the Fed isn’t aggressive enough.”

Bill Adams, the chief economist for Dallas-based Comerica Bank, isn’t quite as bearish about the American economy, but he too is beginning to rethink the likeliness of a recession.

“Following the FOMC decision, last Friday’s bad CPI report, and [Wednesday’s] bad retail sales report, I am raising my view of the probability of a recession starting in 2022 as 25%, up from the 10% I saw previously. I see the risk of a recession starting in 2023 at 30%, up from 25% previously,” he says.

A global problem

The inflation risks are hitting global economies hard, and central banks are scrambling to limit the damage.

The Swiss National Bank on Thursday raised rates by a larger than expected half-percentage point, the first hike in 15 years. That follows an extraordinary session of the European Central Bank designed to calm down the sovereign bond markets there, and keep the euro from sinking further. A weak euro, a currency fast approaching parity with the dollar, represents further bad news for European consumers as it makes imports more expensive—essentially, another form of inflation.

All this turmoil has been great news for dollar bulls. BofA Securities recently reiterated they are bullish on the greenback, and on oil. If its forecast proves correct, that’s more bad news for Powell & Co.

This story was originally featured on Fortune.com

[ad_2]

Source link