MisesWire/Jeff Deist/7-1-2022

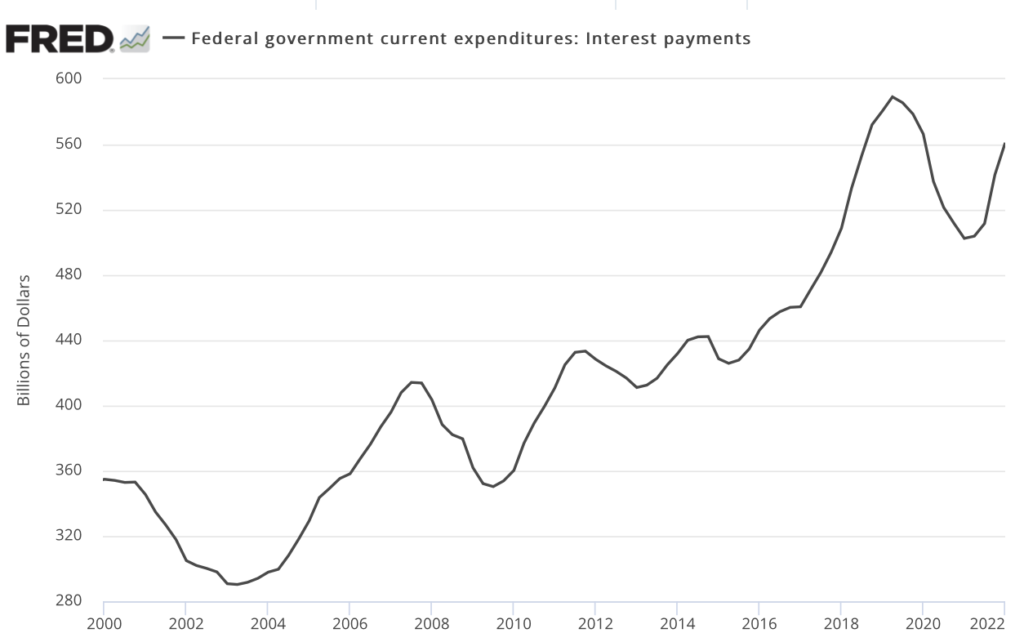

“If Treasury rates continue to rise, and rise precipitously, the effects on congressional budgeting will be immediate and severe. Even if we laughably assume total federal debt remains static at around $23.8 trillion (the publicly held portion of the $30 trillion), interest rates of merely 2 or 3 percent will cause interest expense to rise considerably. Average weighted rates of only 5 percent would cost taxpayers more than $1 trillion every year. Historically, average rates of 7 percent swell that number to more than $1.5 trillion. Rates of 10 percent—hardly unthinkable, given the Paul Volcker era of the late seventies and early eighties—would cause debt service to explode to over $2.3 trillion.”

USAGOLD note: With all eyes on monetary policy, fiscal policy has faded to the background. Deist thinks the unthinkable. At a 5% average rate – not inconceivable given the Fed’s current mindset and inflation at 8.6% – interest cost would become the federal government’s single largest expenditure and amount to over $1rillion annually. Please note, the turn higher in 2022 coincident with rising interest rates.

Sources: St. Louis Federal Reserve [FRED], Board of Governors Federal Reserve System (US)