Parity Beckons for the Euro Even With ECB Speeding Up Rate Hikes

(Bloomberg) — The euro is heading back to dollar parity, and not even a faster pace of rate hikes by the European Central Bank can change that, according to traders and market strategists.

Most Read from Bloomberg

The big issue in Europe remains energy security and that’s why a move back to parity is more likely than a climb to $1.04, said Francesco Pesole, an FX strategist at ING. Plus, the interest-rate differential between Europe and the US still argues for weakness in the euro.

“The size of the ECB’s tightening cycle is so tiny compared with the Fed,” Pesole said. “You can’t say that this can drive euro appreciation in an environment when the euro zone is at risk of not having gas this winter.”

The euro weakened 0.9% to $1.0138 on Friday. Last week, it bounced off the parity level for the first time in 20 years.

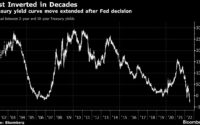

The ECB raised its benchmark rate by 50 basis points on Thursday, a bigger increase than many traders had expected. In the backdrop, traders are also watching Italy’s political turmoil as the country heads toward a snap election and whether Russian gas supplies will return to normal.

The ECB’s rate decision “reduces the speed/magnitude of EUR downside, but is unlikely to change the trajectory,” said Wells Fargo FX strategist Erik Nelson. “We look for EUR/USD to trade as low as $0.95 within the next few months.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

[ad_2]

Source link