Recession Is Priced In; Stagflation Is Not

Submitted by the Space Worm Substack

The Eurodollar futures market is predicting a Fed rate cut in Q1 2023:

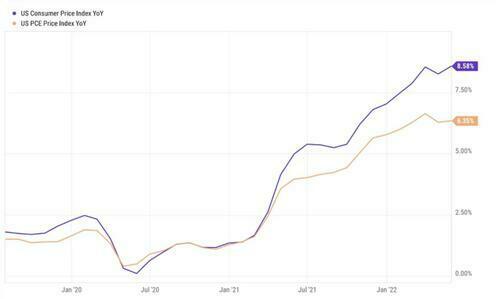

Yet neither CPI nor PCE have declined to any meaningful degree:

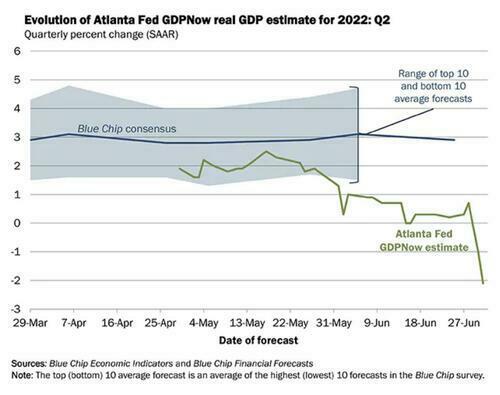

I.e. the market expects a return to easy money but NOT because the Fed has reduced inflation and instead due to troubling economic projections:

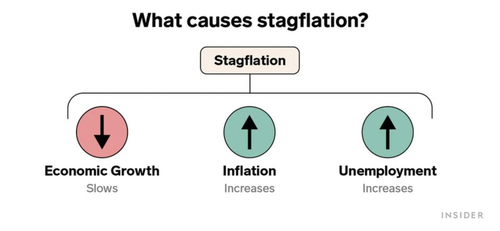

This is textbook Stagflation:

Gold ought to be a preferred Stagflation asset as demand for it is less tethered to real economic activity than virtually all other commodities. Yet, gold mining stocks have taken quite the beating:

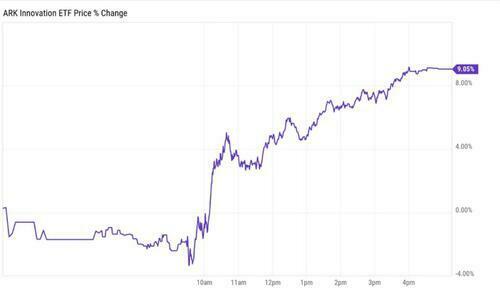

GDXJ (junior gold miners) making new 52-week lows on a day when ARKK rallies 9%:

Analysis:

Today’s ARKK action may be partially attributed to profit taking by the shorts. However, the current zeitgeist is that bad economic news = good market news and an assumption that unprofitable tech names ought to rally hardest given they took the biggest beating. This assumption is bogus.

When the Fed does pivot, if inflation has not yet been reigned in, while the drop in Treasury yields will elevate ALL asset prices, consumers will not have the disposable income to spend on services offered by most big growth names – They will not be purchasing the $121k Tesla (an ARKK holding) Model X and instead opt for the comparable Mercedes GLC at $54k. They will trim down entertainment subscriptions like Netflix, Hulu, Roku (an ARKK holding), Disney+, etc. They will spend less time shopping online, reducing the need for services like Square (an ARKK holding) – Too much income will be required for food, gas, shelter, and clothing. I know these names don’t rely on earnings and instead on “total addressable market” and “network effects”, but these metrics ultimately require ample economic activity to justify.

In such an atmosphere, Demand for a true inflation hedge will manifest. Crypto is superior to gold at subverting authority (something I write about here) but it’s no safe haven, and folks struggling financially will not be able to stomach the volatility. Crypto outflows may be another boon for gold.

I’m not sure when the market will come to this realization. The prevailing assumption seems to be that the recession will cure inflation, but again, the recent Eurodollar pivot has been driven by economic output data – not inflation (which remains at 40 year highs). This said, it may take another elevated CPI print for this to set in.

I took out some call options on GDXJ. Historically, July is a good month for stocks so the timing seas hard to pass up. Then again, the Fed may “break something” in the meantime so I’m maintaining majority cash.

I hope the current market paradigm shifts soon. It’s confusing poor Dave:

If you enjoyed, please follow me on Substack and Twitter.

[ad_2]

Source link