Home Listings Surge in Turnabout for Supply-Starved US Market (Are Homeowners Seeing An End To Home Price Growth With Fed Rate Increases??) – Confounded Interest – Anthony B. Sanders

The Federal Reserve under Berananke, Yellen and Powell kept monetary stimulus out there too long and rates too low, but Powell is now trying to reverse that trend to fight inflation. But how will that impact the housing market?

(Bloomberg – Prashant Gopal) The housing slowdown is helping to solve one of the US real estate market’s most intractable problems: tight inventory.

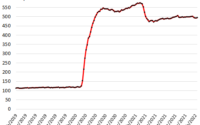

With fewer buyers competing, the number of active US listings jumped 18.7% in June from a year earlier, the largest annual increase in data going back to 2017, Realtor.com said in a report Thursday. And new sellers entered the market at an even faster rate than before the pandemic housing rally began.

The Federal Reserve is cooling off the red-hot housing market as it fights to curb inflation by driving up interest rates. The resulting spike in mortgage costs is making homes less affordable and pushing would-be buyers to the sidelines. That means properties aren’t selling as quickly and must compete with the growing number of new offerings.

I wonder if it is all the Covid monetary and fiscal stimulus that is finally getting homeowners to put their houses on the market, perhaps fearing the end of the housing price run-up with Fed-induced rate hikes?

Let’s see if The Fed’s Frolic Room (aka, open market committee) keeps driving rates up and home affordability down. Or is it The End for the house price bubble?

[ad_2]

Source link