World Gold Council/Staff/7/29/2022

“As the gold price fell in Q2, gold ETFs lost 39t, giving back some of the strong Q1 gains. Net H1 inflows totalled 234 tonnes compared with 127 tonnes of outflows in H1’21. Bar and coin investment (245 tonnes) was unchanged from Q2’21 as a sharp drop in China was offset by growth in India, the Middle East and Turkey. The H1 total saw a 12% y-o-y drop to 526t tonnes on compounded Chinese weakness.”

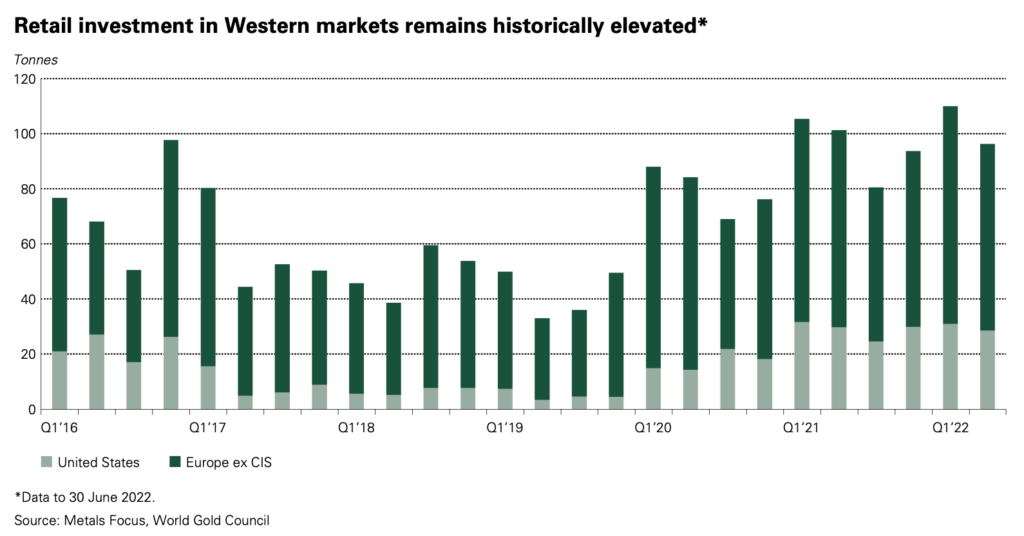

USAGOLD note: WGC reports that investment demand globally posted its third largest gain since 2010. The degree to which European investor demand has outpaced US demand over the past few years is worth noting. Given Europe’s ongoing energy crisis, we suspect demand to be further elevated as we hit the winter months.

Chart courtesy of World Gold Council