Financial Times/Mohamed El Erian/6-28-2022

“The markets are evolving their minds about US economic prospects just as the Federal Reserve has been scrambling again to catch up to developments on the ground. This risks yet another round of undue economic damage, financial volatility and greater inequality. It also increases the probability of a return to the ‘stop-go’ policymaking of the 1970s and 1980s that exacerbates growth and inflation challenges rather than addressing them.”

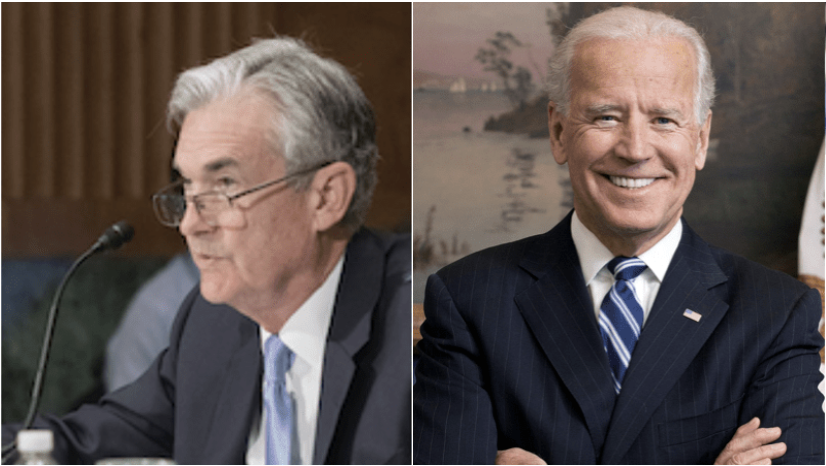

USAGOLD note: Another allusion to the similarities between the Fed-White House (Arthur Burns-Richard Nixon) collaboration of the 1970s and the current Biden-Powell arrangement. As Niall Ferguson put it: “I think I’ve read enough about Burns to suggest plausibly that the current Fed chair, Jay Powell, has more in common with him than with Volcker. This is unfortunate, and potentially disastrous for the US economy.”