Central banks and markets share a secular awakening

The author is president of Queens’ School, Cambridge, and an adviser to Allianz and Gramercy

For the worldwide economic system and markets, final week marked a definitive “awakening”.

As good phrases from central banks about battling inflation gave strategy to extra significant coverage actions, there was a primary awakening with the realisation that, undoubtedly, we have been making a transition to a brand new and more difficult regime for monetary circumstances.

And since this transition is so late in coming, there was a second awakening — a recognition that there isn’t any hiding from the difficulties this poses for policymakers, households, corporations and markets.

Simply take a look at what occurred final week. Within the US, the Federal Reserve hiked its benchmark rates of interest by 0.75 share factors on Wednesday. That went not solely towards its personal ahead steering of a 0.50 level rise but additionally contradicted one thing that chair Jay Powell had himself voluntarily dismissed just a few weeks earlier, saying a 0.75 level improve was not being actively thought of by the central financial institution.

There may be now no denying that, after a protracted interval of resistance, the world’s strongest central financial institution has loudly acknowledged that it has no selection however to handle inflation extra forcefully, whatever the impression on markets.

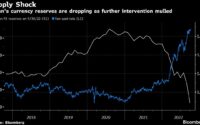

The next day in Europe, the Swiss Nationwide Financial institution raised charges by 0.50 factors, surprisingly decoupling itself from the European Central Financial institution. That crystallised what many have been beginning to suspect. The SNB is a central financial institution long-accustomed to countering the appreciation of the franc. However after witnessing what has occurred in Japan and the UK, it joined the rising variety of its friends wishing to pre-empt a forex depreciation that will make the inflation battle even tougher to win.

And all this occurred within the week that the Fed began implementing the second factor of coverage tightening — that of decreasing its $9tn stability sheet that has been bloated by the protracted programme of asset shopping for to assist markets.

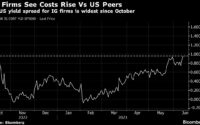

It’s plain that, after years of huge liquidity injections and floored coverage charges, the world is within the grips of a generalised tightening of economic circumstances that feeds on itself. This isn’t a cyclical phenomenon that can quickly unleash mean-reverting forces.

It’s a secular regime change pressured on reluctant central banks by inflation that has received nicely forward of them and threatens livelihoods, worsens inequality and undermines monetary stability.

As it’s late, this shift comes with a heightened danger of collateral harm and unintended penalties. That was evident final week as progress fears gripped markets with extra forecasters leaping into the recession camp.

The awakening is a vital a part of navigating by way of the dangers going through the worldwide economic system. However the course of can’t, and shouldn’t, cease right here. There may be extra to be achieved if the intention is, appropriately, to restrict the harm from the historic coverage mistake initiated final 12 months by the Fed when it stubbornly held on to its mischaracterisation of inflation as transitory.

To proceed to regain coverage credibility, the Fed must comply with the instance of the ECB and clarify why it received its inflation forecasts so improper for thus lengthy, and the way it has improved its forecasting capabilities.

And to carry out its meant and much-needed function of trustworthy adviser, the Fed must comply with the Financial institution of England in being frank and open about what’s forward for the economic system. Because it persists in failing on each, it’s no shock that so many economists, together with former Fed officers, have been fast to complain final week that the central financial institution’s revised financial forecasts remained unrealistic.

In 2016, I printed The Solely Recreation in City*, which checked out what was already then extreme and protracted reliance on central financial institution intervention. I detailed why, inside the subsequent 5 years or so, the worldwide economic system and markets have been prone to confront a “T junction” the place an more and more unsustainable path would give strategy to one in every of two contrasting roads.

One was the trail to excessive, inclusive and sustainable progress, and the opposite to recession, rising inequality and monetary instability. The earlier policymakers recognised the dividing of the methods and acted accordingly, the larger the probability of the higher highway prevailing.

Sadly, this was not achieved. As such, the worldwide economic system is now going through progress disruptions, dangerous inflation, larger inequality, and unsettling monetary market volatility. Having did not act to stop this unlucky flip, policymakers should now step up extra firmly to restrict the general harm and to higher defend probably the most weak segments of our society.

*The Solely Recreation in City: Central Banks, Instability, and Avoiding the Subsequent Collapse

[ad_2]

Source link