“Horror-Show” PMIs Send Euro Tumbling And Europe To Edge Of Recession

Many Wall Street analysts were keeping a close eye on today’s PMI barrage around the globe – among the most popular leading indicators for key economic inflection points – for the latest indication that the economy is sliding into recession. They got that and more when the latest PMI data out of Europe was nothing short of a “Horror-show” as Bloomberg called it.

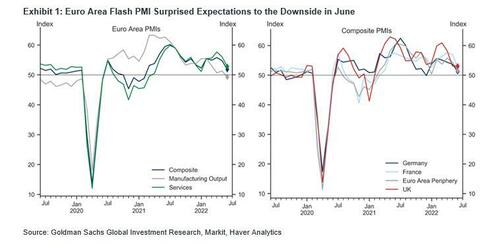

The Euro area composite flash PMI decreased by 2.9pt to 51.9 in June- a 16-month low – and far below consensus expectations of 54.0, and the May print of 54.8.

Here are the key numbers (as an aside, responses were collected between 13 and 21 June):

-

Euro Area Composite PMI (June, Flash): 51.9, consensus 54.0, last 54.8.

-

Euro Area Manufacturing PMI (June, Flash): 52.0, consensus 53.8, last 54.6.

-

Euro Area Services PMI (June, Flash): 52.8, consensus 55.5, last 56.1.

-

-

Germany Composite PMI (June, Flash): 51.3, consensus 53.0, last 53.7.

-

France Composite PMI (June, Flash): 52.8, consensus 55.9, last 57.0.

-

UK Composite PMI (June, Flash): 53.1, consensus 52.4, last 53.1.

As Goldman explains in its PMI post-mortem, “the weakening was broad-based across countries and sectors, but skewed towards France and services.” Today’s data showed moderating momentum in services and a weak manufacturing sector, where the levels of PMI have now fallen into contractionary territory (i.e. recession).

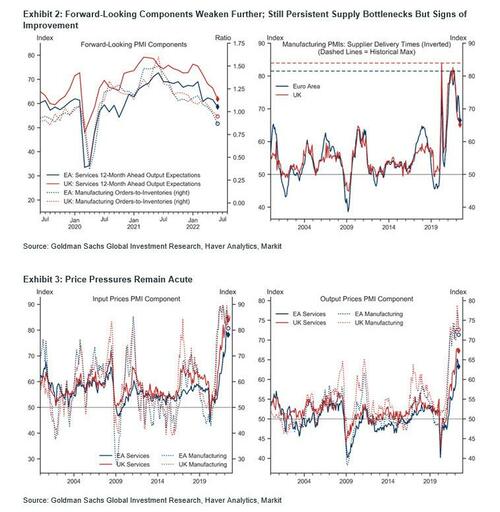

The composition of the June report was squarely weaker than in May, with new orders, employment, new export and backlogs all declining in June. Notably, both new orders and new export orders are now at levels below 50, reflecting a slowdown in both domestic and foreign demand. Firms’ expectations also decreased further, with the gap between expected future and current output (a measure of pent-up momentum) currently around 1.4 standard deviation below its historical average. Suppliers’ delivery times improved for the third consecutive month in a sign of continued easing of bottlenecks in the manufacturing sector and, while price components moderated slightly, they remain near all-time highs.

Regional breakdown:

-

The German composite PMI decreased by 2.4pt to 51.3 in June, below consensus expectations. The composite decline was broad-based across sectors, with manufacturing output falling to levels below 50 again after a slight recovery last month. The composition of the June report showed broad-based declines across components, with new orders, employment, new export orders, and backlogs all declining in June. Firms’ expectations also edged down on the back of a weaker outlook for the manufacturing sector. Price pressures remain acute as both input and output price components remain near all-time highs but bottlenecks in the manufacturing sector continue to ease as suppliers’ delivery times improved further in June.

-

The French composite PMI decreased by 4.2pt to 52.8 in June, well below consensus expectations. As in Germany, the composite decline was broad-based across sectors, reflecting a moderation in services and a contraction in manufacturing output. The composition of the June report showed declines across new orders, employment, new export orders, as well as backlogs. Firms’ expectations of year-ahead output also declined meaningfully—after improving consecutively for the last two months—to below their historical average, reflecting a less optimistic outlook across both sectors. Suppliers’ delivery times improved slightly but both the input and output price components remain near all-time highs despite a slight moderation in the latter. The downside surprise in the June flash PMI is consistent with some components of the INSEE survey (also released this morning), which also showed a decline in its services and headline index, below consensus expectations, but at odds with the INSEE manufacturing index, which improved in June, ahead of consensus expectations for a decline.

The extent of the deceleration observed today was larger than expected and thus today’s data is consistent with expectations of moderating growth in services and further weakening in the manufacturing sector, eventually transforming into a full-blown recession. As such Goldman continues to forecast weak growth in the second half of the year and see risks as skewed towards the downside, particularly in Germany, if gas flows from Russia do not pick up following the end of the pipeline maintenance period in mid-July.

The dismal news understandably sent the EUR tumbling back below 1.05…

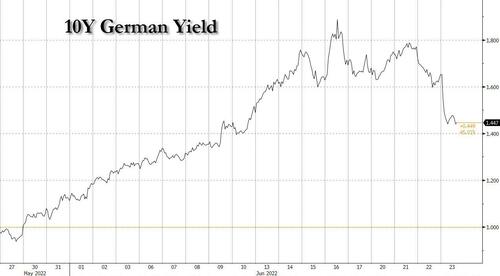

… while the sharp slowdown in Europe’s economy put German 10-year yields on track for their biggest decline in more than three months.

The biggest question, however, is whether Europe will slide into recession before the ECB has even had a chance to follow through with any of its hikes, which are supposed to begin as soon as next month… which is also when the European economy is now widely expected to contract, in another dire repeat of the events that pushed the continent into the sovereign debt crisis.

[ad_2]

Source link