Toronto Star: Why the U.S. Dollar Will Be Replaced as the Dominant Global Currency

Article by Frank Giustran in Toronoto Star

Not long after the first gunfire erupted at the onset of Russia’s invasion of Ukraine, Russia fired another multi-pronged shot, straight across NATO’s financial bow.

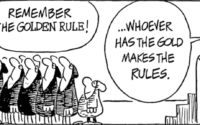

First, and as a reaction to the crippling sanctions and its exclusion from the global SWIFT money transfer system imposed by the West, it moved quickly to protect the ruble by raising interest rates to 20 per cent (subsequently lowered to 11 per cent) and imposing capital controls. Then it demanded that all “non-friendlies” (the West) could only use rubles or gold to buy its much-coveted oil. Russia, which has spent the better part of the last decade getting rid of its U.S. dollars and increasing its gold reserves, also offered to buy gold at the rate of 5,000 rubles per gram. Russian President Vladimir Putin is advocating that BRICS economies look into creating an international reserve currency using the basket of their own currencies. Finally, he started making noises about creating a gold-backed ruble. Why is there any significance to these moves?

The writing is on the wall that some form of change is imminent, and a global monetary system reset may already be underway. According to Credit Suisse, this new economic order will revolve around commodity-based currencies. These commodity-based currencies will further weaken the Eurodollar system, which will be much weaker after the war between Russia and Ukraine ends.

How all these things evolve, and their timing, are beyond anyone’s forecasting abilities, but something will eventually replace the U.S. dollar as the sole dominant global reserve currency, perhaps sooner than anyone expects.

I expect, at the very least, an “alternative trading” currency to emerge and compete with the dollar. This new currency would be used solely for settling trades between nations as opposed to a reserve currency that central banks normally use for diversification. Admittedly, this is sheer speculation and the eventual outcome is anyone’s guess.

If you find my prediction shocking, consider the facts. For 400 years, global reserve currencies have come and gone. The reserve currencies of Spain, the Netherlands, and Britain (to name a few) typically have a lifespan of, give or take, 100 years. The reasons for the demise of reserve currencies are repeated over and over. For a great read on this topic, pick up a copy of Ray Dalio’s “Principles for Dealing with the Changing World Order” or if you are rushed for time, search for his YouTube video, which explains it in very simple terms. Tragically, when global powers lose their dominant reserve status, bloody wars usually follow.

The U.S. dollar attained its dominant reserve status in 1944 with the Bretton Woods agreement. The basics of the agreement between 44 countries was that the dollar would be pegged to gold and all other countries’ currencies would be pegged to the dollar.

A great idea, as long as the U.S. kept its gold and was fiscally responsible. But by 1971, all fiscal discipline had gone out the window and U.S. President Richard Nixon effectively defaulted when he decoupled the dollar from gold.

This move would have been immediately devastating to the U.S., were it not for the brilliant move to create the “Petrodollar.” The relationship was formed between Saudi Arabia and the U.S., where the former would sell its oil in exchange for the dollars earned being reinvested into the U.S. Treasury market along with security promises. To put it simply, the demand for dollars to trade in what is the biggest commodity in the world has served to prop up the dollar despite all the fiscal and monetary abuse that has been heaped upon it.

Couple those changes with the frequent weaponization of the U.S. dollar through sanctions and the SWIFT system, and you can see why certain countries have been desperately looking for U.S. dollar alternatives. In short, the U.S. dollar feels like a lame-duck currency. It still rules, but the world is clearly jockeying for what comes next.

No country is more anxious about these changes than China, especially after the start of the war in Ukraine. A financial-economic war was already simmering between the U.S. and China prior to Russia’s invasion, and China has called for a “new international financial order” in the past. But with the Ukraine war, things may be really heating up. Chinese President Xi Jinping has been criticizing the use of sanctions, especially with respect to weaponizing the dollar and warning of its consequences to the west. As for what would constitute a replacement of the dollar as the supreme reserve currency? We know the Chinese yuan is not capable of replacing it on its own, no matter how much China has tried to change things. It only represents two percent of global foreign exchange reserves. But it might have alternative routes, and one of them could be a partially gold-backed “settlement” currency.

China has been quietly building its gold reserves. It’s the world’s largest gold producer (12 percent of global production) and the world’s largest gold importer. No Chinese-mined gold is allowed to be exported. Incidentally, the government also encourages its citizens to buy gold. Domestic and imported gold just disappears into a big black hole. China is careful in its gold accumulation and doesn’t show its hand, presumably because it doesn’t want the gold price to spike. Its domestic production alone accounts for 7,000 tons over the past 20 years. (America’s official gold reserves stand at 8,200 tons.) China has a habit of not reporting its official gold reserves for many consecutive years and then publishing numbers that are exponentially higher than previous reports. They last reported in 2019 at 1,950 tons. No one believes this is accurate. It could easily be double or even higher.

How would a gold-backed settlement currency work? As economist Jim Rickards explained …..

To read this fascenating article in Toronto Starb in its entirety, click here.

[ad_2]

Source link