Fed Is ‘Just at the Beginning’ of Raising US Rates, Mester Says, MBA Mortgage Purchase Applications Drop -21% WoW As Rates Rise (Mester Channels The Carpenters) – Confounded Interest – Anthony B. Sanders

Cleveland Fed’s Mester is channeling The Carpenter’s song “We’ve only just begun … to raise rates.”

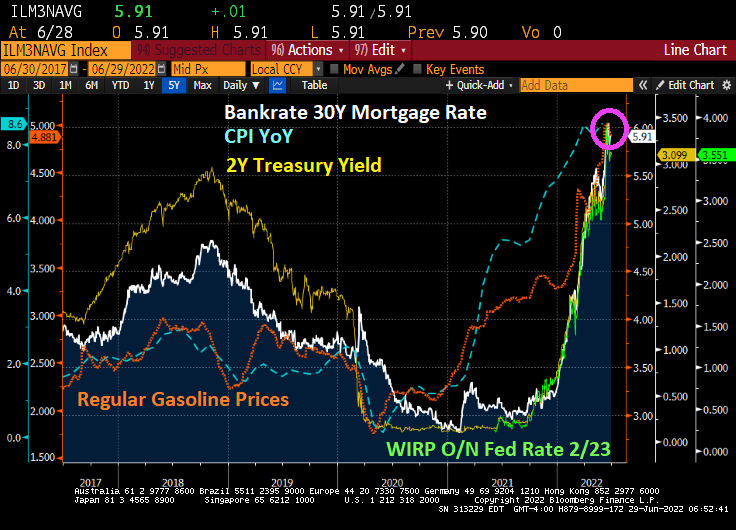

Financial markets are anticipating what Mester is saying: rapidly rising interest rates. But as you can see from the following chart, gasoline prices (orange line) are driving rising US prices. So it is doubtful that monetary tightening will slow price increases. But Mester and company can only control monetary stimulus.

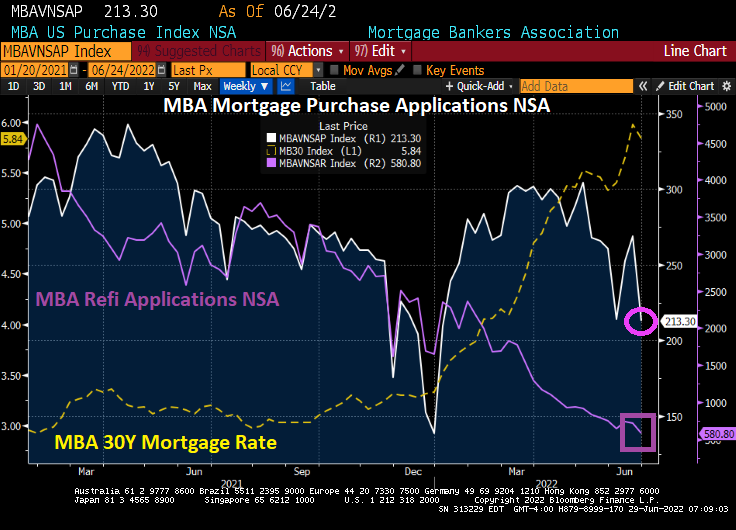

Mortgage rates have soared as The Fed attempts to crush inflation. And mortgage purchase applications fell -21% WoW in the most recent Mortgage Bankers Association survey.

The Refinance Index increased 2 percent from the previous week and was 80 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 0.1 percent from one week earlier. The unadjusted Purchase Index decreased 21 percent compared with the previous week and was 24 percent lower than the same week one year ago.

It almost seems like Mester is following the Taylor Rule (not really). But using CPI YoY, the Taylor Rule is saying that The Fed Funds Target Rate should be … 22.10%. It is only 1.75% after years of excessive stimulus following the banking crisis of 2008/2009. And Yellen who seemingly never met a rate hike that she liked.

If we use core PCE as our measure of inflation, the Taylor Rule is still high at 13.25%, a whopping 11.50 spread over the current target rate.

Will The Fed drive up rates and risk a recession ala Paul Volcker? Are we sitting on top of the world or about to get fried?

Bear in mind that gasoline prices are up 104% under the Biden Administration and mortgage rates are up 105%.

[ad_2]

Source link