“Silliness Is Back” – Financial Conditions Are Now ‘Easier’ Than Before The Fed Started Hiking

The Fed has a problem…

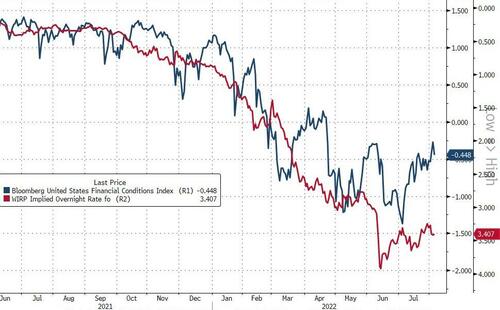

Despite an unprecedentedly fast rate-hiking cycle, and FedSpeak dedicated to a hawkish bias, the market’s belief in its own self-deception that we are past ‘peak inflation’ and/or that a ‘Fed Pivot’ is imminent has – somewhat incredulously – pushed US financial conditions back to their ‘easiest’ levels since before The Fed started hiking rates in March…

Source: Bloomberg

As Nomura’s chief strategist Charlie McElligott points out so succinctly:

“Despite a really fragile macro backdrop of “higher (and tighter) for longer” which continues to bleed growth sentiment…

…set against an “FCI easing” driven by risky-asset reflexivity on the perception that “growth slowdown” will see Fed back-down from their ongoing “hawkish” rhetoric…

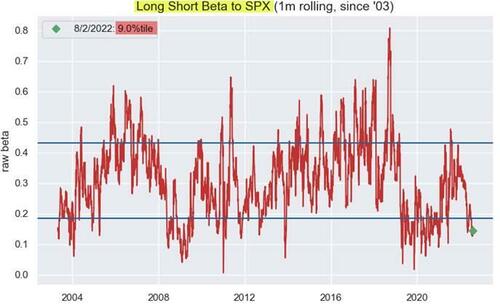

…we are in the midst of an angst-ridden pain-trade higher in Stocks which is pushing us back into increasingly “unstable” FOMO-type behavior, because nobody is there for this move…”

The risky-asset-driven easing of financial conditions has even dramatically decoupled from the short-term interest-rate (STIR) market’s expectations for Fed tightening…

Source: Bloomberg

This is untenable for the Fed.

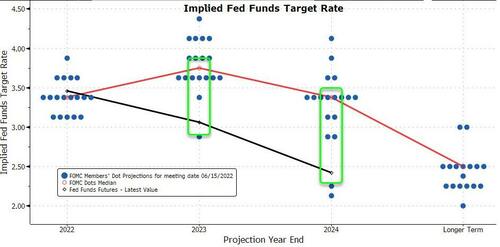

Accordingly, the Fed rhetoric has again turned more vociferous in an attempted push-back of both this “too easy” FCI as-well-as the market’s “dovish” pricing of EASING seen in early ‘23.

That is simply because there is a big difference between a “dovish pivot” – particularly as traders’ have been conditioned to believe that means “rate cuts and large-scale asset purchases” – versus a Fed which in reality IS that rates are going to have to stay “higher for longer” due to still too hot Labor and Wages

Now that the market has indeed / rightfully reset the terminal rate higher over the past few days (from 3.25% now ~ 3.47-.48% per FFOIS), McElligott notes that the best trade on the board continues to be fading the early ’23 “Fed easing / rate cut” bets currently “averaged in” across 2023 STIRS, which the market has rightfully begun to do, after the Fed clapped-back at “dovish pivot” claims with a constant stream of “hawkish” rhetoric the past few days… accordingly, we have removed 60% of a full “Fed cut” already, as EDZ2-Z3 steepened from -77.5bps to the current -62.5bps.

BUT… the truth is, there is still absolutely further potential for incremental “Upside Equities” flows from here, due a number in technical / mechanical / sentiment dynamics beginning around SPX 4200 and beyond, as more mechanical / systematic re-allocation increases likelihood of capitulation from investors who are missing this violent rally off the lows.

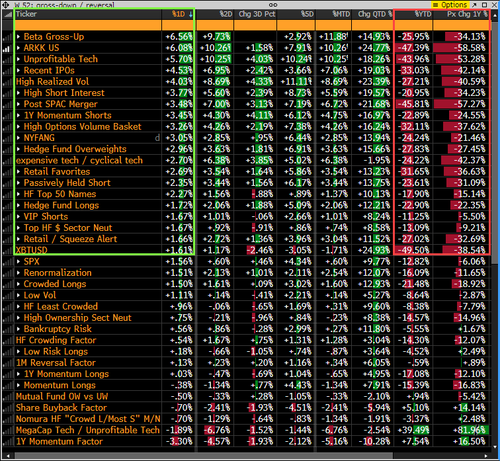

McElligott notes that yesterday saw and explosive resumption of “speculative FOMO” and “VIX Smash” themes which harkened back to the “peak market structure and sentiment mania instability” days of 2021 and Summer 2020.

The now-acute pain of both Fundamental / LS and Macro investors – who simply aren’t there for this rally…

…is feeding into “grabby” behavior.

People are HURTING for performance, and the Equities tape has gotten away from them.

So, just how far can this MOMO/YOLO rip go?

The 4200 level is where things start to get interesting:

-

There have been a number of Call Spreads trade in the market over the past few months where 4200 is a SHORT STRIKE for Buyers – hence, we could see a “Short Gamma” type move on upside break through that level

-

FWIW, 4215 is then the 50% retrace of the high / low move in Spooz from there, while the 200DMA is 4330

Flow-wise, I have pounded you on repeat about Vol Control being set “taking the baton” from CTA Trend short-covering on the Systematic side over the upcoming horizon as 3m rVol is set to crater with big “Vol Outlier” days from late Apr / early May drop out of sample; accordingly, projected daily ~1% SPX changes would see Vol Control with re-allocation flows of +$21.8B to buy over the next 1m period…and a 0.5% daily chg would see that go up to +$27.3B over the upcoming month

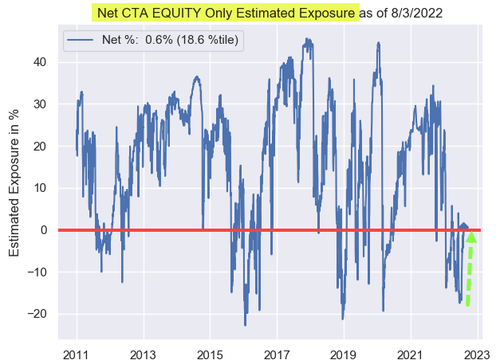

And as these level / flow -dynamics then risk us pushing into currently projected CTA Trend “trigger” levels up +3.5% to +12% from here ballpark, where some of these currently “Net flat” across the aggregated Global position and “small Longs” in US Equities actually would then turn towards all signals aligning into “+100% Long” signals, which would merit a larger re-leveraging and notional buying

Remember, thus far, the CTA Trend buying of Equities has been majority COVERING of what was once a very grossed-up “Short,” totaling a breath-taking +$60.4B notional buying across the Global Equities Futs in the model

Yet that has only brought the aggregate “Net” position across those Global Eq positions back to basically “Flat,” which is historically very low rank at just 18%ile…so there is def potential to get a lot bigger / longer from here

Projecting for today only, but just to get a sense where we’d re-rack “BIG LONG,” CTA Trend model “+100% Long” signal BUY triggers are as follows for profile US Futs:

-

S&P 500 @ 4307 (+3.7% from Spot)

-

Nasdaq 100 @14550 (+9.5% from Spot)

-

Russell 2000 @ 2136 (+11.8% from Spot)

The bottom line

This continues to be “un-economical” and / or “mechanical” behavior which is creating a potential “false optic” for increasingly desperate investors who don’t have performance or positioning, which now in-conjunction with this very erratic and illiquid backdrop, is driving a resumption of nascent “red flag” behavior in recent days:

-

“Spot Up, Vol Up” behavior in Beta, High-Growth & Retail

-

Enormous capitulatory “short-squeezing” in “worst-of” names / sectors / themes / risk prem

-

High Volumes / Prem spent in OTM Upside Calls

All of which is setting the scene for more problems. As SpotGamma sums up perfectly, while our models continue to favor the bullish side, we have to continue applying these asterisks. A single close down 1-1½% places a massive dent in the bullish case, and shifts many of our models back into instability.

We give the last word to Michael ‘Big Short’ Burry:

The Silliness is back. After 1929, after 1968, after 2000, after 2008, the strain of Silliness that transformed bulls into bubbles completely and utterly disappeared.

But that familiar COVID-era Silliness is not dead yet. Like 2001 before Enron, before 9/11, before WorldCom.

— Cassandra B.C. (@michaeljburry) August 4, 2022

So do you feel ‘lucky’ or ‘silly’?

[ad_2]

Source link