YahooFinance-Bloomberg/Michael Mackenzie and Elizabeth Stanton/7-12-2022

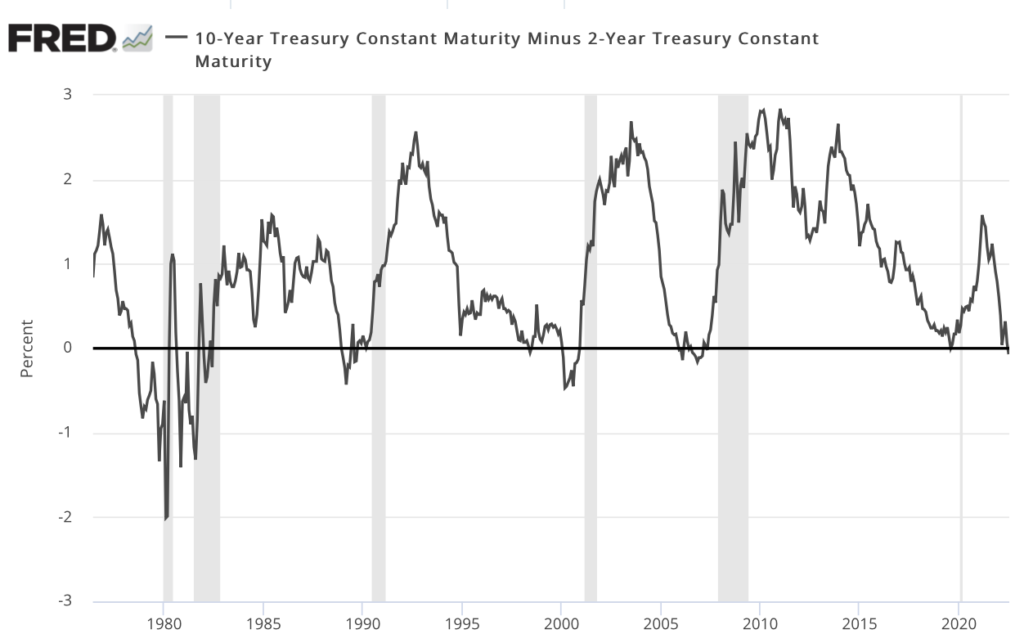

“So-called inversions of the yield curve — in which longer-term rates fall below those on shorter-dated maturities — are regarded as a potential harbinger of an economic slowdown that could eventually result in rate cuts. The spread between 2- and 10-year Treasuries inverted briefly in 2019 and again in April 2022.”

USAGOLD note: The inversions that stick around for a while are cause for worry, as shown in the chart below. The markets will be watching closely to see if this one persists. One analyst quoted in this article says it will because of the Fed’s stated determination to raise rates until inflation slows.

Source: St. Louis Federal Reserve [FRED]