MarketsInsider/Harry Robertson/6-30-2022

“Oil prices are likely to surge to above $200 if the G7 implements plans to cap the price of Russian crude and products, according to an analyst at Swedish bank SEB. Bjarne Schieldrop said Wednesday that the plans were a ‘recipe for disaster’, given the high levels of stress in the oil market, where prices have more than doubled to around $120 a barrel this year.”

USAGOLD note: Oil is a component in the pricing of just about everything. If it goes to $200 a barrel, one would think that consumer price inflation would go on a tear. At $120 oil, it would seem, we are closer to the beginning of the inflation problem than the end.

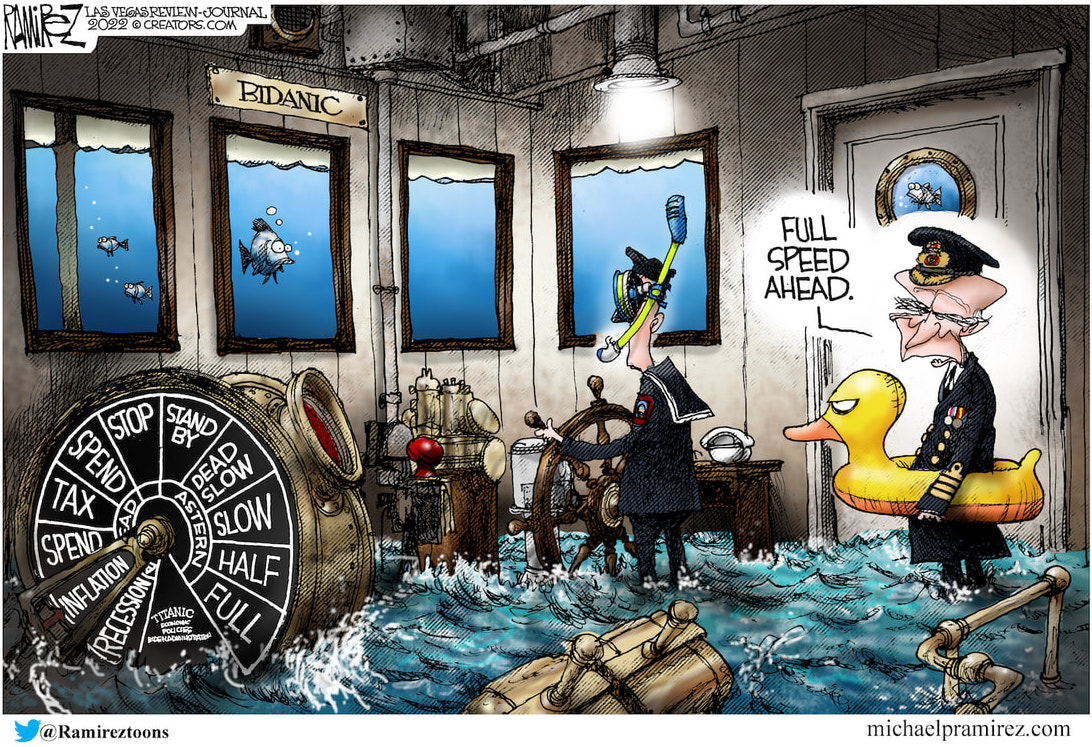

Cartoon courtesy of MichaelPRamirez.com