Will The Fed Hold Its Nerve?

It looked like “bad news was good news” once again on Tuesday, as the market ripped into the close under the assumption that Fed would be set to become more dovish in the second half of this year. Oil plunged nearly 8% on the day, leaving many to think we are finally seeing some deflation in energy – would could serve as the impetus for Fed relief and equity markets seeing even just a short term bottom.

But the Fed remains the most consequential question about the state of equity markets, still.

Determining whether or not the Fed truly “will not blink”, as my friend Kenny Polcari predicts, or whether or not they are going to eventually slip back into QE – maybe even before the end of this year remains the most pertinent question for risk assets heading into 2H 2022.

On everything I’ve written to my subscribers about my personal positions, I have always qualified it with “if the Fed holds course”.

While people like Kenny believe a 100 bps hike is definitely coming down the pike at that the Fed is to blame for “at least 70% of the current problem”, I look at things a little differently. I believe the Fed is going to hold its ground until the very first one or two prominent signs that inflation is starting to abate (i.e. more than just one day of oil prices crashing).

From there, I think they are going to change their tone (not necessarily their actions) which will be enough of a relief valve for markets at this point that they could rally.

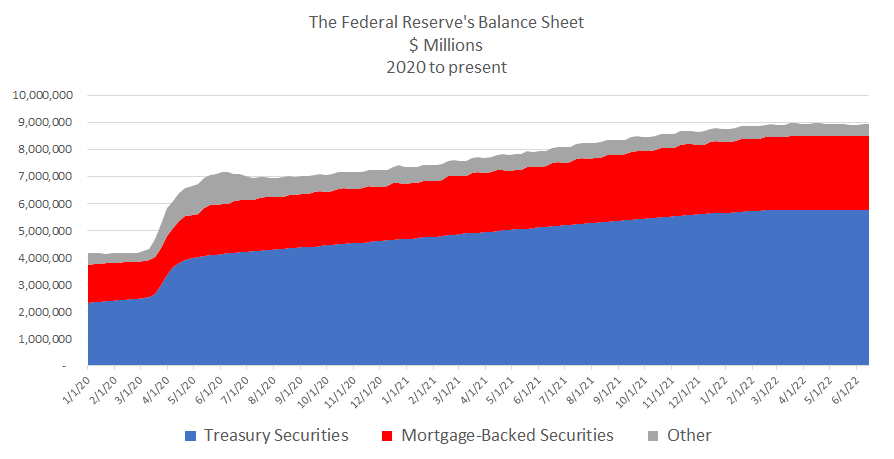

After all, the Fed’s balance sheet is still growing:

The real balance sheet rolloffs are set to start on September 1, 2022, as Vanguard notes:

The Fed plans to reduce its $8.5 trillion balance sheet beginning June 1, when it will no longer reinvest proceeds of up to $30 billion in maturing Treasury securities and up to $17.5 billion in maturing agency mortgage-backed securities per month. Beginning September 1, those caps will rise to $60 billion and $35 billion, respectively, for a maximum potential monthly balance sheet roll-off of $95 billion.

So there’s a real chance that the Fed switches to more dovish language before it starts meaningfully tightening. The catalyst is going to be whether or not we get a couple of drawdowns in the CPI numbers. With energy prices drifting lower over the last month and the last CPI reading coming in at a scorching new high, there’s room for the appearance of inflation dwindling, even if it really isn’t.

This appearance is enough for the Fed to pull the plug on its hawkish tone, in my opinion.

I’ve love to hear your take on these questions in the comments below:

-

Will the Fed keep fighting inflation even if it gets one or two positive looking inflation readings heading into the fall?

-

Is a 100 bps hike possible at this point? Moreover, is it necessary?

-

What do you think the terminus becomes for the Fed actually tightening its balance sheet?

-

Have valuations anywhere gotten to a point where you believe they are cheap by historical norms, because I still am struggling to find any serious “value”?

[ad_2]

Source link