MoneyMagazine/John Stepek/7-14-2022

“Anyway – it seems to me that markets are setting themselves up for disappointment. It’s easy for the Fed to be relentless right now because employment remains high and the political pain is being caused by the soaring cost of living. But how will it react if and when job losses begin and the cost of living is still stratospheric?”

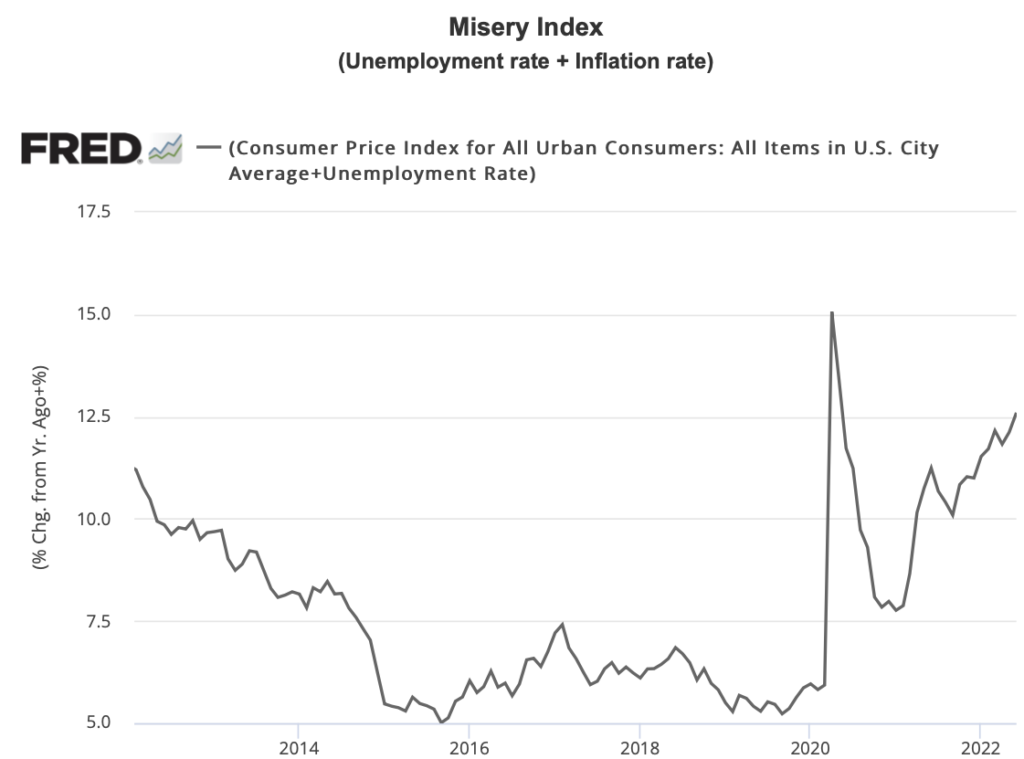

USAGOLD note: We agree with Stepek on this point and expressed as much early on, i.e., back when the Biden administration first began pressuring the Fed on the inflation front. It’s one thing to put up with rising prices. iI is another thing entirely to put up with rising prices and the prospect of unemployment. The Misery Index might be the major issue once again by November – something that has not been a problem since the 1970s. The chart speaks volumes.

Sources: St. Louis Federal Reserve [FRED], Bureau of Labor Statistics